Deepfake insurance specifically covers risks associated with synthetic media fraud, protecting individuals and businesses from financial losses due to manipulated videos or audio used for deception. Fraud insurance broadly safeguards against various fraudulent activities, including identity theft, false claims, and cybercrime, ensuring comprehensive protection against diverse criminal schemes. Explore the distinctions and benefits of deepfake and fraud insurance to secure your assets effectively.

Why it is important

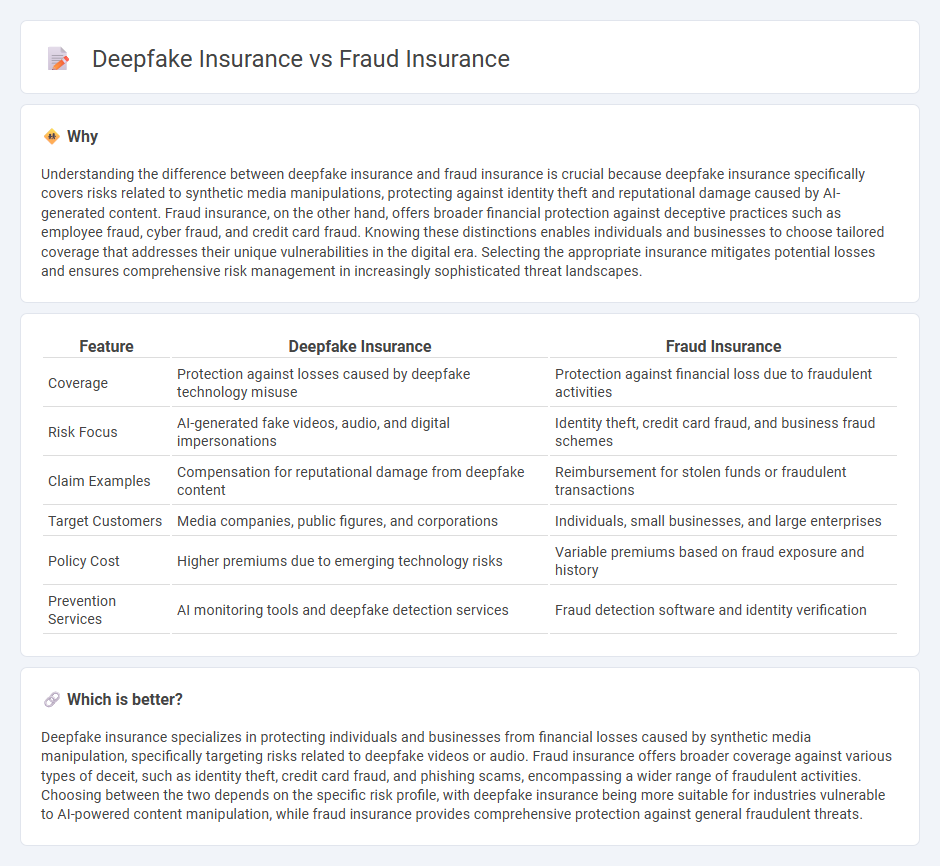

Understanding the difference between deepfake insurance and fraud insurance is crucial because deepfake insurance specifically covers risks related to synthetic media manipulations, protecting against identity theft and reputational damage caused by AI-generated content. Fraud insurance, on the other hand, offers broader financial protection against deceptive practices such as employee fraud, cyber fraud, and credit card fraud. Knowing these distinctions enables individuals and businesses to choose tailored coverage that addresses their unique vulnerabilities in the digital era. Selecting the appropriate insurance mitigates potential losses and ensures comprehensive risk management in increasingly sophisticated threat landscapes.

Comparison Table

| Feature | Deepfake Insurance | Fraud Insurance |

|---|---|---|

| Coverage | Protection against losses caused by deepfake technology misuse | Protection against financial loss due to fraudulent activities |

| Risk Focus | AI-generated fake videos, audio, and digital impersonations | Identity theft, credit card fraud, and business fraud schemes |

| Claim Examples | Compensation for reputational damage from deepfake content | Reimbursement for stolen funds or fraudulent transactions |

| Target Customers | Media companies, public figures, and corporations | Individuals, small businesses, and large enterprises |

| Policy Cost | Higher premiums due to emerging technology risks | Variable premiums based on fraud exposure and history |

| Prevention Services | AI monitoring tools and deepfake detection services | Fraud detection software and identity verification |

Which is better?

Deepfake insurance specializes in protecting individuals and businesses from financial losses caused by synthetic media manipulation, specifically targeting risks related to deepfake videos or audio. Fraud insurance offers broader coverage against various types of deceit, such as identity theft, credit card fraud, and phishing scams, encompassing a wider range of fraudulent activities. Choosing between the two depends on the specific risk profile, with deepfake insurance being more suitable for industries vulnerable to AI-powered content manipulation, while fraud insurance provides comprehensive protection against general fraudulent threats.

Connection

Deepfake insurance and fraud insurance are interconnected as both address emerging risks related to deception and identity manipulation. Deepfake insurance specifically covers damages caused by AI-generated synthetic media used to commit fraud or impersonation, while fraud insurance provides broader protection against financial losses from fraudulent activities, including those enabled by deepfakes. The rise of deepfake technology intensifies the need for specialized fraud insurance products to mitigate sophisticated digital threats in the insurance industry.

Key Terms

**Fraud Insurance:**

Fraud insurance protects businesses and individuals against financial losses caused by deceptive practices such as identity theft, unauthorized transactions, and false claims, providing crucial risk mitigation in sectors like banking and e-commerce. This type of insurance often covers legal fees, investigation costs, and direct monetary losses resulting from fraudulent activities. Explore more to understand how fraud insurance can safeguard your assets in an increasingly digital world.

Misrepresentation

Fraud insurance primarily addresses financial losses resulting from intentional misrepresentation or deceit, protecting policyholders against false claims and fraudulent activities. Deepfake insurance specifically covers damages arising from synthetic media content used to misrepresent individuals or entities, safeguarding against reputational harm and identity manipulation. Explore more to understand the distinct protections these insurances offer in managing misrepresentation risks.

Claim Investigation

Fraud insurance claims investigations rely heavily on forensic analysis, witness statements, and documentation verification to uncover deceptive practices and ensure legitimate payouts. Deepfake insurance claim investigations employ advanced AI-driven detection tools and digital forensics to identify manipulated audio-visual content, addressing the emerging risks posed by synthetic media. Explore how cutting-edge technologies are transforming claim investigation methodologies in both insurance domains.

Source and External Links

What is Insurance Fraud? - Explains the definition and types of insurance fraud, including intent to defraud and examples of fraud schemes.

Types of Insurance Fraud - PA Office of Attorney General - Lists common types of insurance fraud in sectors such as auto, homeowner, health care, life & disability, and agent/industry practices.

Insurance Topics | Insurance Fraud - NAIC - Discusses the impact and prevention of insurance fraud, including fraud by illegitimate insurance companies and dishonest agents.

dowidth.com

dowidth.com