Crop insurance protects farmers against losses due to natural disasters, pests, or adverse weather conditions, ensuring financial stability in unpredictable agricultural environments. Health insurance covers medical expenses for illness, injury, or preventive care, providing access to essential healthcare services. Explore the differences and benefits of crop versus health insurance to make informed coverage decisions.

Why it is important

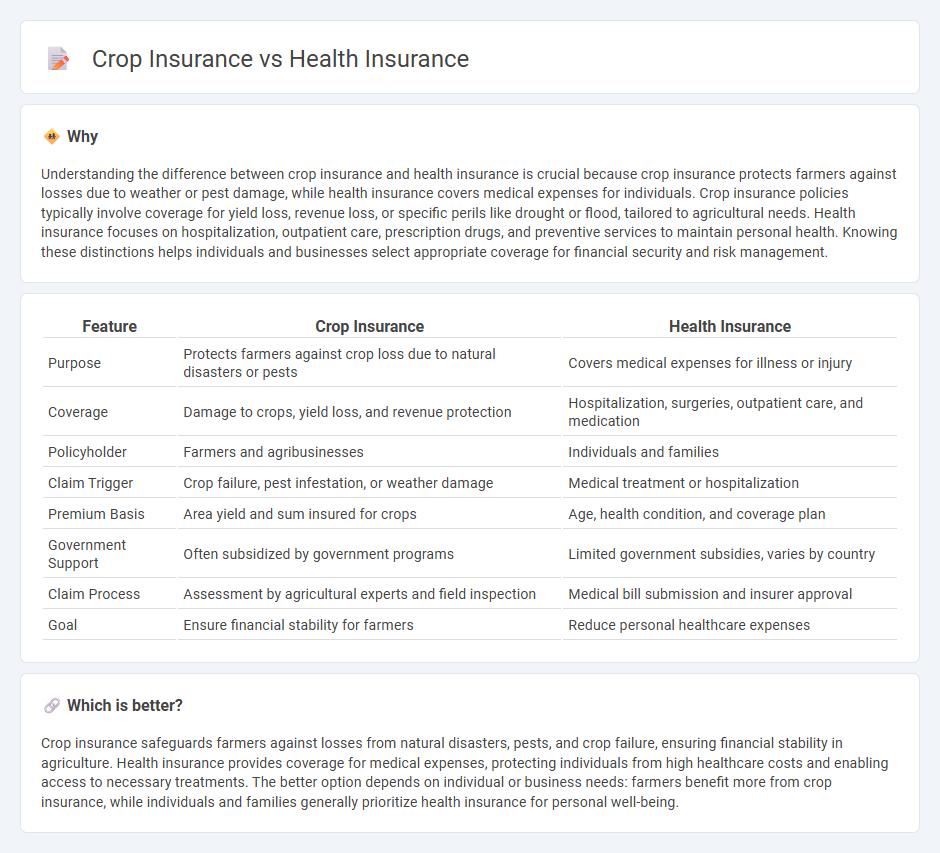

Understanding the difference between crop insurance and health insurance is crucial because crop insurance protects farmers against losses due to weather or pest damage, while health insurance covers medical expenses for individuals. Crop insurance policies typically involve coverage for yield loss, revenue loss, or specific perils like drought or flood, tailored to agricultural needs. Health insurance focuses on hospitalization, outpatient care, prescription drugs, and preventive services to maintain personal health. Knowing these distinctions helps individuals and businesses select appropriate coverage for financial security and risk management.

Comparison Table

| Feature | Crop Insurance | Health Insurance |

|---|---|---|

| Purpose | Protects farmers against crop loss due to natural disasters or pests | Covers medical expenses for illness or injury |

| Coverage | Damage to crops, yield loss, and revenue protection | Hospitalization, surgeries, outpatient care, and medication |

| Policyholder | Farmers and agribusinesses | Individuals and families |

| Claim Trigger | Crop failure, pest infestation, or weather damage | Medical treatment or hospitalization |

| Premium Basis | Area yield and sum insured for crops | Age, health condition, and coverage plan |

| Government Support | Often subsidized by government programs | Limited government subsidies, varies by country |

| Claim Process | Assessment by agricultural experts and field inspection | Medical bill submission and insurer approval |

| Goal | Ensure financial stability for farmers | Reduce personal healthcare expenses |

Which is better?

Crop insurance safeguards farmers against losses from natural disasters, pests, and crop failure, ensuring financial stability in agriculture. Health insurance provides coverage for medical expenses, protecting individuals from high healthcare costs and enabling access to necessary treatments. The better option depends on individual or business needs: farmers benefit more from crop insurance, while individuals and families generally prioritize health insurance for personal well-being.

Connection

Crop insurance and health insurance are connected through risk management and financial protection for families dependent on agriculture. Both types of insurance mitigate economic losses--crop insurance safeguards farmers against crop failure due to weather, pests, or disease, while health insurance covers medical expenses and supports the well-being of agricultural workers. Effective insurance coverage helps stabilize rural economies by ensuring income continuity and access to healthcare, reducing vulnerability in farming communities.

Key Terms

**Health insurance:**

Health insurance provides financial protection against medical expenses by covering doctor visits, hospital stays, surgeries, and prescription medications, ensuring access to quality healthcare. It mitigates risks associated with unexpected health issues, reducing out-of-pocket costs and supporting long-term wellness through preventive care plans. Explore comprehensive health insurance options to safeguard your health and financial security effectively.

Premium

Health insurance premiums are typically based on factors such as age, medical history, and lifestyle, reflecting individual health risks and coverage levels. Crop insurance premiums depend on variables like crop type, acreage, weather patterns, and historical yield data, aiming to hedge against agricultural losses from pests, weather, or natural disasters. Explore detailed comparisons to understand premium determinants and optimize your coverage selection.

Deductible

Health insurance deductibles typically require insured individuals to pay a set amount out-of-pocket before the insurer covers medical expenses, with averages ranging from $1,000 to $4,000 annually depending on the plan. Crop insurance deductibles, however, are calculated based on a percentage of the expected crop yield or insured value, often between 10% to 25%, affecting the indemnity payments farmers receive after losses. Explore more about how deductible structures impact risk management and financial protection in both health and agricultural sectors.

Source and External Links

Health Insurance | Insurance Department - Provides information on health insurance options in Pennsylvania, including Pennie and Medicare.

Health insurance | USAGov - Offers information on various health insurance programs such as Medicaid, Medicare, and the ACA marketplace.

Individual and family health insurance plans - United Healthcare - Provides details on individual and family health insurance plans, including short-term and ACA Marketplace options.

dowidth.com

dowidth.com