Digital claim automation streamlines insurance processes by utilizing artificial intelligence and machine learning to accelerate claim assessments, reduce errors, and enhance customer satisfaction. Outsourced claim administration involves delegating claim processing tasks to third-party specialists, offering cost-efficiency and expert handling but potentially sacrificing direct control over operations. Explore the benefits and challenges of each approach to determine the best solution for your insurance needs.

Why it is important

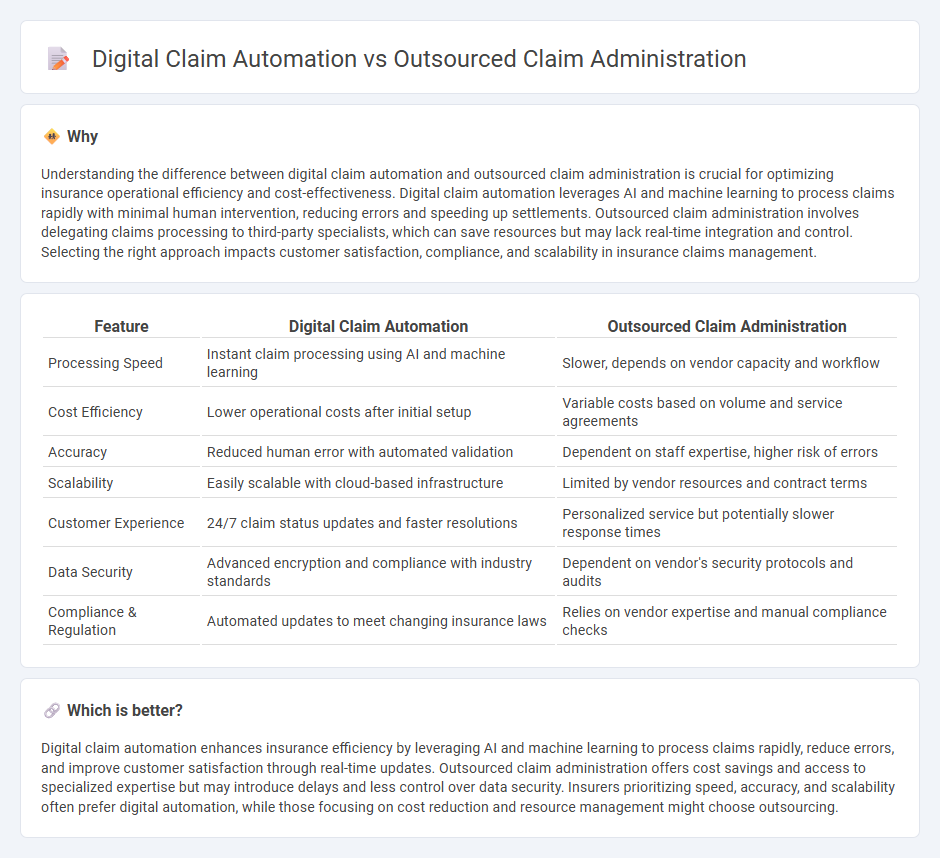

Understanding the difference between digital claim automation and outsourced claim administration is crucial for optimizing insurance operational efficiency and cost-effectiveness. Digital claim automation leverages AI and machine learning to process claims rapidly with minimal human intervention, reducing errors and speeding up settlements. Outsourced claim administration involves delegating claims processing to third-party specialists, which can save resources but may lack real-time integration and control. Selecting the right approach impacts customer satisfaction, compliance, and scalability in insurance claims management.

Comparison Table

| Feature | Digital Claim Automation | Outsourced Claim Administration |

|---|---|---|

| Processing Speed | Instant claim processing using AI and machine learning | Slower, depends on vendor capacity and workflow |

| Cost Efficiency | Lower operational costs after initial setup | Variable costs based on volume and service agreements |

| Accuracy | Reduced human error with automated validation | Dependent on staff expertise, higher risk of errors |

| Scalability | Easily scalable with cloud-based infrastructure | Limited by vendor resources and contract terms |

| Customer Experience | 24/7 claim status updates and faster resolutions | Personalized service but potentially slower response times |

| Data Security | Advanced encryption and compliance with industry standards | Dependent on vendor's security protocols and audits |

| Compliance & Regulation | Automated updates to meet changing insurance laws | Relies on vendor expertise and manual compliance checks |

Which is better?

Digital claim automation enhances insurance efficiency by leveraging AI and machine learning to process claims rapidly, reduce errors, and improve customer satisfaction through real-time updates. Outsourced claim administration offers cost savings and access to specialized expertise but may introduce delays and less control over data security. Insurers prioritizing speed, accuracy, and scalability often prefer digital automation, while those focusing on cost reduction and resource management might choose outsourcing.

Connection

Digital claim automation streamlines the processing of insurance claims by using advanced algorithms to quickly verify, assess, and approve claims, reducing manual errors and processing time. Outsourced claim administration leverages these automated systems by delegating claim management tasks to specialized third-party service providers who utilize digital tools to enhance efficiency and scalability. The integration of digital claim automation within outsourced claim administration enables insurers to optimize operational costs while improving accuracy and customer satisfaction.

Key Terms

Third-Party Administrator (TPA)

Outsourced claim administration through Third-Party Administrators (TPAs) offers human-driven, customizable services that handle complex claim evaluations and customer interactions. Digital claim automation leverages AI and machine learning to streamline processes, reduce errors, and accelerate claim settlements, enhancing efficiency and scalability. Explore how integrating TPAs with digital automation can optimize claim management and drive superior outcomes.

Artificial Intelligence (AI)

Outsourced claim administration relies on human expertise and manual processes, often leading to longer processing times and higher operational costs, while digital claim automation leverages Artificial Intelligence (AI) to streamline claim handling, reduce errors, and enhance decision accuracy through machine learning algorithms and natural language processing. AI-driven platforms enable real-time data analysis, automated fraud detection, and predictive analytics that improve customer satisfaction and operational efficiency in insurance claims management. Explore the transformative impact of AI-powered digital claim automation on the future of insurance administration.

Workflow Integration

Outsourced claim administration often involves manual processes with limited integration capabilities, leading to potential delays and errors in workflow. Digital claim automation leverages advanced software platforms that seamlessly integrate workflows, enhancing speed, accuracy, and real-time data sharing across departments. Explore the benefits of workflow integration in digital claim automation to optimize your claims management process.

Source and External Links

Outsourcing Claims - Outsourcing to a third-party claims administrator can significantly reduce claim turnaround times by leveraging dedicated professionals and efficient workflows.

Outsource Insurance Claims Processing Services - This service involves outsourcing claims processing tasks such as data entry, verification, and policyholder communication to improve efficiency and compliance.

Claims Handling Services - This service provides outsourced claims administration, ensuring compliance with regulations while offering streamlined processes and cost savings for insurance companies.

dowidth.com

dowidth.com