Insurtech platforms leverage advanced technology, such as AI and big data analytics, to streamline traditional insurance processes and enhance customer experience through personalized policies and automated claims management. Parametric insurance platforms focus on predefined event triggers and payout parameters, enabling rapid, transparent claims settlements without the need for extensive loss assessments. Explore how these innovative insurance solutions can transform risk management and provide more efficient coverage options.

Why it is important

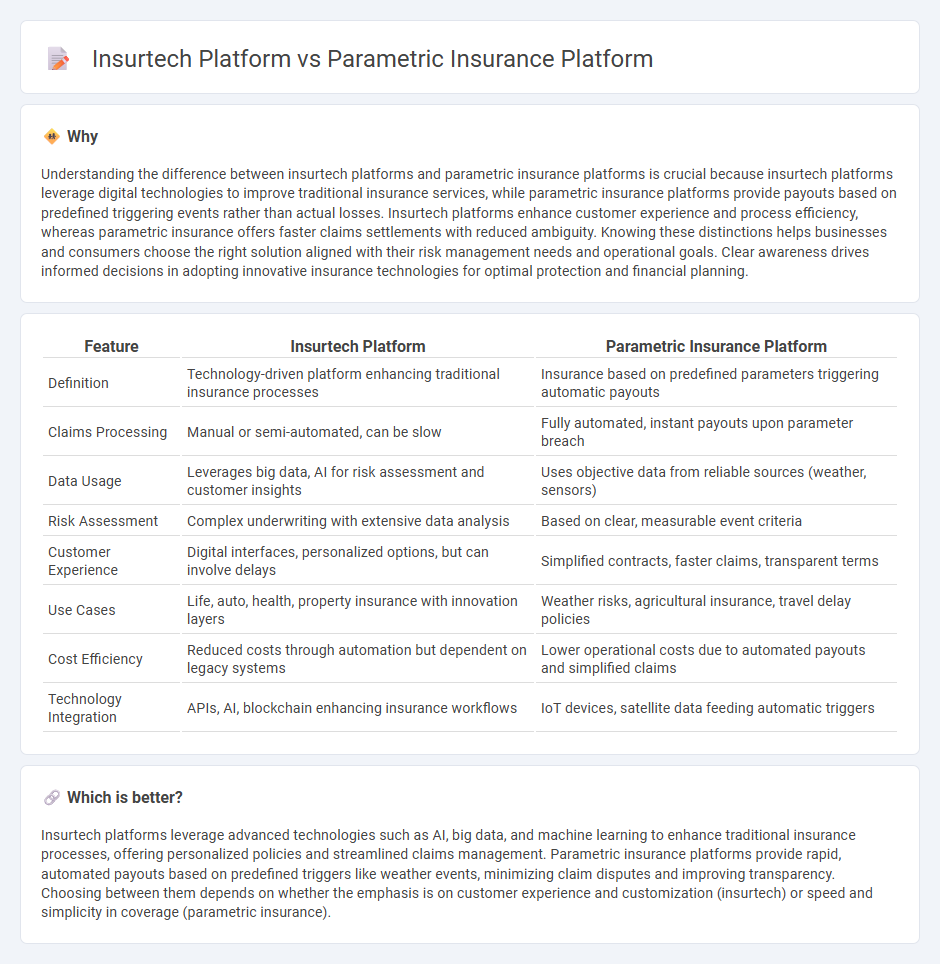

Understanding the difference between insurtech platforms and parametric insurance platforms is crucial because insurtech platforms leverage digital technologies to improve traditional insurance services, while parametric insurance platforms provide payouts based on predefined triggering events rather than actual losses. Insurtech platforms enhance customer experience and process efficiency, whereas parametric insurance offers faster claims settlements with reduced ambiguity. Knowing these distinctions helps businesses and consumers choose the right solution aligned with their risk management needs and operational goals. Clear awareness drives informed decisions in adopting innovative insurance technologies for optimal protection and financial planning.

Comparison Table

| Feature | Insurtech Platform | Parametric Insurance Platform |

|---|---|---|

| Definition | Technology-driven platform enhancing traditional insurance processes | Insurance based on predefined parameters triggering automatic payouts |

| Claims Processing | Manual or semi-automated, can be slow | Fully automated, instant payouts upon parameter breach |

| Data Usage | Leverages big data, AI for risk assessment and customer insights | Uses objective data from reliable sources (weather, sensors) |

| Risk Assessment | Complex underwriting with extensive data analysis | Based on clear, measurable event criteria |

| Customer Experience | Digital interfaces, personalized options, but can involve delays | Simplified contracts, faster claims, transparent terms |

| Use Cases | Life, auto, health, property insurance with innovation layers | Weather risks, agricultural insurance, travel delay policies |

| Cost Efficiency | Reduced costs through automation but dependent on legacy systems | Lower operational costs due to automated payouts and simplified claims |

| Technology Integration | APIs, AI, blockchain enhancing insurance workflows | IoT devices, satellite data feeding automatic triggers |

Which is better?

Insurtech platforms leverage advanced technologies such as AI, big data, and machine learning to enhance traditional insurance processes, offering personalized policies and streamlined claims management. Parametric insurance platforms provide rapid, automated payouts based on predefined triggers like weather events, minimizing claim disputes and improving transparency. Choosing between them depends on whether the emphasis is on customer experience and customization (insurtech) or speed and simplicity in coverage (parametric insurance).

Connection

Insurtech platforms leverage advanced technologies like AI, blockchain, and data analytics to streamline insurance processes, enabling parametric insurance platforms to automate claims based on predefined triggers. Parametric insurance relies on insurtech innovations to instantly verify event parameters such as weather data or seismic activity, ensuring rapid, transparent payouts without traditional claim adjustments. This integration enhances efficiency, reduces fraud, and improves customer experience by using real-time data and smart contracts to deliver precise, automated coverage responses.

Key Terms

**Parametric Insurance Platform:**

Parametric insurance platforms leverage predefined triggers such as weather data, seismic activity, or flight delays to automate claim payouts, ensuring faster, transparent settlements without traditional loss assessments. These platforms use blockchain and IoT technologies to enhance data accuracy and reduce fraud, significantly improving efficiency over conventional insurance models. Explore how parametric insurance platforms are revolutionizing risk management by delivering instant, data-driven solutions.

Trigger Event

Parametric insurance platforms rely on predefined trigger events quantified by specific parameters such as weather data or seismic activity to automatically initiate claims payouts, enhancing speed and transparency. Insurtech platforms encompass a broader range of technological innovations in insurance, including AI-driven underwriting, digital customer experiences, and risk management tools beyond trigger-based claims. Explore the distinct advantages of parametric triggers within insurtech solutions to optimize risk transfer and claims efficiency.

Payout Formula

Parametric insurance platforms utilize predefined payout formulas based on objective triggers such as weather data or seismic activity, enabling rapid and transparent claims settlement without the need for loss assessment. Insurtech platforms, while innovative and technology-driven, often involve traditional indemnity-based insurance processes that require claim validation and adjustment. Explore how each platform's payout methodology impacts efficiency and customer experience in insurance.

Source and External Links

Parametric Insurance: A Disruptive Solution Enabled by a Digital - Discusses the core tenets and features necessary for a parametric-enabled digital insurance platform.

Parametric Insurance | Aon - Offers a simple, straightforward risk transfer solution triggered by specific pre-defined events.

Arbol | The Future is Insured - Provides swift, objective, and scalable parametric insurance coverage addressing specific climate risks.

dowidth.com

dowidth.com