Flood risk modeling focuses on predicting the potential impact of flood events by analyzing hydrological data, geographic information, and historical flood patterns to assess property damage and financial loss probabilities. Operational risk modeling addresses risks arising from internal processes, systems failures, or human errors within insurance companies, aiming to minimize financial and reputational damage through effective risk management strategies. Explore detailed methodologies and applications of both modeling techniques to enhance insurance risk assessment and decision-making.

Why it is important

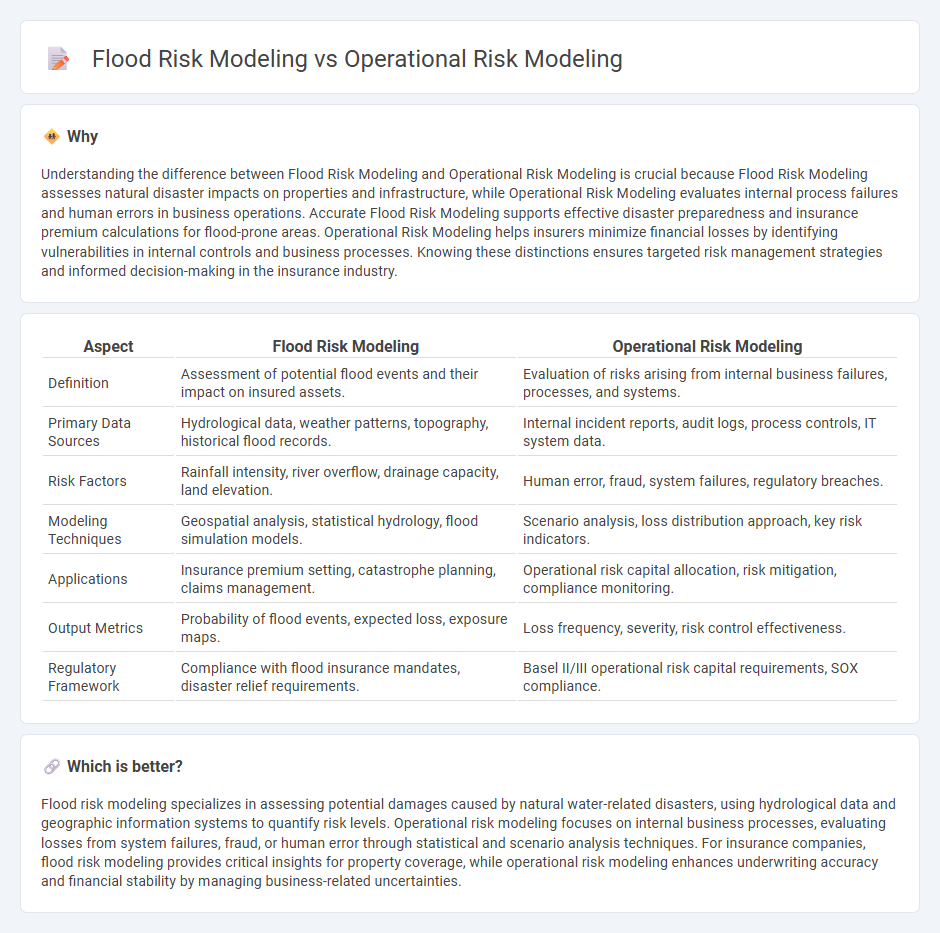

Understanding the difference between Flood Risk Modeling and Operational Risk Modeling is crucial because Flood Risk Modeling assesses natural disaster impacts on properties and infrastructure, while Operational Risk Modeling evaluates internal process failures and human errors in business operations. Accurate Flood Risk Modeling supports effective disaster preparedness and insurance premium calculations for flood-prone areas. Operational Risk Modeling helps insurers minimize financial losses by identifying vulnerabilities in internal controls and business processes. Knowing these distinctions ensures targeted risk management strategies and informed decision-making in the insurance industry.

Comparison Table

| Aspect | Flood Risk Modeling | Operational Risk Modeling |

|---|---|---|

| Definition | Assessment of potential flood events and their impact on insured assets. | Evaluation of risks arising from internal business failures, processes, and systems. |

| Primary Data Sources | Hydrological data, weather patterns, topography, historical flood records. | Internal incident reports, audit logs, process controls, IT system data. |

| Risk Factors | Rainfall intensity, river overflow, drainage capacity, land elevation. | Human error, fraud, system failures, regulatory breaches. |

| Modeling Techniques | Geospatial analysis, statistical hydrology, flood simulation models. | Scenario analysis, loss distribution approach, key risk indicators. |

| Applications | Insurance premium setting, catastrophe planning, claims management. | Operational risk capital allocation, risk mitigation, compliance monitoring. |

| Output Metrics | Probability of flood events, expected loss, exposure maps. | Loss frequency, severity, risk control effectiveness. |

| Regulatory Framework | Compliance with flood insurance mandates, disaster relief requirements. | Basel II/III operational risk capital requirements, SOX compliance. |

Which is better?

Flood risk modeling specializes in assessing potential damages caused by natural water-related disasters, using hydrological data and geographic information systems to quantify risk levels. Operational risk modeling focuses on internal business processes, evaluating losses from system failures, fraud, or human error through statistical and scenario analysis techniques. For insurance companies, flood risk modeling provides critical insights for property coverage, while operational risk modeling enhances underwriting accuracy and financial stability by managing business-related uncertainties.

Connection

Flood risk modeling and operational risk modeling are interconnected through their focus on identifying, assessing, and mitigating potential losses caused by environmental hazards. Flood risk models quantify the probability and potential severity of flood events impacting insured assets, enabling insurers to evaluate exposure and set appropriate premiums. Operational risk modeling integrates these insights to enhance disaster preparedness, business continuity planning, and financial resilience within insurance companies.

Key Terms

Operational risk modeling:

Operational risk modeling quantifies potential losses arising from failures in internal processes, people, systems, or external events, relying on statistical analysis, scenario assessment, and loss distribution approaches to predict risk exposure. It incorporates data from historical incidents, control effectiveness, and organizational vulnerabilities to inform risk management strategies and regulatory compliance. Explore detailed frameworks and methodologies to enhance operational risk modeling effectiveness in your organization.

Loss Event Data

Operational risk modeling relies heavily on comprehensive Loss Event Data (LED) to quantify potential financial impacts from internal failures, fraud, or system breakdowns, emphasizing statistical analysis of historical loss events. Flood risk modeling incorporates hydrological and meteorological data alongside LED related to past flood incidents to estimate damage probabilities and economic losses in vulnerable areas. Explore detailed methodologies and data utilization techniques to enhance predictive accuracy in both risk modeling domains.

Scenario Analysis

Operational risk modeling emphasizes scenario analysis to predict potential losses from internal failures, fraud, or process breakdowns by simulating diverse adverse events within an organization's processes. Flood risk modeling uses scenario analysis to evaluate the impact of various flood events on geographic regions, integrating hydrological data, historical flood patterns, and climate projections to assess exposure and vulnerability. Explore further to understand the specific methodologies and applications of scenario analysis in these distinct risk modeling domains.

Source and External Links

Operational Risk Forecasting: Models in Use Today - Discusses models like the Basic Loss Event Model (BLEM), Monte Carlo Simulation, and Neural Network Model for operational risk forecasting.

Operational Risk Modelling Definition - Defines operational risk modeling as techniques used by banks to gauge loss risks from operational failures.

To Model or Not to Model Your Operational Risk? - Explores the benefits of using modeled approaches in operational risk management, including scenario assessment and capital quantification.

dowidth.com

dowidth.com