Insurtech platforms leverage advanced technology such as AI, machine learning, and automation to streamline insurance processes, enhance customer experience, and provide personalized coverage options. B2B insurance marketplaces connect businesses with multiple insurance providers, enabling efficient comparison, quotation, and purchase of commercial insurance products tailored to specific industry needs. Explore the differences in functionality and benefits to discover the ideal solution for your insurance procurement challenges.

Why it is important

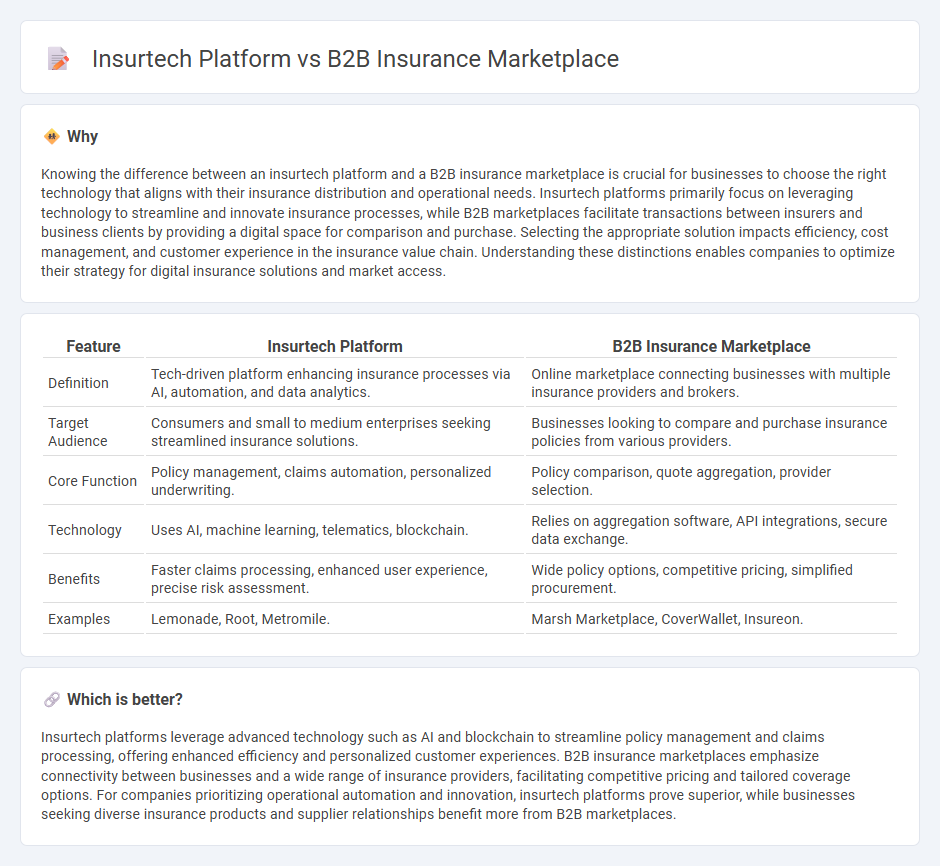

Knowing the difference between an insurtech platform and a B2B insurance marketplace is crucial for businesses to choose the right technology that aligns with their insurance distribution and operational needs. Insurtech platforms primarily focus on leveraging technology to streamline and innovate insurance processes, while B2B marketplaces facilitate transactions between insurers and business clients by providing a digital space for comparison and purchase. Selecting the appropriate solution impacts efficiency, cost management, and customer experience in the insurance value chain. Understanding these distinctions enables companies to optimize their strategy for digital insurance solutions and market access.

Comparison Table

| Feature | Insurtech Platform | B2B Insurance Marketplace |

|---|---|---|

| Definition | Tech-driven platform enhancing insurance processes via AI, automation, and data analytics. | Online marketplace connecting businesses with multiple insurance providers and brokers. |

| Target Audience | Consumers and small to medium enterprises seeking streamlined insurance solutions. | Businesses looking to compare and purchase insurance policies from various providers. |

| Core Function | Policy management, claims automation, personalized underwriting. | Policy comparison, quote aggregation, provider selection. |

| Technology | Uses AI, machine learning, telematics, blockchain. | Relies on aggregation software, API integrations, secure data exchange. |

| Benefits | Faster claims processing, enhanced user experience, precise risk assessment. | Wide policy options, competitive pricing, simplified procurement. |

| Examples | Lemonade, Root, Metromile. | Marsh Marketplace, CoverWallet, Insureon. |

Which is better?

Insurtech platforms leverage advanced technology such as AI and blockchain to streamline policy management and claims processing, offering enhanced efficiency and personalized customer experiences. B2B insurance marketplaces emphasize connectivity between businesses and a wide range of insurance providers, facilitating competitive pricing and tailored coverage options. For companies prioritizing operational automation and innovation, insurtech platforms prove superior, while businesses seeking diverse insurance products and supplier relationships benefit more from B2B marketplaces.

Connection

Insurtech platforms leverage advanced technology to streamline insurance processes, improving underwriting, claims management, and customer experience within the B2B insurance marketplace. These platforms integrate data analytics, AI, and automation to offer tailored insurance solutions and facilitate efficient risk assessment for businesses. By connecting insurers, brokers, and corporate clients through digital marketplaces, insurtech drives transparency, faster transactions, and scalability in the B2B insurance sector.

Key Terms

Risk Placement

B2B insurance marketplaces streamline risk placement by connecting brokers and carriers, enabling faster access to diverse insurance products and competitive pricing. Insurtech platforms leverage advanced technologies like AI and data analytics to enhance underwriting accuracy and automate risk assessment processes. Explore how innovative solutions are transforming risk placement efficiency in the insurance industry.

API Integration

B2B insurance marketplaces connect brokers and carriers through streamlined digital platforms, emphasizing wide access to diverse insurance products. Insurtech platforms prioritize API integration to enable seamless data exchange, automated underwriting, and real-time policy management, enhancing operational efficiency. Explore the advantages of API-driven innovations to transform your insurance business solutions.

Underwriting Automation

B2B insurance marketplaces streamline the purchase process by connecting businesses with multiple insurers, emphasizing transparency and price comparison, while insurtech platforms prioritize underwriting automation to enhance risk assessment accuracy and speed. Advanced machine learning algorithms and AI-driven analytics deployed by insurtech platforms enable real-time data processing, significantly reducing underwriting time and improving decision quality. Explore how underwriting automation transforms insurance efficiency and competitiveness in modern B2B ecosystems.

Source and External Links

Insureon - Provides an online platform for businesses to quickly obtain quotes and purchase various types of insurance coverage.

HealthCare.gov Small Business Health Options Program (SHOP) - Offers a platform for small businesses to compare and purchase group health insurance plans, with potential tax credits.

UnitedHealthcare Small Business - Provides group health insurance plans designed specifically for small businesses, offering extensive provider networks and benefit options.

dowidth.com

dowidth.com