On-demand insurance provides flexible, short-term coverage tailored to specific needs, allowing policyholders to activate or deactivate protection instantly via digital platforms. Group insurance offers collective benefits through an employer or organization, often providing comprehensive coverage at lower individual costs due to risk pooling. Explore the advantages and use cases of each type to determine the best fit for your insurance needs.

Why it is important

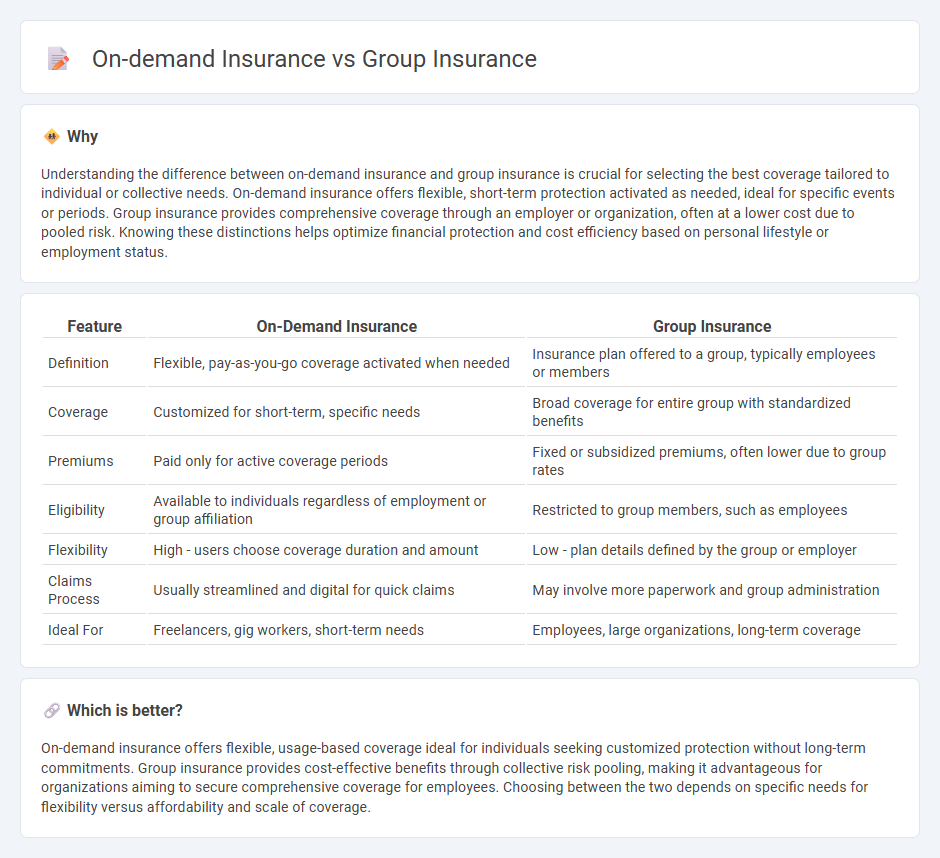

Understanding the difference between on-demand insurance and group insurance is crucial for selecting the best coverage tailored to individual or collective needs. On-demand insurance offers flexible, short-term protection activated as needed, ideal for specific events or periods. Group insurance provides comprehensive coverage through an employer or organization, often at a lower cost due to pooled risk. Knowing these distinctions helps optimize financial protection and cost efficiency based on personal lifestyle or employment status.

Comparison Table

| Feature | On-Demand Insurance | Group Insurance |

|---|---|---|

| Definition | Flexible, pay-as-you-go coverage activated when needed | Insurance plan offered to a group, typically employees or members |

| Coverage | Customized for short-term, specific needs | Broad coverage for entire group with standardized benefits |

| Premiums | Paid only for active coverage periods | Fixed or subsidized premiums, often lower due to group rates |

| Eligibility | Available to individuals regardless of employment or group affiliation | Restricted to group members, such as employees |

| Flexibility | High - users choose coverage duration and amount | Low - plan details defined by the group or employer |

| Claims Process | Usually streamlined and digital for quick claims | May involve more paperwork and group administration |

| Ideal For | Freelancers, gig workers, short-term needs | Employees, large organizations, long-term coverage |

Which is better?

On-demand insurance offers flexible, usage-based coverage ideal for individuals seeking customized protection without long-term commitments. Group insurance provides cost-effective benefits through collective risk pooling, making it advantageous for organizations aiming to secure comprehensive coverage for employees. Choosing between the two depends on specific needs for flexibility versus affordability and scale of coverage.

Connection

On-demand insurance and group insurance intersect by offering flexible coverage options tailored to collective needs, enhancing accessibility for groups while providing customizable protection. Group insurance leverages pooled risk among members, whereas on-demand insurance allows individuals within the group to activate coverage instantly based on specific requirements. Combining these models enables organizations to optimize cost efficiency and member satisfaction through scalable, real-time insurance solutions.

Key Terms

Policyholder

Group insurance offers policyholders collective coverage often provided through employers, delivering cost-effective premiums and standardized benefits across members. On-demand insurance allows policyholders to activate coverage only when needed, offering flexibility and personalized control over protection periods and coverage limits. Explore the advantages and suitability of each option to determine which best meets your insurance needs.

Coverage Duration

Group insurance typically offers continuous coverage for a fixed period, such as a year or the duration of employment, providing consistent protection for members under a collective plan. On-demand insurance, however, delivers flexible, short-term coverage tailored to specific events or time frames, often ranging from hours to weeks, suiting immediate and temporary insurance needs. Discover more about how coverage duration impacts your insurance choice and which option best fits your lifestyle.

Premium Structure

Group insurance typically offers lower premium rates due to risk pooling among members, often resulting in fixed, predictable monthly payments determined by group size and demographics. On-demand insurance employs flexible premium structures based on real-time usage or specific needs, allowing policyholders to pay only for coverage during activated periods, often calculated with dynamic algorithms. Explore our detailed comparison to understand which premium model best suits your insurance requirements.

Source and External Links

What is group insurance? Benefits and limitations - This webpage provides an overview of group health insurance, explaining how it works and its benefits and limitations compared to individual insurance plans.

What is Group Insurance & How Does It Work? - This article describes group insurance as part of an employee benefits package, highlighting its cost-effectiveness and common types such as health, dental, and vision insurance.

Group Insurance - This Wikipedia page covers the general concept of group insurance, including its application in different countries and types of coverage like health and life insurance.

dowidth.com

dowidth.com