Flood risk mapping analyzes geographic data, historical flood events, and topographical features to predict areas vulnerable to flooding and quantify potential damage costs. Hail damage estimation relies on meteorological data, storm intensity, and property characteristics to assess the extent and financial impact of hailstorms on insured assets. Explore detailed methodologies and real-world applications to enhance your understanding of these critical insurance risk assessments.

Why it is important

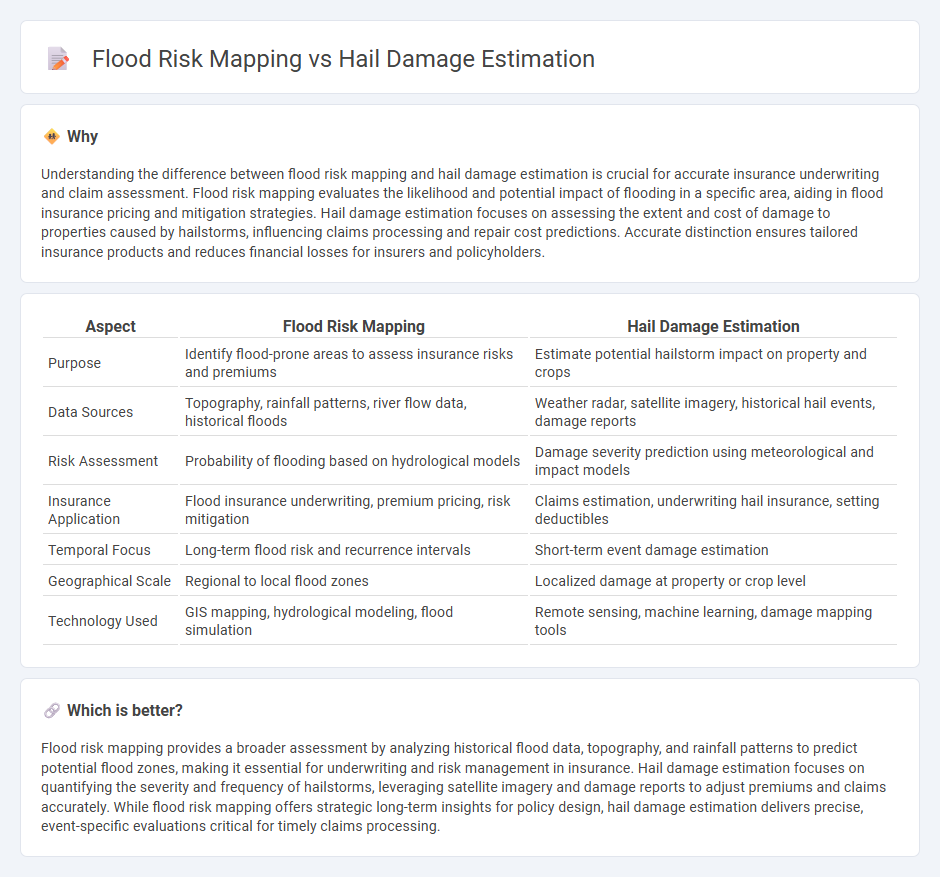

Understanding the difference between flood risk mapping and hail damage estimation is crucial for accurate insurance underwriting and claim assessment. Flood risk mapping evaluates the likelihood and potential impact of flooding in a specific area, aiding in flood insurance pricing and mitigation strategies. Hail damage estimation focuses on assessing the extent and cost of damage to properties caused by hailstorms, influencing claims processing and repair cost predictions. Accurate distinction ensures tailored insurance products and reduces financial losses for insurers and policyholders.

Comparison Table

| Aspect | Flood Risk Mapping | Hail Damage Estimation |

|---|---|---|

| Purpose | Identify flood-prone areas to assess insurance risks and premiums | Estimate potential hailstorm impact on property and crops |

| Data Sources | Topography, rainfall patterns, river flow data, historical floods | Weather radar, satellite imagery, historical hail events, damage reports |

| Risk Assessment | Probability of flooding based on hydrological models | Damage severity prediction using meteorological and impact models |

| Insurance Application | Flood insurance underwriting, premium pricing, risk mitigation | Claims estimation, underwriting hail insurance, setting deductibles |

| Temporal Focus | Long-term flood risk and recurrence intervals | Short-term event damage estimation |

| Geographical Scale | Regional to local flood zones | Localized damage at property or crop level |

| Technology Used | GIS mapping, hydrological modeling, flood simulation | Remote sensing, machine learning, damage mapping tools |

Which is better?

Flood risk mapping provides a broader assessment by analyzing historical flood data, topography, and rainfall patterns to predict potential flood zones, making it essential for underwriting and risk management in insurance. Hail damage estimation focuses on quantifying the severity and frequency of hailstorms, leveraging satellite imagery and damage reports to adjust premiums and claims accurately. While flood risk mapping offers strategic long-term insights for policy design, hail damage estimation delivers precise, event-specific evaluations critical for timely claims processing.

Connection

Flood risk mapping and hail damage estimation are interconnected through their use of geospatial data and weather pattern analysis to assess property vulnerability. Both methods employ satellite imagery, historical weather records, and topographical data to quantify potential losses, aiding insurers in refining premium calculations and risk management strategies. Integrating these assessments improves disaster preparedness and ensures more accurate underwriting for regions prone to extreme weather events.

Key Terms

Hail damage estimation:

Hail damage estimation uses meteorological data, satellite imagery, and machine learning algorithms to assess the extent and severity of damage to crops, vehicles, and buildings, enabling precise risk analysis and quicker insurance claims processing. Flood risk mapping combines hydrological models, topographical data, and historical flood patterns to predict areas vulnerable to flooding and inform urban planning and emergency response strategies. Explore deeper insights into hail damage estimation techniques and their applications for enhanced risk management.

Loss assessment

Hail damage estimation quantifies the extent and severity of property or crop damage caused by hailstorms, using high-resolution satellite imagery and machine learning algorithms to assess economic losses accurately. Flood risk mapping identifies vulnerable areas by analyzing hydrological data, topography, and historical flood patterns to estimate potential loss in human life, infrastructure, and property during flood events. Explore detailed methodologies and applications to enhance your understanding of loss assessment techniques in natural disaster management.

Impact resistance rating

Impact resistance rating is crucial for accurately estimating hail damage by assessing the durability of building materials against hailstone impacts, whereas flood risk mapping primarily evaluates exposure to water-related hazards and does not focus on material resilience. Hail damage models incorporate impact resistance data to predict potential repair costs and maintenance needs, enhancing insurance underwriting and risk management. Explore detailed methodologies on integrating impact resistance ratings in hail damage estimation for more precise risk assessments.

Source and External Links

AI-powered hail damage detection & estimation | Inspektlabs - Hail damage estimation involves assessing dents, paint chips, and broken glass, with repair costs typically ranging from $30 to $75 per dent and an average repair claim around $3,500; multiple estimates and insurance coverage checks are advised before repair.

Calculate Hail Damage Repair Cost With This Calculator - Repair costs vary depending on dent size, number, damage location, and whether paint is chipped, with paintless dent repair (PDR) being more affordable for minor cosmetic dents and professional repair recommended over DIY solutions.

Hail Damage Car Repair Cost Calculator - StormWise Auto Body Shop - A free online hail dent repair cost estimator uses dent count and size (measured against coins) to provide a paintless dent repair estimate, excluding parts replacement and related labor, with additional services like insurance claims support and warranty offered.

dowidth.com

dowidth.com