Natural catastrophe bonds transfer risk to capital markets, providing insurers with upfront capital to cover losses from events like hurricanes and earthquakes. Parametric insurance offers predetermined payouts based on specific trigger events such as wind speed or earthquake magnitude, enabling faster claims processing without loss adjustment delays. Explore the differences and benefits of these innovative risk management solutions to better protect against natural disasters.

Why it is important

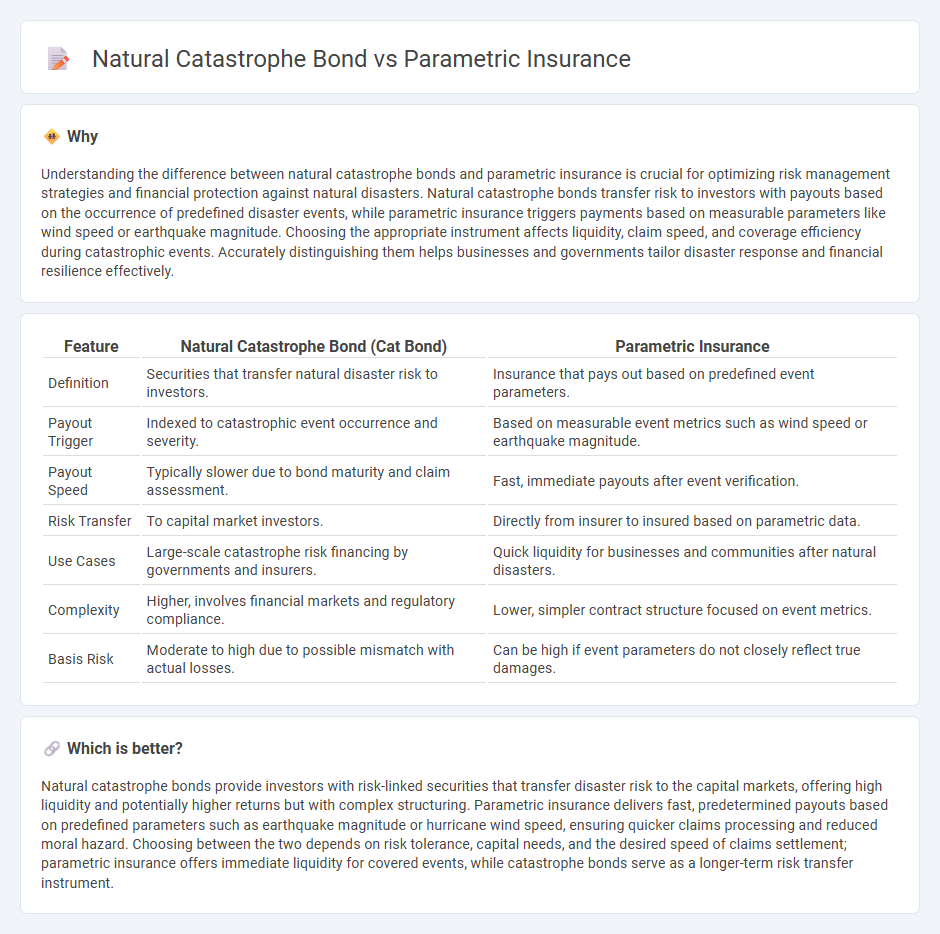

Understanding the difference between natural catastrophe bonds and parametric insurance is crucial for optimizing risk management strategies and financial protection against natural disasters. Natural catastrophe bonds transfer risk to investors with payouts based on the occurrence of predefined disaster events, while parametric insurance triggers payments based on measurable parameters like wind speed or earthquake magnitude. Choosing the appropriate instrument affects liquidity, claim speed, and coverage efficiency during catastrophic events. Accurately distinguishing them helps businesses and governments tailor disaster response and financial resilience effectively.

Comparison Table

| Feature | Natural Catastrophe Bond (Cat Bond) | Parametric Insurance |

|---|---|---|

| Definition | Securities that transfer natural disaster risk to investors. | Insurance that pays out based on predefined event parameters. |

| Payout Trigger | Indexed to catastrophic event occurrence and severity. | Based on measurable event metrics such as wind speed or earthquake magnitude. |

| Payout Speed | Typically slower due to bond maturity and claim assessment. | Fast, immediate payouts after event verification. |

| Risk Transfer | To capital market investors. | Directly from insurer to insured based on parametric data. |

| Use Cases | Large-scale catastrophe risk financing by governments and insurers. | Quick liquidity for businesses and communities after natural disasters. |

| Complexity | Higher, involves financial markets and regulatory compliance. | Lower, simpler contract structure focused on event metrics. |

| Basis Risk | Moderate to high due to possible mismatch with actual losses. | Can be high if event parameters do not closely reflect true damages. |

Which is better?

Natural catastrophe bonds provide investors with risk-linked securities that transfer disaster risk to the capital markets, offering high liquidity and potentially higher returns but with complex structuring. Parametric insurance delivers fast, predetermined payouts based on predefined parameters such as earthquake magnitude or hurricane wind speed, ensuring quicker claims processing and reduced moral hazard. Choosing between the two depends on risk tolerance, capital needs, and the desired speed of claims settlement; parametric insurance offers immediate liquidity for covered events, while catastrophe bonds serve as a longer-term risk transfer instrument.

Connection

Natural catastrophe bonds and parametric insurance are interconnected financial tools designed to transfer risk from insurance companies to capital markets. Cat bonds provide upfront capital to insurers when predefined triggers, such as earthquake magnitude or hurricane wind speed, exceed certain thresholds, similar to parametric insurance payouts based on objective event parameters. Both mechanisms enhance risk management efficiency by offering rapid claims settlement without the need for traditional loss adjustment processes.

Key Terms

Trigger Event

Parametric insurance triggers payouts based on predefined indices such as wind speed or earthquake magnitude exceeding a specific threshold, enabling rapid claims settlement without damage assessment. Natural catastrophe bonds activate payments when a triggered event causes losses that meet predefined parameters, transferring risk to investors and providing capital relief to issuers. Explore the nuances of parametric triggers and catastrophe bond structures to understand their distinct mechanisms and benefits.

Payout Structure

Parametric insurance triggers payouts based on predefined parameters, such as earthquake magnitude or wind speed, ensuring quick claims settlements without damage assessments. Natural catastrophe bonds rely on insurance-linked securities with payouts contingent on specific event losses exceeding a set threshold, often involving more complex assessment processes. Explore more about how these payout structures impact risk management and financial recovery strategies.

Risk Transfer

Parametric insurance offers rapid payouts based on predefined triggers such as hurricane wind speed or earthquake magnitude, transferring specific, quantifiable risks directly to insurers. Natural catastrophe bonds sell risk to investors by linking bond repayments to the occurrence of predefined catastrophic events, providing an alternative risk transfer mechanism that can cover more extensive losses. Explore the advantages and limitations of these instruments to understand which risk transfer solution best fits your exposure.

Source and External Links

What is parametric insurance? - This webpage explains parametric insurance as a type of insurance that provides payouts based on the occurrence of predefined events like earthquakes or hurricanes, without requiring actual loss assessment.

Parametric insurance - This Wikipedia article describes parametric insurance as a non-traditional insurance product offering pre-specified payouts triggered by specific events, differing from traditional indemnity insurance by focusing on event parameters rather than actual losses.

Parametric Insurance Solutions - This webpage highlights parametric insurance as a solution that pays based on predefined event thresholds, providing quick payouts and flexibility in covering various perils like hurricanes or earthquakes.

dowidth.com

dowidth.com