Insurance as a service offers dynamic, personalized risk management solutions tailored to evolving customer needs, leveraging technology for real-time adjustments and proactive support. Insurance as a product provides standardized policy packages with fixed coverages and pricing, focusing on transactional sales rather than ongoing customer engagement. Explore how these distinct approaches can impact your protection strategy and financial security.

Why it is important

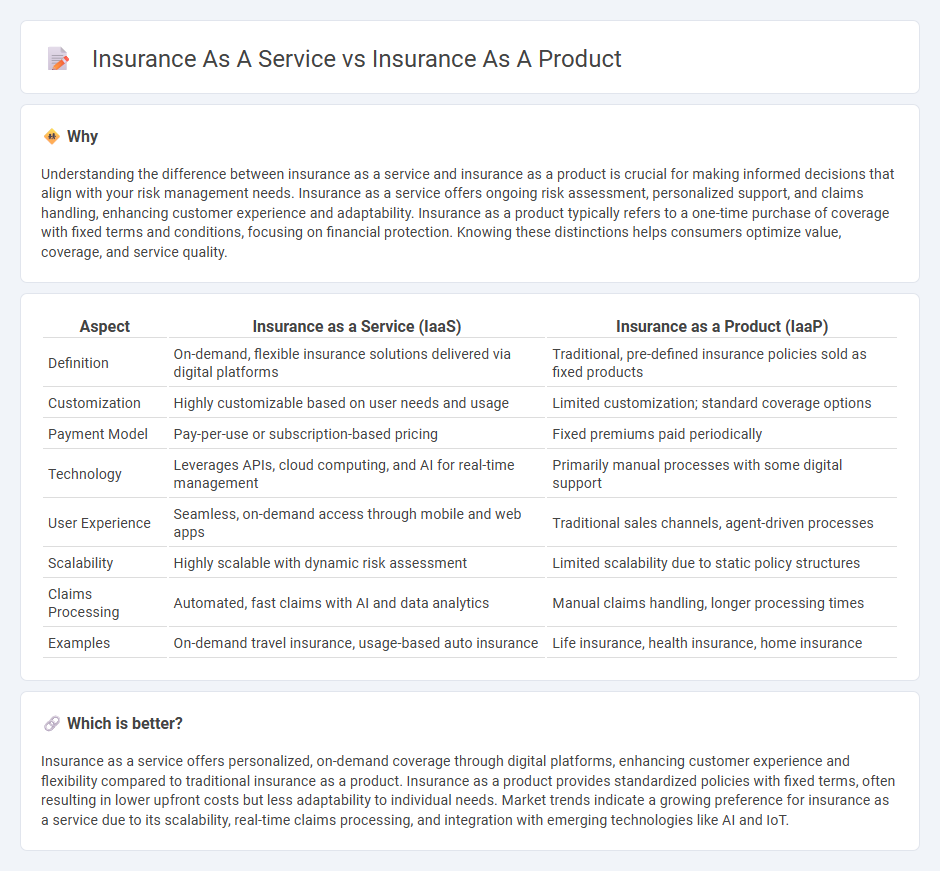

Understanding the difference between insurance as a service and insurance as a product is crucial for making informed decisions that align with your risk management needs. Insurance as a service offers ongoing risk assessment, personalized support, and claims handling, enhancing customer experience and adaptability. Insurance as a product typically refers to a one-time purchase of coverage with fixed terms and conditions, focusing on financial protection. Knowing these distinctions helps consumers optimize value, coverage, and service quality.

Comparison Table

| Aspect | Insurance as a Service (IaaS) | Insurance as a Product (IaaP) |

|---|---|---|

| Definition | On-demand, flexible insurance solutions delivered via digital platforms | Traditional, pre-defined insurance policies sold as fixed products |

| Customization | Highly customizable based on user needs and usage | Limited customization; standard coverage options |

| Payment Model | Pay-per-use or subscription-based pricing | Fixed premiums paid periodically |

| Technology | Leverages APIs, cloud computing, and AI for real-time management | Primarily manual processes with some digital support |

| User Experience | Seamless, on-demand access through mobile and web apps | Traditional sales channels, agent-driven processes |

| Scalability | Highly scalable with dynamic risk assessment | Limited scalability due to static policy structures |

| Claims Processing | Automated, fast claims with AI and data analytics | Manual claims handling, longer processing times |

| Examples | On-demand travel insurance, usage-based auto insurance | Life insurance, health insurance, home insurance |

Which is better?

Insurance as a service offers personalized, on-demand coverage through digital platforms, enhancing customer experience and flexibility compared to traditional insurance as a product. Insurance as a product provides standardized policies with fixed terms, often resulting in lower upfront costs but less adaptability to individual needs. Market trends indicate a growing preference for insurance as a service due to its scalability, real-time claims processing, and integration with emerging technologies like AI and IoT.

Connection

Insurance as a service delivers ongoing risk management and claims support tailored to policyholders, while insurance as a product represents the packaged policies offering financial protection against specific risks. The service aspect enhances the product's value through customer engagement, personalized coverage adjustments, and seamless claims processing. Together, they create an integrated ecosystem where the product provides coverage and the service ensures effective utilization and customer satisfaction.

Key Terms

Risk Coverage

Insurance as a product provides predefined risk coverage with fixed terms and limits tailored to standard customer profiles, ensuring straightforward protection against specific perils. Insurance as a service offers dynamic, personalized risk solutions leveraging real-time data analysis and continuous adjustment to evolving customer needs, enhancing risk mitigation effectiveness. Explore how transforming insurance into a service model optimizes risk coverage and customer value.

Claims Processing

Insurance as a product traditionally involves a fixed package of coverage with standardized claims processing protocols designed for efficiency but limited customization. Insurance as a service emphasizes personalized claims handling using advanced technologies like AI and predictive analytics to enhance transparency, speed, and customer satisfaction. Discover how evolving claims processing models are transforming the insurance industry and improving policyholder experiences.

Customer Support

Insurance as a product typically offers a one-time transaction with limited ongoing interaction, while insurance as a service emphasizes continuous customer support and personalized assistance throughout the policy lifecycle, enhancing customer satisfaction and loyalty. Companies adopting an insurance-as-a-service model leverage digital tools, such as AI-driven chatbots and 24/7 support centers, to provide real-time claim processing and tailored advice. Explore how leading insurers transform customer experience by integrating service-first strategies.

Source and External Links

Federal Definitions for Health Insurance Products and Plans - Outlines the definition and structure of health insurance products, including network types and benefit packages.

Insurance Product Management - Discusses the process of developing, launching, and optimizing insurance products to meet customer needs and business objectives.

Product Liability Insurance - Provides protection for businesses against claims related to harm caused by their products or services.

dowidth.com

dowidth.com