Social prescribing insurance covers costs related to non-medical health support services that enhance well-being, while income protection insurance provides financial replacement if you become unable to work due to illness or injury. Both types of insurance serve distinct roles in safeguarding personal health and income, addressing different aspects of risk management. Discover how each insurance type can protect your financial and health interests effectively.

Why it is important

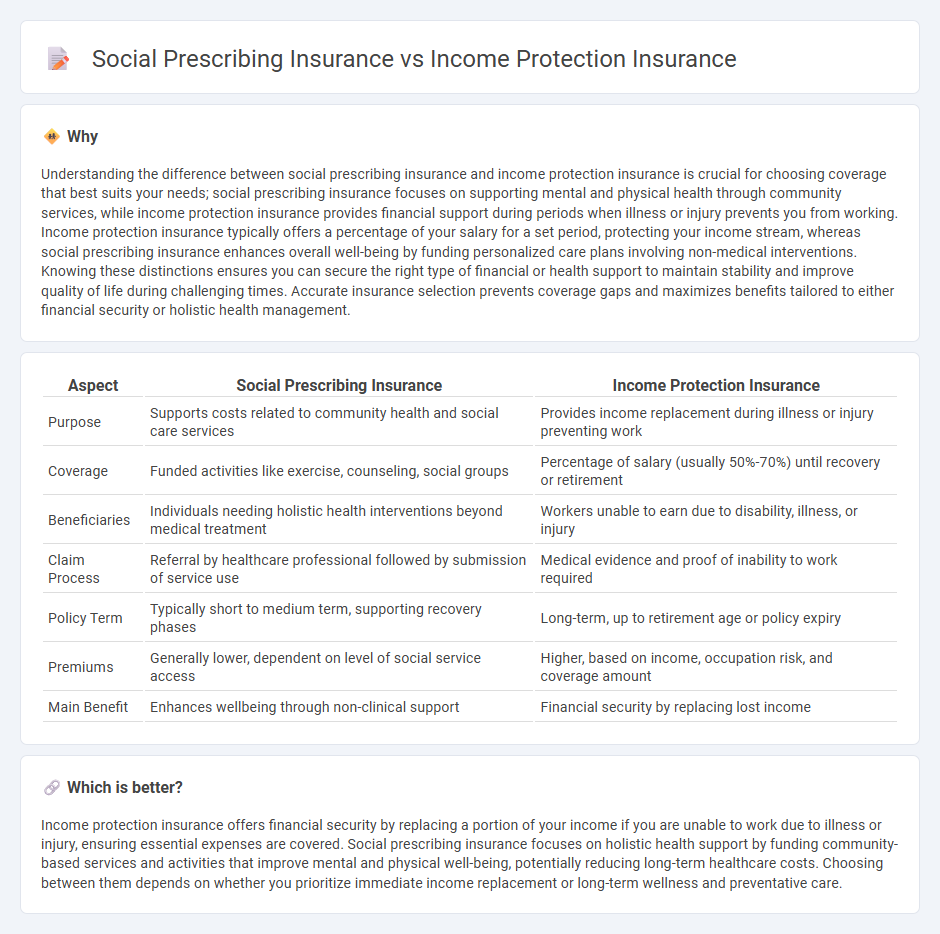

Understanding the difference between social prescribing insurance and income protection insurance is crucial for choosing coverage that best suits your needs; social prescribing insurance focuses on supporting mental and physical health through community services, while income protection insurance provides financial support during periods when illness or injury prevents you from working. Income protection insurance typically offers a percentage of your salary for a set period, protecting your income stream, whereas social prescribing insurance enhances overall well-being by funding personalized care plans involving non-medical interventions. Knowing these distinctions ensures you can secure the right type of financial or health support to maintain stability and improve quality of life during challenging times. Accurate insurance selection prevents coverage gaps and maximizes benefits tailored to either financial security or holistic health management.

Comparison Table

| Aspect | Social Prescribing Insurance | Income Protection Insurance |

|---|---|---|

| Purpose | Supports costs related to community health and social care services | Provides income replacement during illness or injury preventing work |

| Coverage | Funded activities like exercise, counseling, social groups | Percentage of salary (usually 50%-70%) until recovery or retirement |

| Beneficiaries | Individuals needing holistic health interventions beyond medical treatment | Workers unable to earn due to disability, illness, or injury |

| Claim Process | Referral by healthcare professional followed by submission of service use | Medical evidence and proof of inability to work required |

| Policy Term | Typically short to medium term, supporting recovery phases | Long-term, up to retirement age or policy expiry |

| Premiums | Generally lower, dependent on level of social service access | Higher, based on income, occupation risk, and coverage amount |

| Main Benefit | Enhances wellbeing through non-clinical support | Financial security by replacing lost income |

Which is better?

Income protection insurance offers financial security by replacing a portion of your income if you are unable to work due to illness or injury, ensuring essential expenses are covered. Social prescribing insurance focuses on holistic health support by funding community-based services and activities that improve mental and physical well-being, potentially reducing long-term healthcare costs. Choosing between them depends on whether you prioritize immediate income replacement or long-term wellness and preventative care.

Connection

Social prescribing insurance and income protection insurance intersect by supporting individuals' financial stability during health-related challenges. Social prescribing insurance often complements healthcare by funding non-medical interventions that improve well-being, which can reduce the duration of illness or disability. Income protection insurance provides a safety net by replacing lost income when illness or injury prevents working, ensuring continuous financial support alongside social prescribing benefits.

Key Terms

**Income Protection Insurance:**

Income Protection Insurance provides financial security by replacing a portion of your income if illness or injury prevents you from working, typically covering up to 70% of your salary for a specified period. It offers long-term support compared to social prescribing insurance, which focuses on holistic health and well-being interventions. Discover how Income Protection Insurance can safeguard your financial stability during unforeseen health challenges.

Benefit Period

Income protection insurance typically offers a benefit period ranging from two years to retirement age, ensuring long-term financial support during extended illness or disability. Social prescribing insurance, however, generally provides short-term coverage aimed at promoting well-being through non-clinical interventions, with benefit periods often lasting only a few months. Explore the differences in benefit period structures to determine which insurance best suits your needs.

Waiting Period

Income protection insurance typically enforces a waiting period ranging from 30 to 90 days before benefits commence, ensuring coverage during extended illness or injury. Social prescribing insurance, however, often features shorter waiting periods or immediate access to holistic health services, facilitating quicker support through community-based interventions. Explore more about how waiting periods impact your coverage choice and overall financial and health security.

dowidth.com

dowidth.com