Drone insurance protects unmanned aerial vehicles against damage, theft, and liability risks during operation, while health insurance covers medical expenses related to illness or injury. Both types of insurance mitigate financial loss but differ significantly in scope--drone insurance focuses on equipment and liability, whereas health insurance centers on personal healthcare costs. Explore the key differences and benefits of drone insurance versus health insurance to understand which coverage suits your needs best.

Why it is important

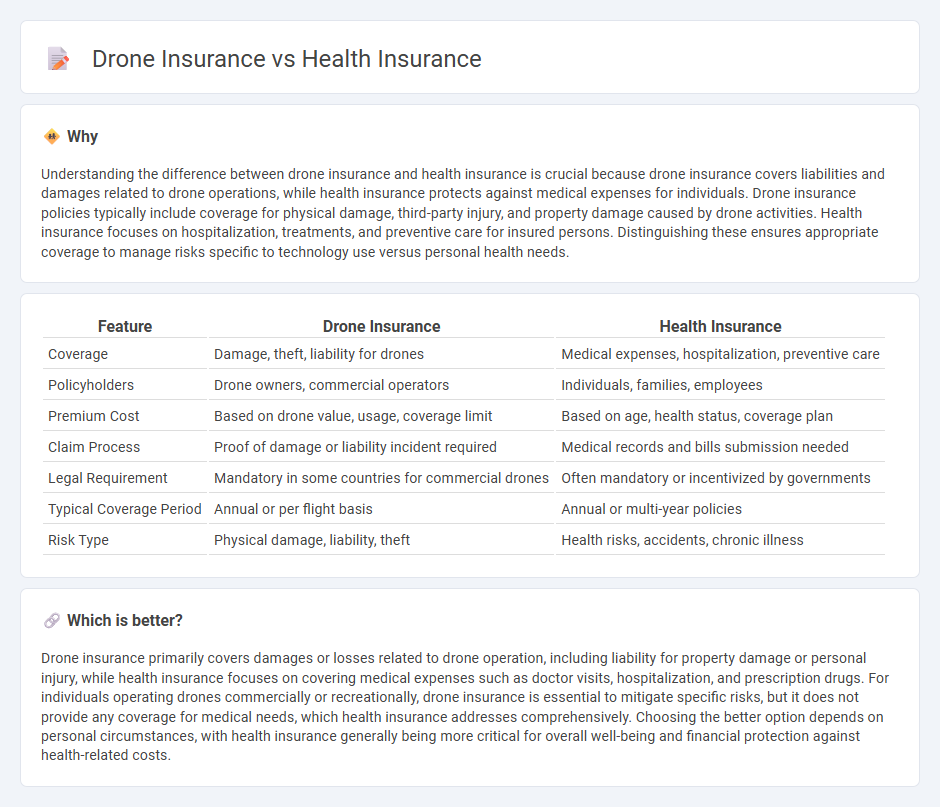

Understanding the difference between drone insurance and health insurance is crucial because drone insurance covers liabilities and damages related to drone operations, while health insurance protects against medical expenses for individuals. Drone insurance policies typically include coverage for physical damage, third-party injury, and property damage caused by drone activities. Health insurance focuses on hospitalization, treatments, and preventive care for insured persons. Distinguishing these ensures appropriate coverage to manage risks specific to technology use versus personal health needs.

Comparison Table

| Feature | Drone Insurance | Health Insurance |

|---|---|---|

| Coverage | Damage, theft, liability for drones | Medical expenses, hospitalization, preventive care |

| Policyholders | Drone owners, commercial operators | Individuals, families, employees |

| Premium Cost | Based on drone value, usage, coverage limit | Based on age, health status, coverage plan |

| Claim Process | Proof of damage or liability incident required | Medical records and bills submission needed |

| Legal Requirement | Mandatory in some countries for commercial drones | Often mandatory or incentivized by governments |

| Typical Coverage Period | Annual or per flight basis | Annual or multi-year policies |

| Risk Type | Physical damage, liability, theft | Health risks, accidents, chronic illness |

Which is better?

Drone insurance primarily covers damages or losses related to drone operation, including liability for property damage or personal injury, while health insurance focuses on covering medical expenses such as doctor visits, hospitalization, and prescription drugs. For individuals operating drones commercially or recreationally, drone insurance is essential to mitigate specific risks, but it does not provide any coverage for medical needs, which health insurance addresses comprehensively. Choosing the better option depends on personal circumstances, with health insurance generally being more critical for overall well-being and financial protection against health-related costs.

Connection

Drone insurance and health insurance are connected through the shared focus on risk management and liability coverage for individuals and businesses utilizing drones. Drone insurance typically covers physical damage, liability for third-party injuries, and property damage, while health insurance ensures medical expense coverage for operators injured during drone operation. Both types of insurance contribute to comprehensive protection strategies, addressing physical safety risks and financial exposure in drone-related activities.

Key Terms

Health Insurance:

Health insurance provides financial protection against medical expenses, covering doctor visits, hospital stays, surgeries, and prescription medications, which vary based on the plan's coverage and premiums. It offers benefits like preventive care, chronic disease management, and emergency treatment, ensuring access to essential healthcare services and reducing out-of-pocket costs. Explore further to understand how health insurance safeguards your well-being and supports long-term financial security.

Premium

Health insurance premiums are typically based on factors such as age, medical history, and coverage level, often resulting in monthly or annual payments that vary widely. Drone insurance premiums depend on drone type, usage frequency, coverage options including liability and damage protection, and pilot experience, with costs fluctuating accordingly. Explore detailed premium comparisons to determine the best policy fit for your needs.

Deductible

Health insurance deductibles vary widely based on plan type, often ranging from $500 to $3,000 annually, impacting out-of-pocket costs before coverage begins. Drone insurance deductibles typically depend on policy specifics and drone value, with amounts ranging from $250 to $1,000 per claim, affecting repair or replacement expenses after incidents. Explore detailed deductible structures and coverage options to choose the right insurance for your needs.

Source and External Links

Health insurance | USAGov - Provides information on various U.S. health insurance programs, including Medicaid, Medicare, the ACA marketplace, and COBRA.

Health Insurance - State of Michigan - Offers guidance on health insurance in Michigan, including open enrollment periods and available subsidies.

Individual and family health insurance plans - United Healthcare - Allows users to explore and compare individual and family health insurance plans in their area, highlighting various coverage options.

dowidth.com

dowidth.com