Natural catastrophe bonds transfer catastrophic risk to capital markets, offering investors a high-yield opportunity while insurers gain immediate capital relief after events like hurricanes or earthquakes. Retrocessional cover functions as reinsurance for reinsurers, providing a secondary layer of risk protection by ceding part of their liabilities to other reinsurers, enhancing overall risk diversification. Explore the detailed benefits and applications of these insurance solutions to optimize your risk management strategy.

Why it is important

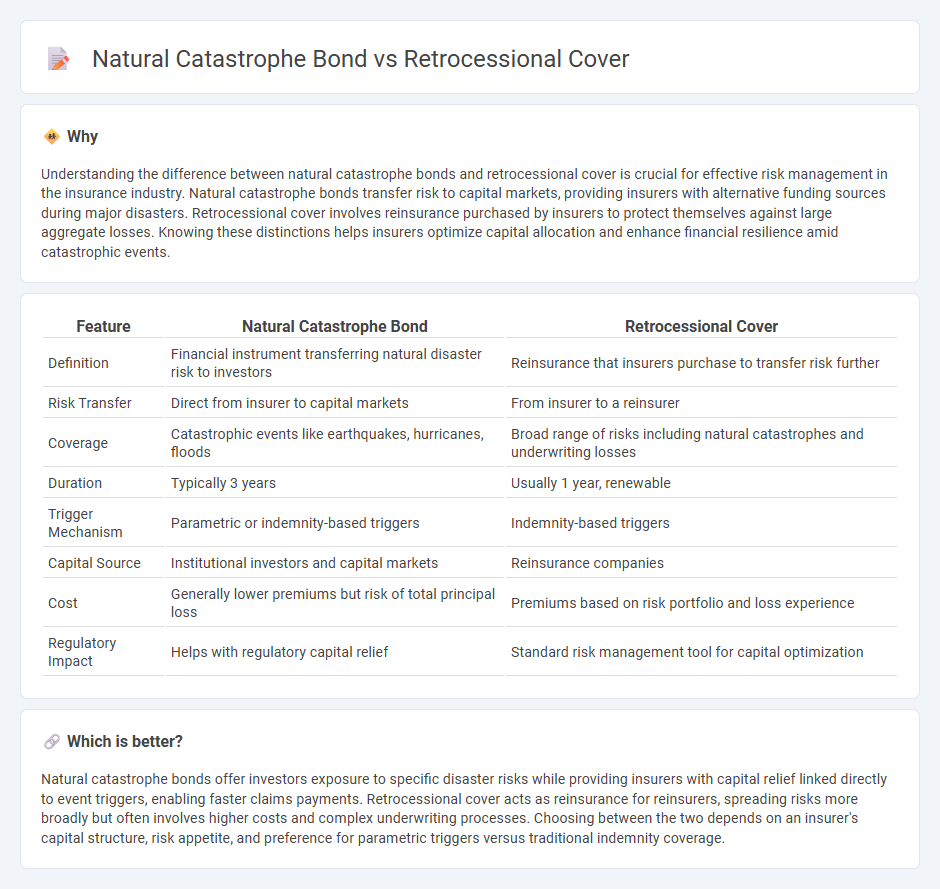

Understanding the difference between natural catastrophe bonds and retrocessional cover is crucial for effective risk management in the insurance industry. Natural catastrophe bonds transfer risk to capital markets, providing insurers with alternative funding sources during major disasters. Retrocessional cover involves reinsurance purchased by insurers to protect themselves against large aggregate losses. Knowing these distinctions helps insurers optimize capital allocation and enhance financial resilience amid catastrophic events.

Comparison Table

| Feature | Natural Catastrophe Bond | Retrocessional Cover |

|---|---|---|

| Definition | Financial instrument transferring natural disaster risk to investors | Reinsurance that insurers purchase to transfer risk further |

| Risk Transfer | Direct from insurer to capital markets | From insurer to a reinsurer |

| Coverage | Catastrophic events like earthquakes, hurricanes, floods | Broad range of risks including natural catastrophes and underwriting losses |

| Duration | Typically 3 years | Usually 1 year, renewable |

| Trigger Mechanism | Parametric or indemnity-based triggers | Indemnity-based triggers |

| Capital Source | Institutional investors and capital markets | Reinsurance companies |

| Cost | Generally lower premiums but risk of total principal loss | Premiums based on risk portfolio and loss experience |

| Regulatory Impact | Helps with regulatory capital relief | Standard risk management tool for capital optimization |

Which is better?

Natural catastrophe bonds offer investors exposure to specific disaster risks while providing insurers with capital relief linked directly to event triggers, enabling faster claims payments. Retrocessional cover acts as reinsurance for reinsurers, spreading risks more broadly but often involves higher costs and complex underwriting processes. Choosing between the two depends on an insurer's capital structure, risk appetite, and preference for parametric triggers versus traditional indemnity coverage.

Connection

Natural catastrophe bonds provide insurers with capital relief by transferring catastrophe risk to investors, while retrocessional cover allows reinsurers to further transfer this risk to other parties. Both mechanisms enhance risk management and liquidity for insurance companies facing large-scale natural disaster exposures. By integrating these financial instruments, insurers and reinsurers optimize their capacity to absorb catastrophic losses and stabilize their balance sheets.

Key Terms

**Retrocessional Cover:**

Retrocessional cover provides reinsurance protection to primary reinsurers, allowing them to transfer portions of their risk portfolios to other entities, which enhances capital efficiency and stabilizes financial performance during large loss events. Unlike natural catastrophe bonds that transfer risk directly to capital markets via structured financial instruments, retrocessional cover operates within the traditional reinsurance market through contractual agreements. Explore comprehensive insights into retrocessional cover's role in risk management and capital optimization strategies.

Reinsurance

Retrocessional cover provides reinsurance for primary insurers by transferring excess risks from reinsurance companies, ensuring risk diversification and capital relief. Natural catastrophe bonds enable insurers to access capital markets by issuing securities that pay out in the event of specified natural disaster losses, offering alternative risk financing with potentially higher returns. Explore how these instruments reshape risk management strategies in the reinsurance sector.

Risk Transfer

Retrocessional cover involves the transfer of underwriting risk from a primary reinsurer to a retrocessionaire, facilitating risk diversification and capital relief within traditional reinsurance markets. Natural catastrophe bonds, or cat bonds, securitize catastrophe risk by transferring it to capital market investors, offering a non-traditional risk transfer mechanism with parametric or indemnity triggers. Explore these innovative financial instruments to understand their unique risk transfer dynamics and applications.

Source and External Links

Retrocession - Insurance Glossary - Retrocession is a process where a reinsurer transfers some of its assumed risks to another reinsurer to manage risk exposure and portfolio stability.

Retrocession - Insuranceopedia - Retrocession occurs when one reinsurance company transfers some of its risks to another insurance company to avoid overexposure to claims.

Retrocession - Artemis.bm Glossary - Retrocession refers to the reinsuring of a reinsurance contract, acting as reinsurance for reinsurers, often involving capital markets and insurance-linked securities.

dowidth.com

dowidth.com