Cyber risk insurance offers protection against financial losses caused by data breaches, cyberattacks, and other digital threats, while business interruption insurance covers revenue loss due to unexpected operational disruptions like natural disasters or equipment failure. Both policies address different aspects of business continuity, with cyber risk insurance focusing on technology-related incidents and business interruption insurance safeguarding against broader physical and logistical interruptions. Explore the key differences and benefits between these vital insurance types to better secure your business operations.

Why it is important

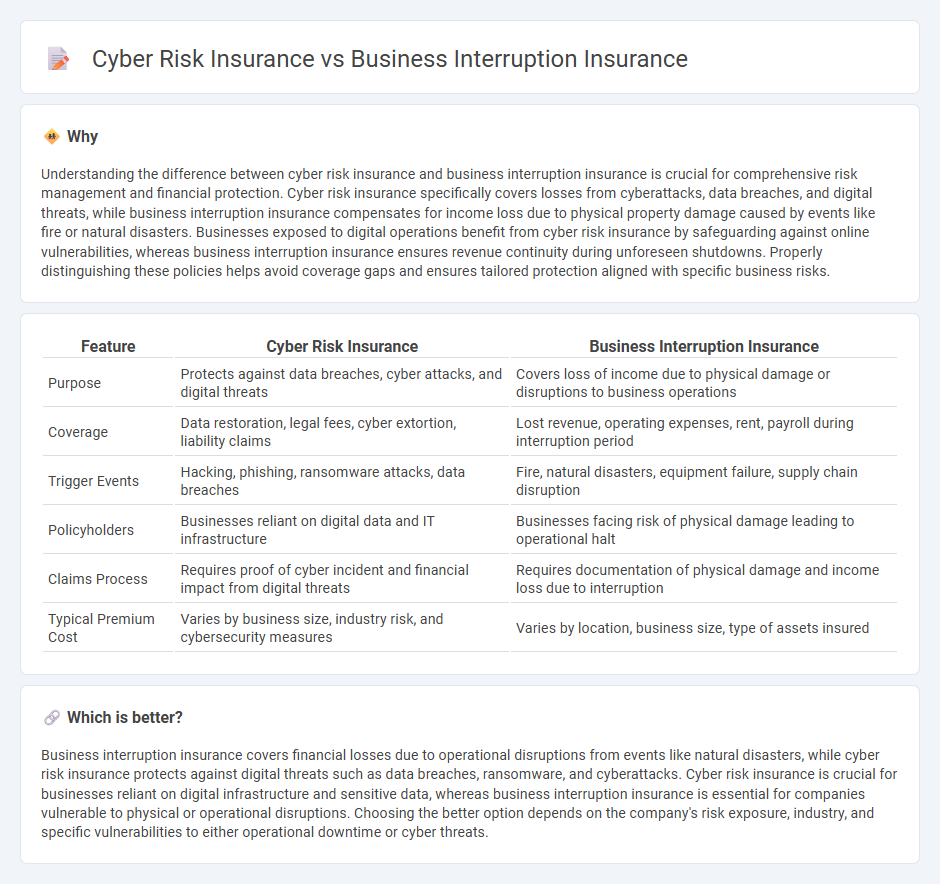

Understanding the difference between cyber risk insurance and business interruption insurance is crucial for comprehensive risk management and financial protection. Cyber risk insurance specifically covers losses from cyberattacks, data breaches, and digital threats, while business interruption insurance compensates for income loss due to physical property damage caused by events like fire or natural disasters. Businesses exposed to digital operations benefit from cyber risk insurance by safeguarding against online vulnerabilities, whereas business interruption insurance ensures revenue continuity during unforeseen shutdowns. Properly distinguishing these policies helps avoid coverage gaps and ensures tailored protection aligned with specific business risks.

Comparison Table

| Feature | Cyber Risk Insurance | Business Interruption Insurance |

|---|---|---|

| Purpose | Protects against data breaches, cyber attacks, and digital threats | Covers loss of income due to physical damage or disruptions to business operations |

| Coverage | Data restoration, legal fees, cyber extortion, liability claims | Lost revenue, operating expenses, rent, payroll during interruption period |

| Trigger Events | Hacking, phishing, ransomware attacks, data breaches | Fire, natural disasters, equipment failure, supply chain disruption |

| Policyholders | Businesses reliant on digital data and IT infrastructure | Businesses facing risk of physical damage leading to operational halt |

| Claims Process | Requires proof of cyber incident and financial impact from digital threats | Requires documentation of physical damage and income loss due to interruption |

| Typical Premium Cost | Varies by business size, industry risk, and cybersecurity measures | Varies by location, business size, type of assets insured |

Which is better?

Business interruption insurance covers financial losses due to operational disruptions from events like natural disasters, while cyber risk insurance protects against digital threats such as data breaches, ransomware, and cyberattacks. Cyber risk insurance is crucial for businesses reliant on digital infrastructure and sensitive data, whereas business interruption insurance is essential for companies vulnerable to physical or operational disruptions. Choosing the better option depends on the company's risk exposure, industry, and specific vulnerabilities to either operational downtime or cyber threats.

Connection

Cyber risk insurance and business interruption insurance are interconnected as cyber incidents often trigger operational disruptions leading to financial losses. Cyber risk insurance covers damages from data breaches, ransomware attacks, and system failures, which can result in business interruption. Business interruption insurance complements this by compensating for income loss and extra expenses incurred during downtime caused by cyber events.

Key Terms

**Business Interruption Insurance:**

Business Interruption Insurance covers financial losses resulting from unexpected disruptions like natural disasters, fires, or equipment breakdowns that halt business operations, ensuring ongoing expenses such as payroll and rent are met. It typically requires a direct physical loss or damage to trigger coverage, unlike Cyber Risk Insurance which addresses data breaches, cyberattacks, and related digital threats. Explore more about how Business Interruption Insurance safeguards your company's continuity against unforeseen operational stoppages.

Indemnity Period

Business interruption insurance typically covers lost income during the indemnity period following physical property damage, ensuring revenue replacement over a specified timeframe. Cyber risk insurance indemnity periods address operational downtime caused by cyberattacks, including data breaches and system failures, with tailored coverage for digital disruptions. Explore detailed policy comparisons to understand how indemnity periods impact financial recovery in different risk scenarios.

Gross Profit

Business interruption insurance primarily covers loss of gross profit due to physical damage to insured property causing operational disruptions, ensuring financial stability during recovery periods. Cyber risk insurance addresses losses in gross profit stemming from cyberattacks such as ransomware or data breaches, covering business interruption without physical damage. Explore the nuances and coverage details of these policies to safeguard your business effectively.

Source and External Links

Business Interruption Insurance: Coverage, Quotes & Policies - Business interruption insurance covers lost income and extra expenses when a business is unable to operate due to a covered peril like fire or theft.

What Is Business Interruption Insurance? - Business interruption insurance helps replace lost income and pay for extra expenses if a business is affected by covered perils such as fire or wind.

Business Interruption Insurance Coverage Basics - Business interruption insurance covers operating expenses and lost income for a set period after a business is unable to operate due to physical damage from a covered event.

dowidth.com

dowidth.com