Drone insurance provides coverage specifically tailored for unmanned aerial vehicles, protecting against damage, liability, and theft, while cargo insurance safeguards goods in transit from loss, damage, or theft during shipping. Both insurance types are essential for minimizing financial risks in their respective industries, ensuring operational continuity and asset protection. Explore our detailed comparison to determine which insurance best fits your specific needs.

Why it is important

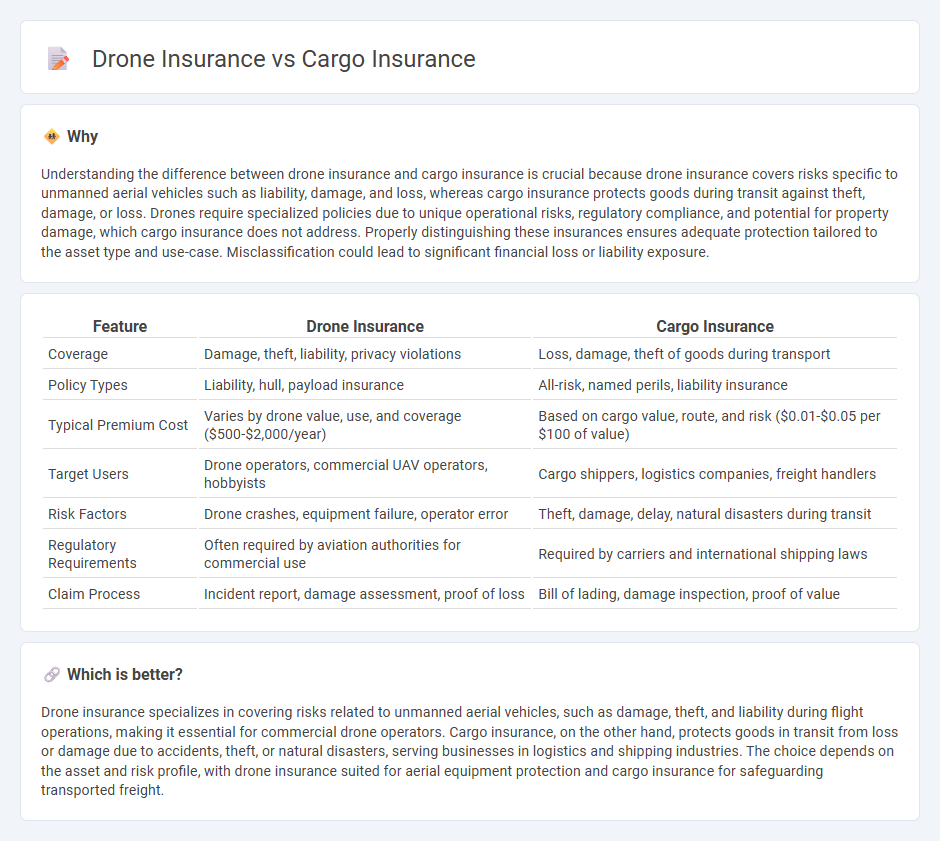

Understanding the difference between drone insurance and cargo insurance is crucial because drone insurance covers risks specific to unmanned aerial vehicles such as liability, damage, and loss, whereas cargo insurance protects goods during transit against theft, damage, or loss. Drones require specialized policies due to unique operational risks, regulatory compliance, and potential for property damage, which cargo insurance does not address. Properly distinguishing these insurances ensures adequate protection tailored to the asset type and use-case. Misclassification could lead to significant financial loss or liability exposure.

Comparison Table

| Feature | Drone Insurance | Cargo Insurance |

|---|---|---|

| Coverage | Damage, theft, liability, privacy violations | Loss, damage, theft of goods during transport |

| Policy Types | Liability, hull, payload insurance | All-risk, named perils, liability insurance |

| Typical Premium Cost | Varies by drone value, use, and coverage ($500-$2,000/year) | Based on cargo value, route, and risk ($0.01-$0.05 per $100 of value) |

| Target Users | Drone operators, commercial UAV operators, hobbyists | Cargo shippers, logistics companies, freight handlers |

| Risk Factors | Drone crashes, equipment failure, operator error | Theft, damage, delay, natural disasters during transit |

| Regulatory Requirements | Often required by aviation authorities for commercial use | Required by carriers and international shipping laws |

| Claim Process | Incident report, damage assessment, proof of loss | Bill of lading, damage inspection, proof of value |

Which is better?

Drone insurance specializes in covering risks related to unmanned aerial vehicles, such as damage, theft, and liability during flight operations, making it essential for commercial drone operators. Cargo insurance, on the other hand, protects goods in transit from loss or damage due to accidents, theft, or natural disasters, serving businesses in logistics and shipping industries. The choice depends on the asset and risk profile, with drone insurance suited for aerial equipment protection and cargo insurance for safeguarding transported freight.

Connection

Drone insurance and cargo insurance intersect through their shared focus on protecting valuable assets during transit, where drones are increasingly used for delivering cargo efficiently. Both insurance types cover risks such as damage, theft, and liability, ensuring financial security for operators against potential losses. The integration of drone technology in logistics highlights the growing importance of comprehensive insurance policies that address airborne cargo transportation challenges.

Key Terms

**Cargo Insurance:**

Cargo insurance provides comprehensive coverage for goods in transit, protecting against risks like theft, damage, or loss during shipping by land, sea, or air. This insurance is crucial for businesses involved in logistics, import-export, and freight forwarding, ensuring financial protection against unforeseen delays or accidents. Discover the key benefits and coverage options available for cargo insurance to safeguard your valuable shipments effectively.

Marine Policy

Marine cargo insurance specifically covers loss or damage to goods transported by sea, protecting shippers against risks like theft, weather, or accidents during maritime transit. Drone insurance, on the other hand, primarily covers liabilities and physical damage related to drone operations, including potential damage to the drone and third-party property. Explore how marine cargo policies can be tailored for emerging drone delivery services in maritime trade for further insights.

General Average

Cargo insurance covers loss or damage to goods during transit, while drone insurance protects against risks specific to unmanned aerial vehicles, such as crashes or liability claims. General Average is a maritime principle where all parties share loss costs from a voluntary sacrifice to save the ship and cargo, relevant primarily to cargo insurance but not to drone insurance. To understand the distinctions and applications in detail, explore our comprehensive guide on cargo versus drone insurance.

Source and External Links

Motor Truck Cargo Insurance - Progressive Commercial - Provides financial protection against damage, loss, or harm to transported materials, covering incidents like fire, collision, and theft.

Motor Truck Cargo Insurance - Northland - Offers comprehensive protection for a wide range of commodities during transport, including high-value and specialized freight.

Cargo Insurance | Flexport - Specialized insurance that protects against loss or damage to goods transported by land, air, or sea, tailored to the risks involved in different transportation modes.

dowidth.com

dowidth.com