NFT insurance offers coverage based on unique, tokenized digital assets, providing protection tailored to the specific risks associated with NFTs in the blockchain ecosystem. Parametric insurance delivers fast, trigger-based payouts determined by predefined parameters such as weather events or natural disasters, eliminating the need for traditional claim assessments. Explore the key differences and benefits of NFT insurance versus parametric insurance to understand which solution best fits your risk management needs.

Why it is important

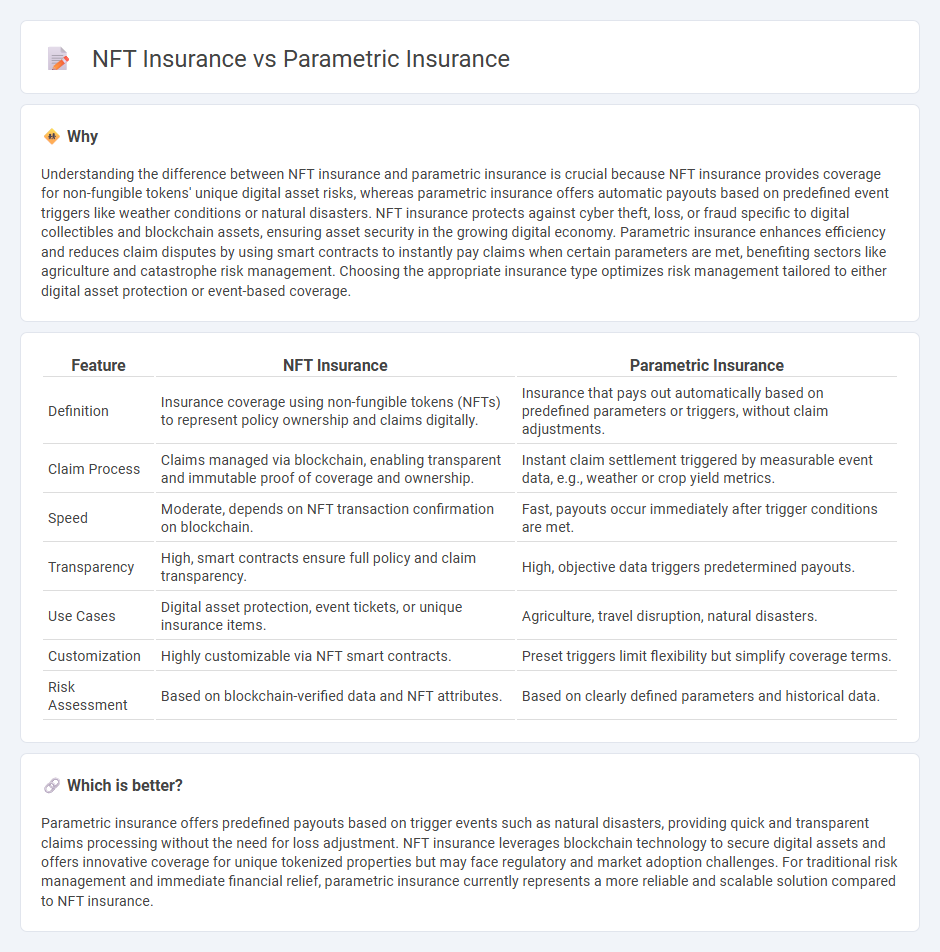

Understanding the difference between NFT insurance and parametric insurance is crucial because NFT insurance provides coverage for non-fungible tokens' unique digital asset risks, whereas parametric insurance offers automatic payouts based on predefined event triggers like weather conditions or natural disasters. NFT insurance protects against cyber theft, loss, or fraud specific to digital collectibles and blockchain assets, ensuring asset security in the growing digital economy. Parametric insurance enhances efficiency and reduces claim disputes by using smart contracts to instantly pay claims when certain parameters are met, benefiting sectors like agriculture and catastrophe risk management. Choosing the appropriate insurance type optimizes risk management tailored to either digital asset protection or event-based coverage.

Comparison Table

| Feature | NFT Insurance | Parametric Insurance |

|---|---|---|

| Definition | Insurance coverage using non-fungible tokens (NFTs) to represent policy ownership and claims digitally. | Insurance that pays out automatically based on predefined parameters or triggers, without claim adjustments. |

| Claim Process | Claims managed via blockchain, enabling transparent and immutable proof of coverage and ownership. | Instant claim settlement triggered by measurable event data, e.g., weather or crop yield metrics. |

| Speed | Moderate, depends on NFT transaction confirmation on blockchain. | Fast, payouts occur immediately after trigger conditions are met. |

| Transparency | High, smart contracts ensure full policy and claim transparency. | High, objective data triggers predetermined payouts. |

| Use Cases | Digital asset protection, event tickets, or unique insurance items. | Agriculture, travel disruption, natural disasters. |

| Customization | Highly customizable via NFT smart contracts. | Preset triggers limit flexibility but simplify coverage terms. |

| Risk Assessment | Based on blockchain-verified data and NFT attributes. | Based on clearly defined parameters and historical data. |

Which is better?

Parametric insurance offers predefined payouts based on trigger events such as natural disasters, providing quick and transparent claims processing without the need for loss adjustment. NFT insurance leverages blockchain technology to secure digital assets and offers innovative coverage for unique tokenized properties but may face regulatory and market adoption challenges. For traditional risk management and immediate financial relief, parametric insurance currently represents a more reliable and scalable solution compared to NFT insurance.

Connection

NFT insurance leverages blockchain technology to provide secure, transparent coverage for digital assets, while parametric insurance uses predefined parameters to trigger automatic claims payouts. Both insurance models minimize traditional claims processing by utilizing smart contracts and real-time data verification. This integration enhances efficiency, reduces fraud, and offers customized risk management solutions for emerging digital markets.

Key Terms

**Parametric Insurance:**

Parametric insurance provides coverage by triggering automatic payouts based on predefined parameters such as weather events, natural disasters, or other measurable criteria, eliminating lengthy claims processes. This type of insurance offers transparency, efficiency, and faster claim settlements compared to traditional indemnity-based insurance. Explore how parametric insurance is revolutionizing risk management and providing innovative solutions for businesses and individuals.

Trigger Event

Parametric insurance offers payouts based on predefined trigger events such as natural disasters or weather conditions, delivering swift compensation without complex claims processes. NFT insurance protects digital assets by verifying ownership and triggering coverage when specific blockchain events, like smart contract breaches or asset loss, occur. Explore the distinct mechanisms and benefits of these innovative insurance models to better safeguard physical and digital assets.

Payout Formula

Parametric insurance uses predetermined triggers and payout formulas based on measurable events like weather data or earthquake magnitude, ensuring quick and transparent claim settlements. NFT insurance leverages blockchain technology to provide decentralized coverage, with payout formulas often linked to the value or status of the insured non-fungible tokens, enhancing security and traceability. Explore the distinctions and applications of payout formulas in parametric and NFT insurance to understand their innovative approaches to risk management.

Source and External Links

What is Parametric Insurance? - Parametric insurance is a type of insurance that provides payouts based on the occurrence of predefined events, such as earthquakes or hurricanes, reaching specific thresholds, rather than actual losses incurred.

Parametric Insurance Solutions - Parametric insurance policies pay out based on pre-defined event triggers, such as wind speed or magnitude, allowing for faster claims processing and providing liquidity post-disaster.

Parametric Insurance - Parametric insurance offers pre-specified payouts after a trigger event, such as a weather disaster, without needing to assess the actual damage, making it quicker to distribute payouts compared to traditional indemnity insurance.

dowidth.com

dowidth.com