Buy now insurance offers immediate, personalized coverage with flexible plans tailored to individual needs and risk profiles. Group insurance provides collective protection under a single policy, often funded by employers for cost efficiency and simplified administration. Explore detailed comparisons to determine which insurance option best suits your financial security goals.

Why it is important

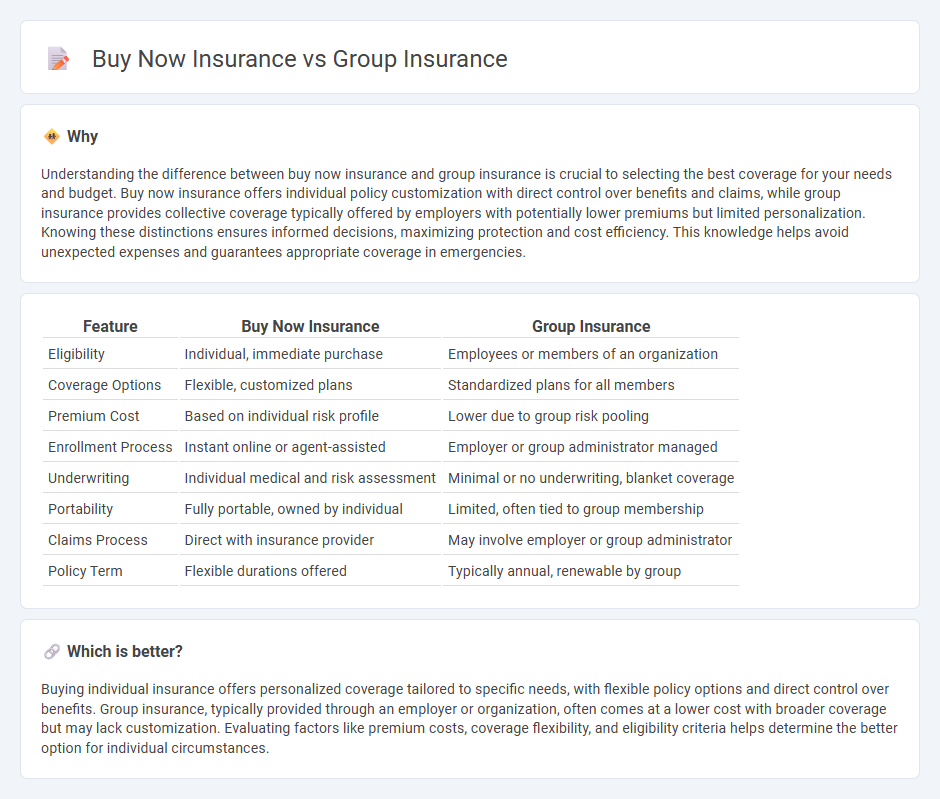

Understanding the difference between buy now insurance and group insurance is crucial to selecting the best coverage for your needs and budget. Buy now insurance offers individual policy customization with direct control over benefits and claims, while group insurance provides collective coverage typically offered by employers with potentially lower premiums but limited personalization. Knowing these distinctions ensures informed decisions, maximizing protection and cost efficiency. This knowledge helps avoid unexpected expenses and guarantees appropriate coverage in emergencies.

Comparison Table

| Feature | Buy Now Insurance | Group Insurance |

|---|---|---|

| Eligibility | Individual, immediate purchase | Employees or members of an organization |

| Coverage Options | Flexible, customized plans | Standardized plans for all members |

| Premium Cost | Based on individual risk profile | Lower due to group risk pooling |

| Enrollment Process | Instant online or agent-assisted | Employer or group administrator managed |

| Underwriting | Individual medical and risk assessment | Minimal or no underwriting, blanket coverage |

| Portability | Fully portable, owned by individual | Limited, often tied to group membership |

| Claims Process | Direct with insurance provider | May involve employer or group administrator |

| Policy Term | Flexible durations offered | Typically annual, renewable by group |

Which is better?

Buying individual insurance offers personalized coverage tailored to specific needs, with flexible policy options and direct control over benefits. Group insurance, typically provided through an employer or organization, often comes at a lower cost with broader coverage but may lack customization. Evaluating factors like premium costs, coverage flexibility, and eligibility criteria helps determine the better option for individual circumstances.

Connection

Buy now insurance platforms streamline the process of purchasing policies by offering instant quotes and immediate coverage, which complements group insurance by increasing accessibility for members. Group insurance leverages collective bargaining power to reduce premiums and expand coverage options, benefiting from digital buy now tools that simplify enrollment and claims management. Integration of buy now insurance technology enhances the efficiency and appeal of group insurance plans within organizations or associations.

Key Terms

Underwriting

Group insurance typically features simplified underwriting processes due to risk pooling across members, resulting in fewer medical exams and faster approval times. Buy now insurance policies often require detailed individual underwriting, including medical history, lifestyle factors, and risk assessments, which can delay coverage activation. Discover the advantages of each underwriting approach to determine which insurance option best suits your needs.

Premiums

Group insurance premiums are typically lower due to risk pooling and employer subsidies, offering cost-effective coverage for employees. Buy now insurance premiums vary widely based on individual risk factors like age, health, and coverage level, often resulting in higher costs compared to group plans. Explore detailed comparisons to determine the best premium strategy for your needs.

Risk Pooling

Group insurance leverages risk pooling by spreading the risk across a large number of members, resulting in lower premiums and increased coverage stability compared to individual plans. Buy-now insurance lacks the collective risk distribution, often leading to higher costs and potential coverage limitations due to individualized underwriting. Explore more about how risk pooling impacts your insurance choices and benefits.

Source and External Links

What is group insurance? Benefits and limitations - This article explains how group insurance works, its benefits, and limitations, including comparisons with individual insurance plans.

What is Group Insurance & How Does It Work? - This page discusses group insurance as part of employee benefits packages, highlighting its cost advantages and common types like health insurance.

Group insurance - This Wikipedia page provides an overview of group insurance, including international variations and types of coverage such as health and life insurance.

dowidth.com

dowidth.com