Invisible insurance leverages embedded technology and data analytics to provide seamless, automatic coverage without requiring active user engagement, optimizing risk protection in everyday activities. Parametric insurance offers predefined payout triggers based on measurable events, such as weather data or seismic activity, ensuring rapid claims settlement without traditional loss assessments. Explore the distinctive benefits and applications of invisible and parametric insurance to understand which solution best fits your risk management needs.

Why it is important

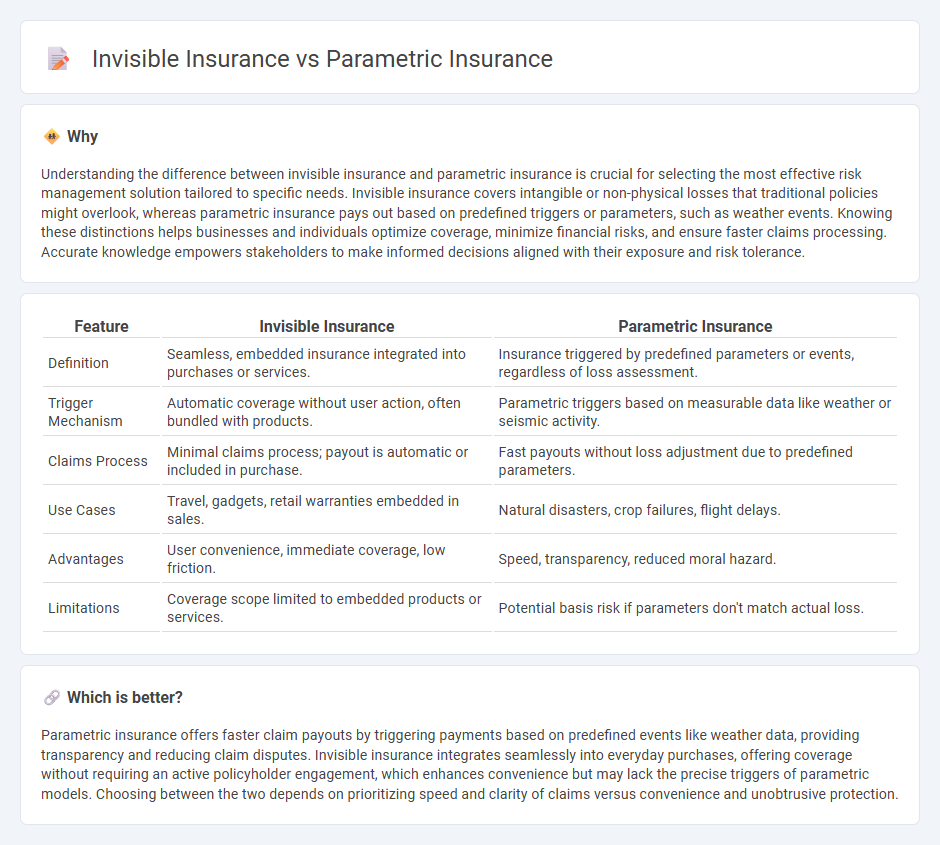

Understanding the difference between invisible insurance and parametric insurance is crucial for selecting the most effective risk management solution tailored to specific needs. Invisible insurance covers intangible or non-physical losses that traditional policies might overlook, whereas parametric insurance pays out based on predefined triggers or parameters, such as weather events. Knowing these distinctions helps businesses and individuals optimize coverage, minimize financial risks, and ensure faster claims processing. Accurate knowledge empowers stakeholders to make informed decisions aligned with their exposure and risk tolerance.

Comparison Table

| Feature | Invisible Insurance | Parametric Insurance |

|---|---|---|

| Definition | Seamless, embedded insurance integrated into purchases or services. | Insurance triggered by predefined parameters or events, regardless of loss assessment. |

| Trigger Mechanism | Automatic coverage without user action, often bundled with products. | Parametric triggers based on measurable data like weather or seismic activity. |

| Claims Process | Minimal claims process; payout is automatic or included in purchase. | Fast payouts without loss adjustment due to predefined parameters. |

| Use Cases | Travel, gadgets, retail warranties embedded in sales. | Natural disasters, crop failures, flight delays. |

| Advantages | User convenience, immediate coverage, low friction. | Speed, transparency, reduced moral hazard. |

| Limitations | Coverage scope limited to embedded products or services. | Potential basis risk if parameters don't match actual loss. |

Which is better?

Parametric insurance offers faster claim payouts by triggering payments based on predefined events like weather data, providing transparency and reducing claim disputes. Invisible insurance integrates seamlessly into everyday purchases, offering coverage without requiring an active policyholder engagement, which enhances convenience but may lack the precise triggers of parametric models. Choosing between the two depends on prioritizing speed and clarity of claims versus convenience and unobtrusive protection.

Connection

Invisible insurance and parametric insurance are connected through their innovative use of technology and data to simplify the claims process and enhance customer experience. Both types leverage automated triggers--parametric insurance pays out predefined amounts based on measurable events, while invisible insurance integrates seamlessly into everyday transactions without requiring active consumer involvement. This synergy reduces friction, speeds up settlements, and expands coverage accessibility across diverse risk scenarios.

Key Terms

**Parametric insurance:**

Parametric insurance provides coverage based on predefined triggers tied to measurable events such as natural disasters, enabling swift payouts without lengthy claims processes. This approach reduces administrative costs and offers transparency through objective data metrics like rainfall levels or earthquake magnitude. Discover more about how parametric insurance transforms risk management with precise and efficient protection solutions.

Trigger event

Parametric insurance provides coverage based on predefined trigger events such as earthquakes or hurricanes, paying out a fixed amount when specific parameters like wind speed or seismic magnitude are met. Invisible insurance operates subtly within broader policies or systems, activating coverage when certain indirect conditions or losses occur, often without explicit customer awareness. Explore the nuances of both models to understand which suits your risk management needs best.

Payout formula

Parametric insurance relies on predefined trigger events and objective data such as rainfall levels or wind speed to calculate payouts, allowing for swift claim settlements without assessing individual losses. Invisible insurance, integrated seamlessly into products or services, uses implicit coverage with payout formulas embedded in usage metrics or consumption patterns, often unnoticed by the policyholder. Explore the nuanced differences in payout calculations and risk management strategies between these innovative insurance models.

Source and External Links

What is parametric insurance? - Swiss Re Corporate Solutions - Parametric insurance covers the probability of a loss-causing event by making payments based on pre-defined thresholds and parameters, such as earthquake magnitude or wind speed.

Parametric Insurance Solutions - Amwins - Parametric insurance policies pay out based on specific event triggers, such as wind speed or earthquake magnitude, offering quick financial relief without needing detailed loss assessments.

Parametric insurance - Wikipedia - Parametric insurance provides pre-specified payouts based on trigger events, offering faster payouts than traditional insurance and suited for covering high-intensity, low-frequency risks.

dowidth.com

dowidth.com