Telematics insurance uses real-time data from devices installed in vehicles to calculate premiums based on actual driving behavior, enhancing personalized risk assessment and potentially lowering costs for safe drivers. Parametric insurance offers coverage triggered by predefined events such as natural disasters, providing swift, automatic payouts without the need for traditional claims processing. Explore the distinct advantages and applications of these innovative insurance models to determine which best suits your needs.

Why it is important

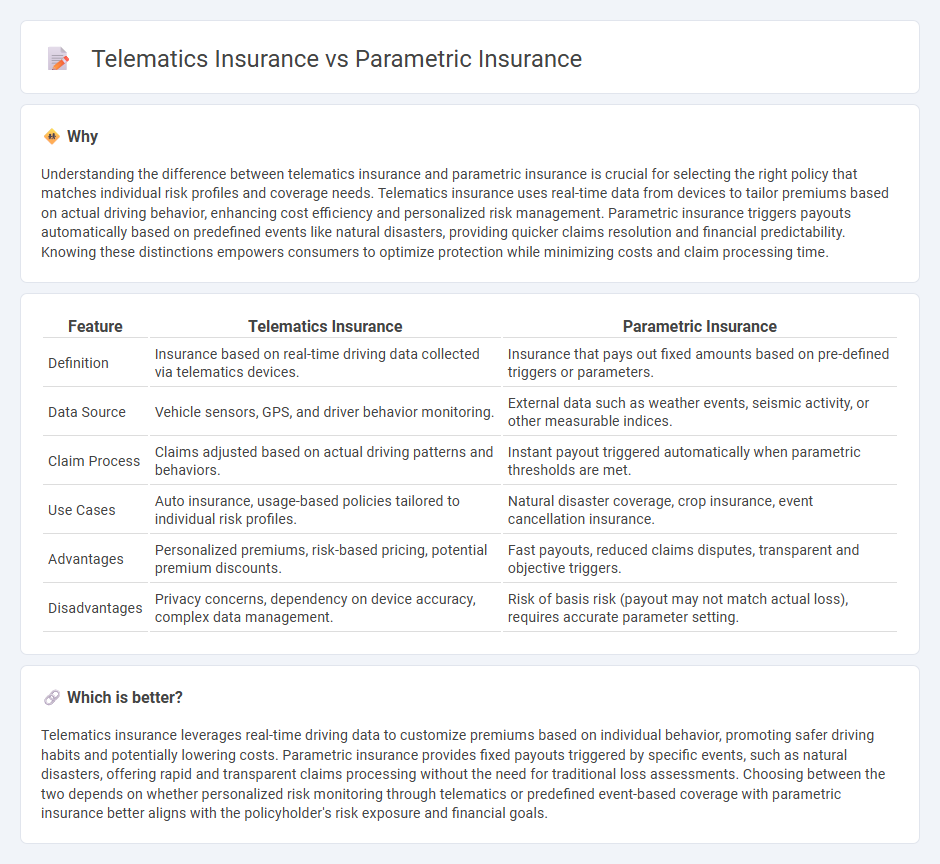

Understanding the difference between telematics insurance and parametric insurance is crucial for selecting the right policy that matches individual risk profiles and coverage needs. Telematics insurance uses real-time data from devices to tailor premiums based on actual driving behavior, enhancing cost efficiency and personalized risk management. Parametric insurance triggers payouts automatically based on predefined events like natural disasters, providing quicker claims resolution and financial predictability. Knowing these distinctions empowers consumers to optimize protection while minimizing costs and claim processing time.

Comparison Table

| Feature | Telematics Insurance | Parametric Insurance |

|---|---|---|

| Definition | Insurance based on real-time driving data collected via telematics devices. | Insurance that pays out fixed amounts based on pre-defined triggers or parameters. |

| Data Source | Vehicle sensors, GPS, and driver behavior monitoring. | External data such as weather events, seismic activity, or other measurable indices. |

| Claim Process | Claims adjusted based on actual driving patterns and behaviors. | Instant payout triggered automatically when parametric thresholds are met. |

| Use Cases | Auto insurance, usage-based policies tailored to individual risk profiles. | Natural disaster coverage, crop insurance, event cancellation insurance. |

| Advantages | Personalized premiums, risk-based pricing, potential premium discounts. | Fast payouts, reduced claims disputes, transparent and objective triggers. |

| Disadvantages | Privacy concerns, dependency on device accuracy, complex data management. | Risk of basis risk (payout may not match actual loss), requires accurate parameter setting. |

Which is better?

Telematics insurance leverages real-time driving data to customize premiums based on individual behavior, promoting safer driving habits and potentially lowering costs. Parametric insurance provides fixed payouts triggered by specific events, such as natural disasters, offering rapid and transparent claims processing without the need for traditional loss assessments. Choosing between the two depends on whether personalized risk monitoring through telematics or predefined event-based coverage with parametric insurance better aligns with the policyholder's risk exposure and financial goals.

Connection

Telematics insurance leverages real-time data from connected devices to assess risk based on driving behavior, while parametric insurance uses predefined triggers and data inputs to automate claims processing. Both rely heavily on advanced data collection and analytics to enhance accuracy and efficiency in underwriting and claims management. Integrating telematics data into parametric models enables insurers to offer more personalized, transparent, and rapid insurance solutions.

Key Terms

Trigger Event (Parametric)

Parametric insurance activates coverage based on a predefined trigger event, such as specific weather conditions or seismic activity, resulting in faster claims payouts without the need for traditional loss assessments. This contrasts with telematics insurance, which relies on real-time driving data and behavior analysis to adjust premiums and claim evaluations. Discover how understanding trigger events can optimize your risk management strategy with parametric insurance.

Data Collection (Telematics)

Telematics insurance relies on continuous data collection from GPS devices, accelerometers, and sensors installed in vehicles to monitor driving behavior, location, speed, and braking patterns in real-time, enabling personalized premiums and risk assessment. Parametric insurance, however, triggers payments based on pre-defined parameters or indices like weather events or natural disasters without extensive individual data monitoring. Explore more to understand how data collection drives innovation in risk management and pricing models within these insurance types.

Payout Mechanism

Parametric insurance offers predefined payouts triggered by specific parameters like weather events or natural disasters, ensuring quick and transparent claims without loss assessments, whereas telematics insurance uses real-time driving data and behavior analytics to determine personalized premiums and claim settlements. The parametric model reduces administrative costs and accelerates payouts based on measurable events, while telematics provides dynamic risk evaluation through continuous monitoring of driving habits. Explore deeper insights into how these payout mechanisms impact policyholder benefits and insurer efficiency.

Source and External Links

What is parametric insurance? - Swiss Re Corporate Solutions - Parametric insurance is a type of coverage that pays out when a predefined event parameter (such as earthquake magnitude or wind speed) exceeds a certain threshold, rather than indemnifying actual loss incurred, enabling fast and objective payouts based on measurable triggers.

Parametric Insurance Solutions - Amwins - Parametric insurance pays out based on predefined event triggers (like wind speed or seismic magnitude), allowing quick claims processing using real-time data, with the insured free to utilize proceeds as needed for recovery.

Parametric insurance - Wikipedia - Unlike traditional indemnity insurance, parametric insurance offers faster, predetermined payouts based on objective event triggers verified by trusted data, especially useful for covering catastrophic risks and reducing claims processing time and costs.

dowidth.com

dowidth.com