Invisible insurance offers personalized coverage tailored to individual risks and lifestyle, while group insurance provides collective benefits typically arranged by employers for their members. Group insurance often features lower premiums due to pooled risk, whereas invisible insurance allows for more flexible and specific protection plans. Explore further to understand which insurance type aligns best with your needs and financial goals.

Why it is important

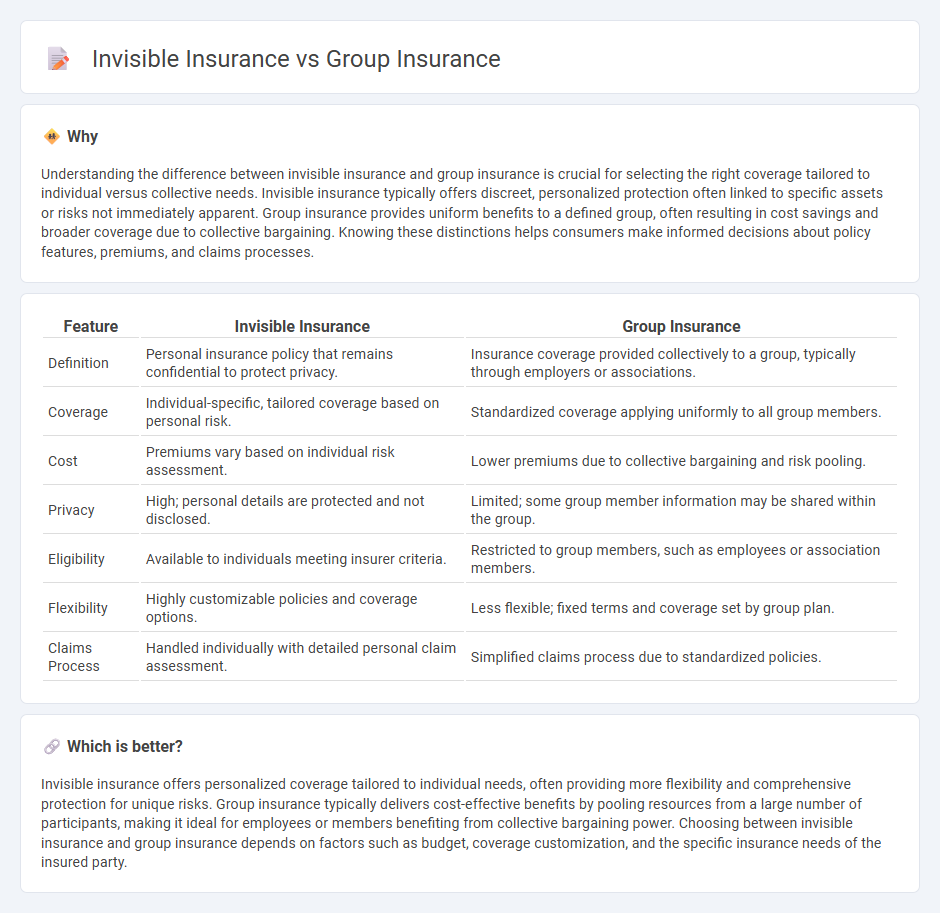

Understanding the difference between invisible insurance and group insurance is crucial for selecting the right coverage tailored to individual versus collective needs. Invisible insurance typically offers discreet, personalized protection often linked to specific assets or risks not immediately apparent. Group insurance provides uniform benefits to a defined group, often resulting in cost savings and broader coverage due to collective bargaining. Knowing these distinctions helps consumers make informed decisions about policy features, premiums, and claims processes.

Comparison Table

| Feature | Invisible Insurance | Group Insurance |

|---|---|---|

| Definition | Personal insurance policy that remains confidential to protect privacy. | Insurance coverage provided collectively to a group, typically through employers or associations. |

| Coverage | Individual-specific, tailored coverage based on personal risk. | Standardized coverage applying uniformly to all group members. |

| Cost | Premiums vary based on individual risk assessment. | Lower premiums due to collective bargaining and risk pooling. |

| Privacy | High; personal details are protected and not disclosed. | Limited; some group member information may be shared within the group. |

| Eligibility | Available to individuals meeting insurer criteria. | Restricted to group members, such as employees or association members. |

| Flexibility | Highly customizable policies and coverage options. | Less flexible; fixed terms and coverage set by group plan. |

| Claims Process | Handled individually with detailed personal claim assessment. | Simplified claims process due to standardized policies. |

Which is better?

Invisible insurance offers personalized coverage tailored to individual needs, often providing more flexibility and comprehensive protection for unique risks. Group insurance typically delivers cost-effective benefits by pooling resources from a large number of participants, making it ideal for employees or members benefiting from collective bargaining power. Choosing between invisible insurance and group insurance depends on factors such as budget, coverage customization, and the specific insurance needs of the insured party.

Connection

Invisible insurance and group insurance are interconnected through their shared goal of providing financial protection to members without overt transactional experiences. Group insurance typically covers employees or members of an organization under a single policy, while invisible insurance integrates coverage seamlessly into everyday transactions or services, often enhancing group insurance offerings by embedding benefits within routine activities. This synergy allows organizations to offer comprehensive risk management solutions that are both cost-effective and unobtrusive, improving coverage accessibility and user experience.

Key Terms

Underwriting

Group insurance underwriting typically involves simplified medical evaluations due to coverage of a large pool, resulting in faster approvals and lower premiums. Invisible insurance, often positioned as supplemental benefits like life or critical illness coverage, applies more stringent individual underwriting criteria to tailor risk assessment precisely. Explore the nuances of underwriting processes to determine which insurance option aligns best with your risk profile and financial goals.

Risk Pooling

Group insurance leverages risk pooling by aggregating a large number of individuals, which spreads the risk and lowers premiums, making coverage more affordable for members of the group. Invisible insurance, often embedded within other financial products or services, minimizes the perception of risk through subtle integration but may lack the extensive risk pooling benefits of group plans. Explore the distinct mechanisms of risk pooling in group insurance versus the discreet approach of invisible insurance to understand which fits your financial strategy better.

Transparency

Group insurance offers collective coverage with standard terms, often lacking detailed transparency on individual policy conditions and costs. Invisible insurance emphasizes clear, itemized disclosures and personalized premiums, enhancing trust and understanding for policyholders. Explore the differences to ensure your insurance choice aligns with your expectations for transparency and coverage.

Source and External Links

What is group insurance? Benefits and limitations [2025] - Group insurance provides standardized health coverage to employees of a business or organization through a single master policy, often with employer contributions to the premium and limited customization options.

What is Group Insurance & How Does It Work? - Group insurance is employer-sponsored coverage for a workforce, typically offered as a benefit with lower costs due to group rates and employer premium contributions, and each employee is enrolled under the same group policy.

Group-term life insurance | Internal Revenue Service - Group-term life insurance up to $50,000 of coverage provided by an employer is tax-exempt for employees, but the imputed cost of coverage above this limit must be included as taxable income.

dowidth.com

dowidth.com