Behavioral policy pricing relies on assessing policyholders' historical data and risk profiles to determine premiums, which often results in a broad categorization based on demographic and past behavior. Telematics-based pricing collects real-time driving data through devices or apps to personalize insurance rates, reflecting individual driving habits such as speed, braking, and mileage. Explore how these innovative pricing models transform risk assessment and premium accuracy in the insurance industry.

Why it is important

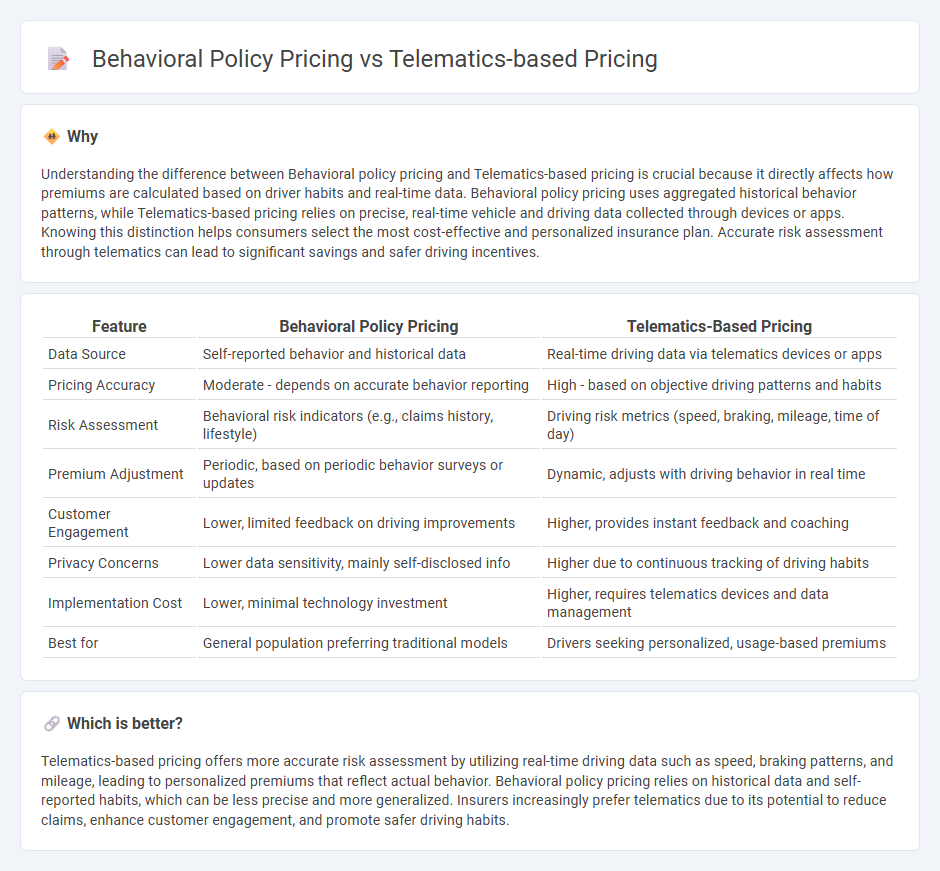

Understanding the difference between Behavioral policy pricing and Telematics-based pricing is crucial because it directly affects how premiums are calculated based on driver habits and real-time data. Behavioral policy pricing uses aggregated historical behavior patterns, while Telematics-based pricing relies on precise, real-time vehicle and driving data collected through devices or apps. Knowing this distinction helps consumers select the most cost-effective and personalized insurance plan. Accurate risk assessment through telematics can lead to significant savings and safer driving incentives.

Comparison Table

| Feature | Behavioral Policy Pricing | Telematics-Based Pricing |

|---|---|---|

| Data Source | Self-reported behavior and historical data | Real-time driving data via telematics devices or apps |

| Pricing Accuracy | Moderate - depends on accurate behavior reporting | High - based on objective driving patterns and habits |

| Risk Assessment | Behavioral risk indicators (e.g., claims history, lifestyle) | Driving risk metrics (speed, braking, mileage, time of day) |

| Premium Adjustment | Periodic, based on periodic behavior surveys or updates | Dynamic, adjusts with driving behavior in real time |

| Customer Engagement | Lower, limited feedback on driving improvements | Higher, provides instant feedback and coaching |

| Privacy Concerns | Lower data sensitivity, mainly self-disclosed info | Higher due to continuous tracking of driving habits |

| Implementation Cost | Lower, minimal technology investment | Higher, requires telematics devices and data management |

| Best for | General population preferring traditional models | Drivers seeking personalized, usage-based premiums |

Which is better?

Telematics-based pricing offers more accurate risk assessment by utilizing real-time driving data such as speed, braking patterns, and mileage, leading to personalized premiums that reflect actual behavior. Behavioral policy pricing relies on historical data and self-reported habits, which can be less precise and more generalized. Insurers increasingly prefer telematics due to its potential to reduce claims, enhance customer engagement, and promote safer driving habits.

Connection

Behavioral policy pricing and telematics-based pricing are interconnected through their focus on personalized risk assessment using real-time driving data. Telematics devices collect detailed information such as speed, braking patterns, and mileage, enabling insurers to tailor premiums according to individual driving behavior. This data-driven approach enhances accuracy in pricing by reflecting actual risk levels rather than traditional demographic factors.

Key Terms

Usage-based Insurance (UBI)

Telematics-based pricing utilizes GPS and sensor data to monitor real-time driving behaviors such as speed, acceleration, and driving patterns, enabling insurers to assess risk more accurately and offer personalized premiums. Behavioral policy pricing focuses on analyzing aggregated driver behavior data and historic claims information to adjust insurance rates based on individual risk profiles. Explore the evolving landscape of Usage-Based Insurance (UBI) to understand how these innovative pricing models are transforming risk evaluation and premium calculations.

Risk Scoring

Telematics-based pricing leverages real-time driving data collected through GPS and in-vehicle sensors to create dynamic risk scores that reward safe behavior and penalize risky driving patterns. Behavioral policy pricing uses historical driving data, including past claims and violations, combined with statistical models to assess risk and determine premiums. Explore the nuances and advantages of each approach to understand how risk scoring transforms insurance pricing models.

Driving Behavior Analytics

Telematics-based pricing utilizes real-time driving data collected through GPS and sensors to assess risk and personalize insurance premiums, offering a dynamic and precise evaluation of driving habits. Behavioral policy pricing focuses on analyzing historical driving behavior patterns, such as speed, braking, and acceleration, to predict future risk and adjust policy costs accordingly. Explore how integrating advanced driving behavior analytics can transform risk assessment and optimize insurance pricing models.

Source and External Links

Telematics Pricing: Understanding the Factors Impacting Cost - Telematics pricing models are typically subscription-based and can be influenced by factors such as contract duration and the integration of additional products like dash cams and asset tracking.

Types of Telematics Insurance: Usage-Based Insurance, Pay-As... - Telematics-based pricing in insurance adjusts premiums based on driving behaviors, offering safe drivers lower rates and promoting more accurate risk assessments.

Telematics Insurance: How it Works, Benefits + Providers - Telematics insurance uses real-time vehicle tracking and driver behavior insights to offer usage-based premiums, which can lead to cost savings through better risk profiling.

dowidth.com

dowidth.com