Peer-to-peer insurance leverages community pooling of risks to reduce costs and increase transparency, while parametric insurance offers predetermined payouts based on specific triggers such as weather events or natural disasters. Both models offer innovative solutions beyond traditional insurance by enhancing efficiency and customer control through technology and predefined data parameters. Explore more to understand which insurance type suits your unique risk management needs.

Why it is important

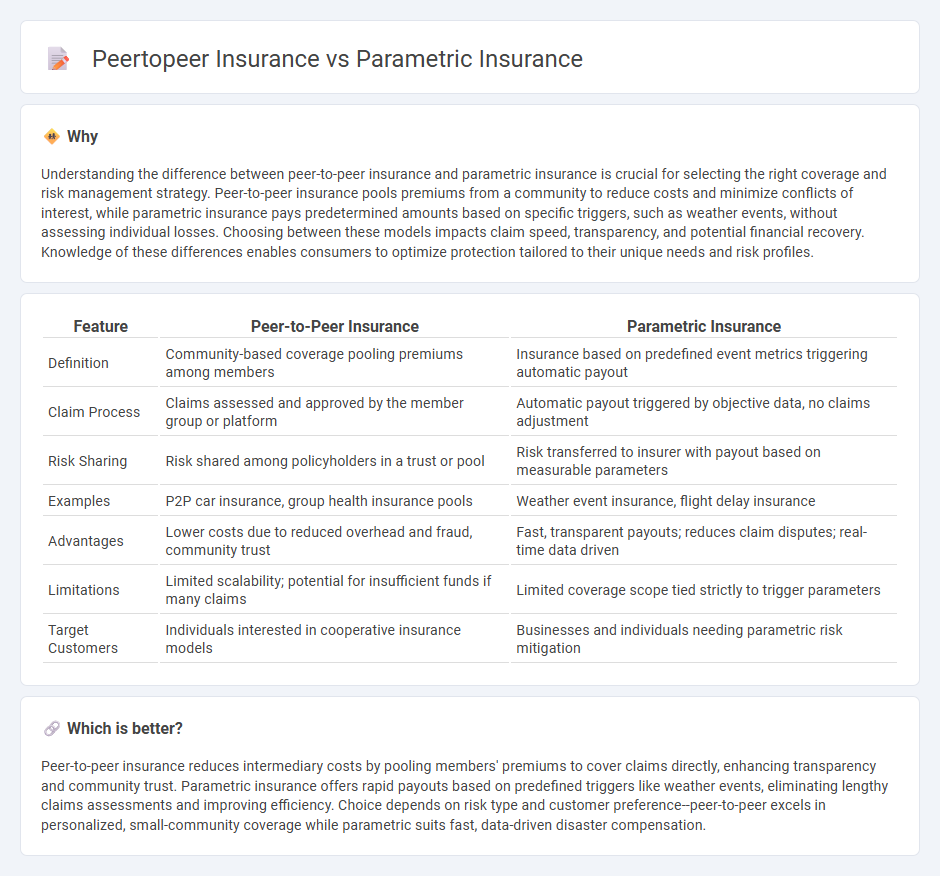

Understanding the difference between peer-to-peer insurance and parametric insurance is crucial for selecting the right coverage and risk management strategy. Peer-to-peer insurance pools premiums from a community to reduce costs and minimize conflicts of interest, while parametric insurance pays predetermined amounts based on specific triggers, such as weather events, without assessing individual losses. Choosing between these models impacts claim speed, transparency, and potential financial recovery. Knowledge of these differences enables consumers to optimize protection tailored to their unique needs and risk profiles.

Comparison Table

| Feature | Peer-to-Peer Insurance | Parametric Insurance |

|---|---|---|

| Definition | Community-based coverage pooling premiums among members | Insurance based on predefined event metrics triggering automatic payout |

| Claim Process | Claims assessed and approved by the member group or platform | Automatic payout triggered by objective data, no claims adjustment |

| Risk Sharing | Risk shared among policyholders in a trust or pool | Risk transferred to insurer with payout based on measurable parameters |

| Examples | P2P car insurance, group health insurance pools | Weather event insurance, flight delay insurance |

| Advantages | Lower costs due to reduced overhead and fraud, community trust | Fast, transparent payouts; reduces claim disputes; real-time data driven |

| Limitations | Limited scalability; potential for insufficient funds if many claims | Limited coverage scope tied strictly to trigger parameters |

| Target Customers | Individuals interested in cooperative insurance models | Businesses and individuals needing parametric risk mitigation |

Which is better?

Peer-to-peer insurance reduces intermediary costs by pooling members' premiums to cover claims directly, enhancing transparency and community trust. Parametric insurance offers rapid payouts based on predefined triggers like weather events, eliminating lengthy claims assessments and improving efficiency. Choice depends on risk type and customer preference--peer-to-peer excels in personalized, small-community coverage while parametric suits fast, data-driven disaster compensation.

Connection

Peer-to-peer insurance and parametric insurance are connected through their innovative approach to risk-sharing and claims processing. Peer-to-peer insurance leverages collective groups to pool premiums and distribute payouts transparently, while parametric insurance uses predefined triggers based on objective data, such as weather or seismic activity, to automate claims settlements. Both models enhance efficiency, reduce administrative costs, and increase trust by minimizing traditional insurance complexities and delays.

Key Terms

Parametric insurance:

Parametric insurance provides predefined payouts based on the occurrence of specific triggering events, such as weather conditions or natural disasters, eliminating the need for lengthy claims assessments. This type of insurance relies on objective data, like satellite measurements or seismic readings, ensuring faster and more transparent compensation processes. Explore how parametric insurance can enhance risk management and offer efficient protection for your assets.

Trigger event

Parametric insurance activates coverage based on predefined trigger events measured by objective data such as earthquake magnitude or rainfall levels, providing rapid payout without the need for loss adjustment. Peer-to-peer insurance pools premiums among members to cover claims collectively, with trigger events varying based on group agreements and often requiring verification and claims assessment. Explore deeper insights into how trigger events influence payout efficiency and risk management in both insurance models.

Payout formula

Parametric insurance features a predefined payout formula based on specific parameters or triggers, such as weather data or seismic activity, making claims processing faster and more transparent. Peer-to-peer insurance relies on pooling premiums from a group of members, with payouts determined by collective claims and often involves mutual governance. Discover the detailed mechanisms and benefits of each payout method to understand which suits your risk management needs best.

Source and External Links

What is parametric insurance? - Swiss Re Corporate Solutions - Parametric insurance pays out a predetermined amount when a specific, objectively measurable event (like an earthquake of a certain magnitude) occurs, regardless of the actual loss suffered by the insured.

Parametric Insurance Solutions - Amwins - This type of insurance uses pre-defined triggers (such as wind speed or seismic activity) to determine payouts, which are made quickly based on verified event data rather than traditional loss assessment.

Parametric insurance - Wikipedia - Parametric insurance offers fast, pre-specified payouts upon the occurrence of a trigger event, but may not fully cover the insured's actual losses due to basis risk.

dowidth.com

dowidth.com