Buy now insurance requires an upfront payment for full coverage, offering immediate protection and predictable costs. Pay-as-you-go insurance charges premiums based on actual usage or risk exposure, providing flexibility and potential savings for low-frequency users. Explore the differences to determine which insurance payment model best suits your needs.

Why it is important

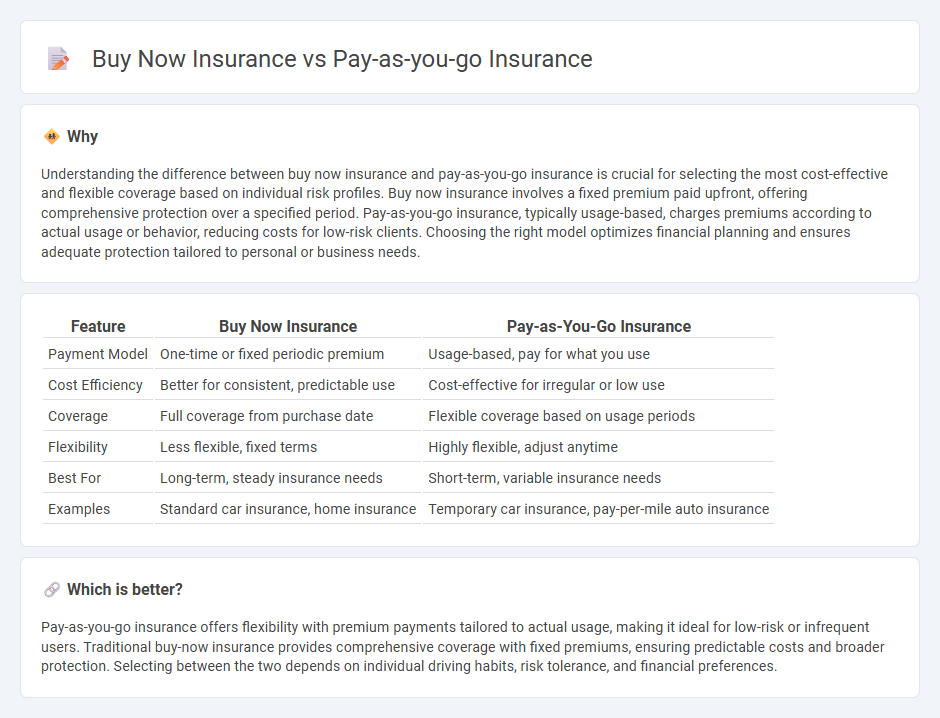

Understanding the difference between buy now insurance and pay-as-you-go insurance is crucial for selecting the most cost-effective and flexible coverage based on individual risk profiles. Buy now insurance involves a fixed premium paid upfront, offering comprehensive protection over a specified period. Pay-as-you-go insurance, typically usage-based, charges premiums according to actual usage or behavior, reducing costs for low-risk clients. Choosing the right model optimizes financial planning and ensures adequate protection tailored to personal or business needs.

Comparison Table

| Feature | Buy Now Insurance | Pay-as-You-Go Insurance |

|---|---|---|

| Payment Model | One-time or fixed periodic premium | Usage-based, pay for what you use |

| Cost Efficiency | Better for consistent, predictable use | Cost-effective for irregular or low use |

| Coverage | Full coverage from purchase date | Flexible coverage based on usage periods |

| Flexibility | Less flexible, fixed terms | Highly flexible, adjust anytime |

| Best For | Long-term, steady insurance needs | Short-term, variable insurance needs |

| Examples | Standard car insurance, home insurance | Temporary car insurance, pay-per-mile auto insurance |

Which is better?

Pay-as-you-go insurance offers flexibility with premium payments tailored to actual usage, making it ideal for low-risk or infrequent users. Traditional buy-now insurance provides comprehensive coverage with fixed premiums, ensuring predictable costs and broader protection. Selecting between the two depends on individual driving habits, risk tolerance, and financial preferences.

Connection

Buy now insurance and pay-as-you-go insurance are connected through their focus on flexible payment structures tailored to customer needs. Both models emphasize instant coverage activation, with buy now insurance allowing immediate purchase while pay-as-you-go insurance charges users based on actual usage or time periods. This synergy enhances accessibility and affordability in the insurance market by reducing upfront costs and aligning premiums with individual risk exposure.

Key Terms

Premium Payment Structure

Pay-as-you-go insurance offers flexible premium payments based on actual usage or risk exposure, allowing policyholders to pay only for the coverage they utilize, which can lead to cost savings compared to traditional fixed premiums. Buy now insurance requires upfront payment of the full premium for a defined coverage period, providing predictable costs and immediate coverage but less flexibility for changing needs. Explore detailed comparisons of premium payment structures and how they impact your insurance costs and coverage options.

Coverage Duration

Pay-as-you-go insurance offers flexible coverage duration tailored to actual usage, allowing policyholders to pay solely for the time they need protection. Buy now insurance typically involves a fixed-term coverage period with upfront payment, often ranging from monthly to annual policies. Explore detailed comparisons to determine which coverage duration aligns best with your insurance needs.

Flexibility

Pay-as-you-go insurance offers unparalleled flexibility by allowing policyholders to pay only for the coverage they use, adapting to changing needs without long-term commitments. Buy now insurance requires an upfront, fixed payment for a predetermined coverage period, limiting adjustments once the policy is active. Explore the benefits and suited scenarios of each option to determine which insurance model best matches your lifestyle and financial goals.

Source and External Links

Pay-As-You-Go Car Insurance That Works for You - Offers manageable biweekly payments aligned with your paycheck schedule, requiring little to no down payment.

Does Pay-As-You-Go Car Insurance Really Save - Informs on whether pay-as-you-go car insurance can save money, especially for low-mileage drivers, but warns of potential rate increases based on driving history.

Temporary Car Insurance - Discusses how pay-as-you-go insurance allows drivers to only pay for coverage when they drive, as an alternative to traditional policies.

dowidth.com

dowidth.com