Gig worker insurance often focuses on flexible coverage tailored to independent contracts, including liability and income protection, while small business owner insurance typically offers comprehensive plans encompassing property, liability, and employee-related risks. Both insurance types address distinct operational needs and risk exposures based on business structure and scale. Explore more about selecting the optimal insurance solution for your specific professional status.

Why it is important

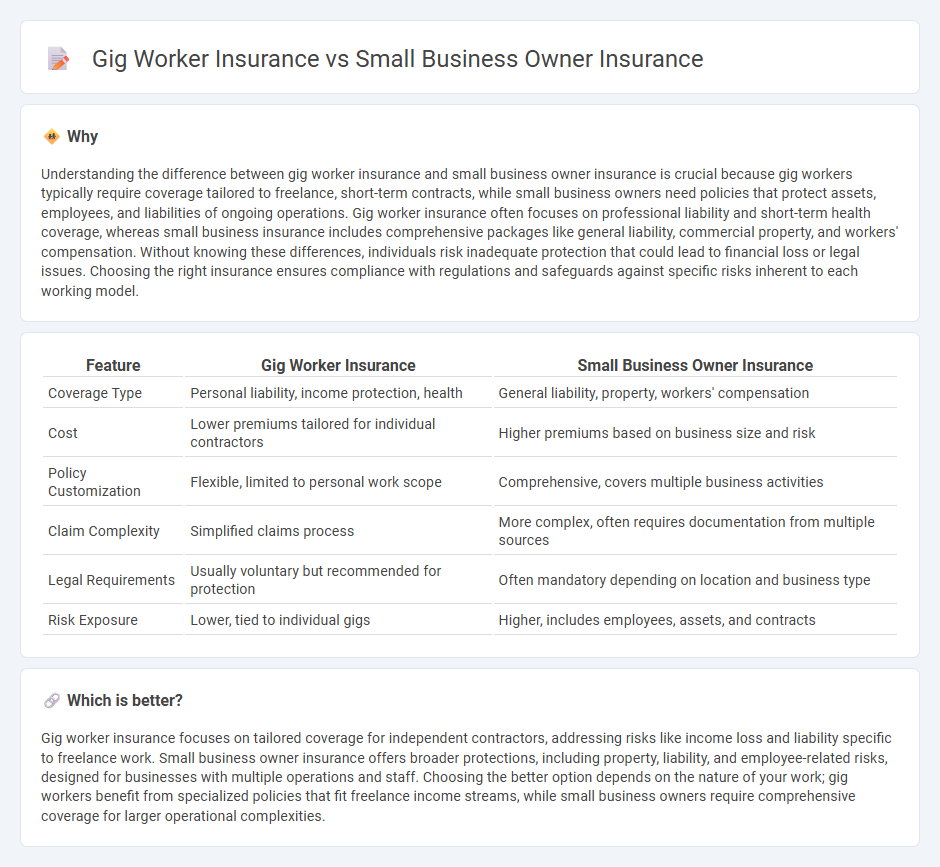

Understanding the difference between gig worker insurance and small business owner insurance is crucial because gig workers typically require coverage tailored to freelance, short-term contracts, while small business owners need policies that protect assets, employees, and liabilities of ongoing operations. Gig worker insurance often focuses on professional liability and short-term health coverage, whereas small business insurance includes comprehensive packages like general liability, commercial property, and workers' compensation. Without knowing these differences, individuals risk inadequate protection that could lead to financial loss or legal issues. Choosing the right insurance ensures compliance with regulations and safeguards against specific risks inherent to each working model.

Comparison Table

| Feature | Gig Worker Insurance | Small Business Owner Insurance |

|---|---|---|

| Coverage Type | Personal liability, income protection, health | General liability, property, workers' compensation |

| Cost | Lower premiums tailored for individual contractors | Higher premiums based on business size and risk |

| Policy Customization | Flexible, limited to personal work scope | Comprehensive, covers multiple business activities |

| Claim Complexity | Simplified claims process | More complex, often requires documentation from multiple sources |

| Legal Requirements | Usually voluntary but recommended for protection | Often mandatory depending on location and business type |

| Risk Exposure | Lower, tied to individual gigs | Higher, includes employees, assets, and contracts |

Which is better?

Gig worker insurance focuses on tailored coverage for independent contractors, addressing risks like income loss and liability specific to freelance work. Small business owner insurance offers broader protections, including property, liability, and employee-related risks, designed for businesses with multiple operations and staff. Choosing the better option depends on the nature of your work; gig workers benefit from specialized policies that fit freelance income streams, while small business owners require comprehensive coverage for larger operational complexities.

Connection

Gig worker insurance and small business owner insurance both provide tailored coverage that addresses the unique risks associated with independent work and entrepreneurship. Both types of insurance typically include liability protection, health coverage options, and income loss safeguards, ensuring financial stability for self-employed individuals and small-scale enterprises. By offering customizable policies, insurance providers create a bridge between gig economy professionals and small business owners, recognizing the overlapping needs for risk management and asset protection.

Key Terms

**Small Business Owner Insurance:**

Small business owner insurance offers comprehensive coverage tailored to the unique risks faced by entrepreneurs, including property damage, liability claims, and business interruption. It typically includes policies such as general liability, commercial property, and workers' compensation, providing financial protection and peace of mind for business operations. Explore detailed benefits and coverage options to determine the best insurance for your small business needs.

Business Owner's Policy (BOP)

A Business Owner's Policy (BOP) offers small business owners a comprehensive insurance solutioncombining general liability, property insurance, and business interruption coverage tailored to protect physical assets and reduce financial risks. Gig workers typically require specialized insurance focusing on liability and task-specific risks, making BOPs less applicable to their flexible, often mobile work arrangements. Explore the distinct coverages and benefits of BOPs to determine if it fits your business insurance needs.

General Liability Insurance

General Liability Insurance for small business owners covers property damage, bodily injury, and legal defense costs linked to business operations, often providing broader protection due to various business risks. Gig worker insurance typically offers tailored general liability coverage designed for short-term or project-based work, focusing on specific client contracts and lower risk exposure. Explore detailed policy comparisons and coverage options to find the best fit for your professional liabilities.

Source and External Links

Hiscox Small Business Insurance - Offers customized insurance coverage for small businesses, protecting against claims and lawsuits, with options to bundle and save on premiums.

Progressive Commercial Business Insurance - Provides customizable business insurance options, including general liability, professional liability, and workers' compensation, tailored to specific business needs.

The Hartford Business Insurance - Offers a range of business insurance coverages, including Business Owner's Policies, general liability, and professional liability, with personalized options for small businesses.

dowidth.com

dowidth.com