Climate risk insurance provides financial protection against losses from extreme weather events such as hurricanes, floods, and droughts, focusing on mitigating the economic impact of climate change. Pandemic insurance, by contrast, covers business interruptions and health-related losses caused by widespread infectious disease outbreaks, supporting recovery efforts during global health crises. Explore the differences and benefits of these specialized insurance types to safeguard your assets effectively.

Why it is important

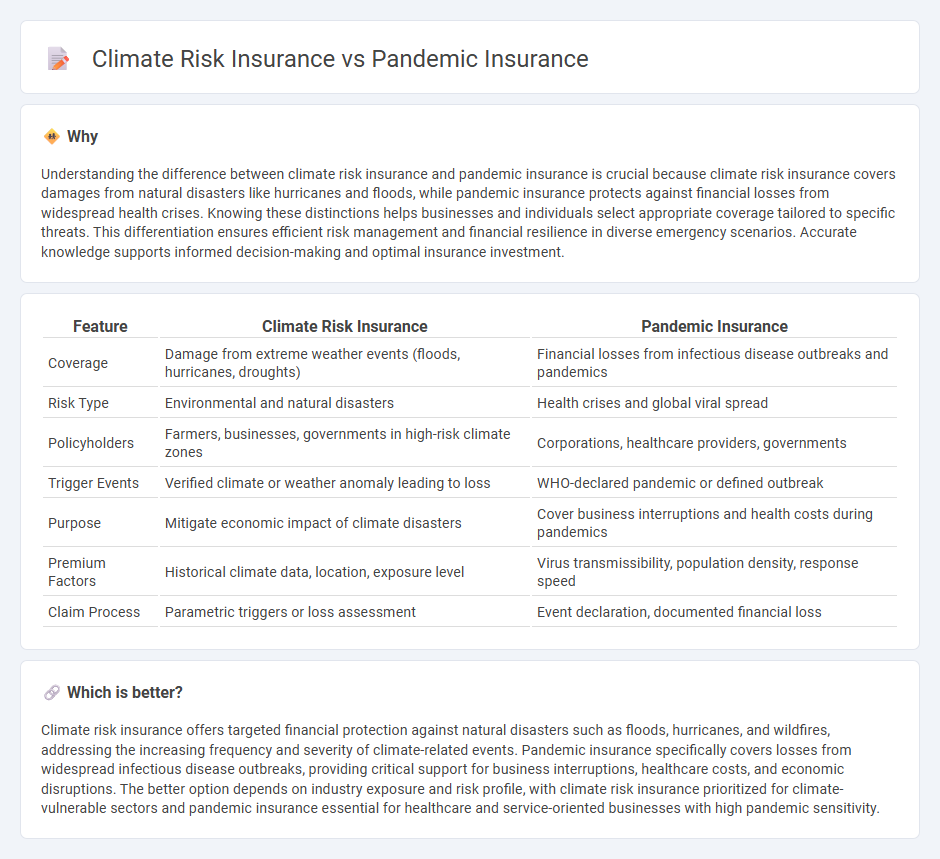

Understanding the difference between climate risk insurance and pandemic insurance is crucial because climate risk insurance covers damages from natural disasters like hurricanes and floods, while pandemic insurance protects against financial losses from widespread health crises. Knowing these distinctions helps businesses and individuals select appropriate coverage tailored to specific threats. This differentiation ensures efficient risk management and financial resilience in diverse emergency scenarios. Accurate knowledge supports informed decision-making and optimal insurance investment.

Comparison Table

| Feature | Climate Risk Insurance | Pandemic Insurance |

|---|---|---|

| Coverage | Damage from extreme weather events (floods, hurricanes, droughts) | Financial losses from infectious disease outbreaks and pandemics |

| Risk Type | Environmental and natural disasters | Health crises and global viral spread |

| Policyholders | Farmers, businesses, governments in high-risk climate zones | Corporations, healthcare providers, governments |

| Trigger Events | Verified climate or weather anomaly leading to loss | WHO-declared pandemic or defined outbreak |

| Purpose | Mitigate economic impact of climate disasters | Cover business interruptions and health costs during pandemics |

| Premium Factors | Historical climate data, location, exposure level | Virus transmissibility, population density, response speed |

| Claim Process | Parametric triggers or loss assessment | Event declaration, documented financial loss |

Which is better?

Climate risk insurance offers targeted financial protection against natural disasters such as floods, hurricanes, and wildfires, addressing the increasing frequency and severity of climate-related events. Pandemic insurance specifically covers losses from widespread infectious disease outbreaks, providing critical support for business interruptions, healthcare costs, and economic disruptions. The better option depends on industry exposure and risk profile, with climate risk insurance prioritized for climate-vulnerable sectors and pandemic insurance essential for healthcare and service-oriented businesses with high pandemic sensitivity.

Connection

Climate risk insurance and pandemic insurance both address increasingly frequent and severe global threats by providing financial protection against disruptive events caused by environmental and health crises. These insurance types leverage data analytics and risk modeling to assess and mitigate economic losses from natural disasters and disease outbreaks, reflecting a growing trend toward comprehensive risk management solutions. Insurers are integrating these products to enhance resilience for businesses and communities facing interconnected climate and public health challenges.

Key Terms

Pandemic Insurance:

Pandemic insurance provides financial protection against losses resulting from infectious disease outbreaks, covering business interruptions, healthcare costs, and government response expenses. It focuses on mitigating economic impacts caused by pandemics such as COVID-19 by offering coverage for revenue loss, supply chain disruptions, and employee absences. Explore the key features and benefits of pandemic insurance to better manage pandemic-related financial risks.

Business Interruption

Pandemic insurance primarily covers business interruption losses resulting from government-mandated shutdowns and supply chain disruptions caused by infectious disease outbreaks, whereas climate risk insurance addresses property damage and operational stoppages triggered by extreme weather events such as floods, hurricanes, or wildfires. Business interruption coverage in pandemic insurance tends to have more complex trigger conditions compared to climate risk insurance, which often relies on quantifiable environmental data. Explore comprehensive insurance solutions designed to protect businesses against diverse interruption scenarios.

Disease Outbreak Trigger

Pandemic insurance primarily covers losses triggered by disease outbreaks, offering financial protection against events like COVID-19 that disrupt global economies and supply chains. Climate risk insurance focuses on environmental triggers such as hurricanes, floods, and wildfires, which result from climate change impacts and cause widespread property and agricultural damage. Explore detailed comparisons and policy options to understand which insurance best suits your risk management strategy.

Source and External Links

Principles for Legislative Solution for Pandemic Insurance Coverage - The U.S. Treasury outlines a public-private partnership approach to pandemic insurance, emphasizing federal backstops for types of coverage including non-physical-damage business interruption and event cancellations to close coverage gaps revealed by COVID-19.

Insurance Topics | Pandemics and COVID-19 - NAIC - The NAIC promotes pandemic risk management via stress testing and risk transfer, supporting hybrid public-private solutions; federal programs like the proposed Pandemic Risk Insurance Act are modeled after terrorism insurance frameworks to foster preparedness.

Epidemic and pandemic risk solutions - Munich Re - Munich Re offers expert pricing and structuring of epidemic and pandemic risks, seeking to close insurance gaps by transferring risk to capital markets and creating innovative epidemic risk financial instruments beyond traditional insurer capacity.

dowidth.com

dowidth.com