Crop insurance protects farmers against financial losses due to natural disasters, pests, or adverse weather conditions, ensuring stability in agricultural production and income. Pet insurance covers veterinary expenses for unexpected illnesses and accidents, providing peace of mind for pet owners while safeguarding pets' health and well-being. Explore the details and benefits of crop insurance versus pet insurance to find the best protection for your needs.

Why it is important

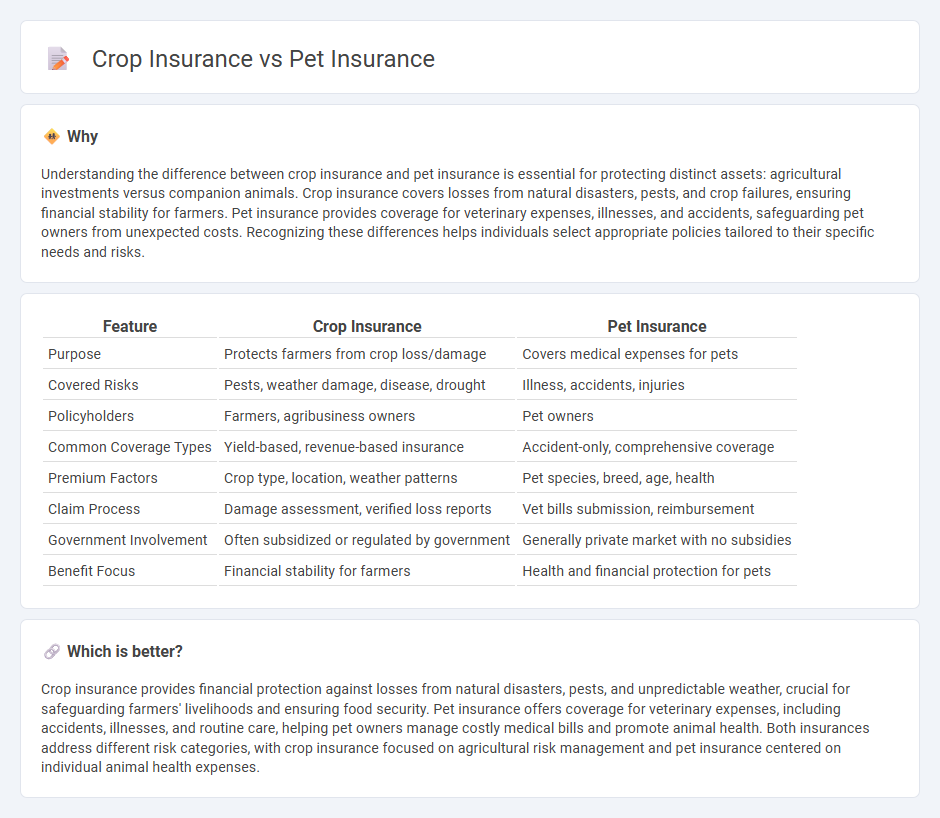

Understanding the difference between crop insurance and pet insurance is essential for protecting distinct assets: agricultural investments versus companion animals. Crop insurance covers losses from natural disasters, pests, and crop failures, ensuring financial stability for farmers. Pet insurance provides coverage for veterinary expenses, illnesses, and accidents, safeguarding pet owners from unexpected costs. Recognizing these differences helps individuals select appropriate policies tailored to their specific needs and risks.

Comparison Table

| Feature | Crop Insurance | Pet Insurance |

|---|---|---|

| Purpose | Protects farmers from crop loss/damage | Covers medical expenses for pets |

| Covered Risks | Pests, weather damage, disease, drought | Illness, accidents, injuries |

| Policyholders | Farmers, agribusiness owners | Pet owners |

| Common Coverage Types | Yield-based, revenue-based insurance | Accident-only, comprehensive coverage |

| Premium Factors | Crop type, location, weather patterns | Pet species, breed, age, health |

| Claim Process | Damage assessment, verified loss reports | Vet bills submission, reimbursement |

| Government Involvement | Often subsidized or regulated by government | Generally private market with no subsidies |

| Benefit Focus | Financial stability for farmers | Health and financial protection for pets |

Which is better?

Crop insurance provides financial protection against losses from natural disasters, pests, and unpredictable weather, crucial for safeguarding farmers' livelihoods and ensuring food security. Pet insurance offers coverage for veterinary expenses, including accidents, illnesses, and routine care, helping pet owners manage costly medical bills and promote animal health. Both insurances address different risk categories, with crop insurance focused on agricultural risk management and pet insurance centered on individual animal health expenses.

Connection

Crop insurance and pet insurance both serve as risk management tools that protect against unexpected financial losses, with crop insurance covering agricultural production risks and pet insurance addressing health-related expenses for animals. Both types of insurance policies rely on assessing risk factors and premium calculations to provide coverage tailored to specific needs, facilitating financial stability for farmers and pet owners alike. The underlying principle of mitigating unforeseen costs establishes a connection between crop and pet insurance within the broader insurance industry.

Key Terms

Coverage Scope

Pet insurance covers veterinary expenses, including accidents, illnesses, surgeries, and sometimes routine care like vaccinations and dental cleanings, ensuring your pet receives timely medical attention. Crop insurance protects farmers against losses from natural disasters such as droughts, floods, pests, and diseases that affect crop yield and quality, stabilizing income in unpredictable agricultural environments. Discover more about how each insurance type safeguards your valuable assets and provides financial security.

Policyholder Type

Pet insurance primarily targets individual pet owners seeking financial protection against veterinary expenses, while crop insurance is designed for farmers and agricultural producers to mitigate risks related to crop loss due to weather, pests, or disease. Policyholders in pet insurance typically manage personal pets with coverage plans tailored for various animal species and health conditions, whereas crop insurance policyholders require specialized plans addressing yield, revenue, and acreage specifics. Explore comprehensive comparisons to understand which insurance type best fits your needs.

Claim Triggers

Pet insurance claim triggers typically include veterinary treatments for illnesses, injuries, surgeries, and emergency care, ensuring coverage when pets require medical attention. Crop insurance claim triggers involve weather-related damages such as drought, flood, hail, and pest infestations that negatively affect crop yield and farm income. Explore detailed comparisons and benefits of claim triggers in both insurance types to make informed coverage decisions.

Source and External Links

Costco Pet Insurance - Offers pet insurance plans through Figo, providing up to 100% reimbursement for medical expenses based on factors like age, breed, and location.

Lemonade Pet Insurance - Provides top-rated coverage for dogs and cats with customizable plans and fast claims processing, offering accident and illness policies as well as preventative packages.

ASPCA Pet Insurance - Offers flexible coverage plans that cover accidents, illnesses, hereditary conditions, and more, with benefits like a 30-day money-back guarantee and multi-pet discounts.

dowidth.com

dowidth.com