Buy-now-pay-later protection offers flexible payment options that allow customers to defer premium costs, improving cash flow management compared to traditional insurance premium payments, which typically require upfront or scheduled installments. This innovative approach reduces financial strain and enhances accessibility for policyholders by aligning payments with their purchase timelines. Discover how buy-now-pay-later protection can transform your insurance experience.

Why it is important

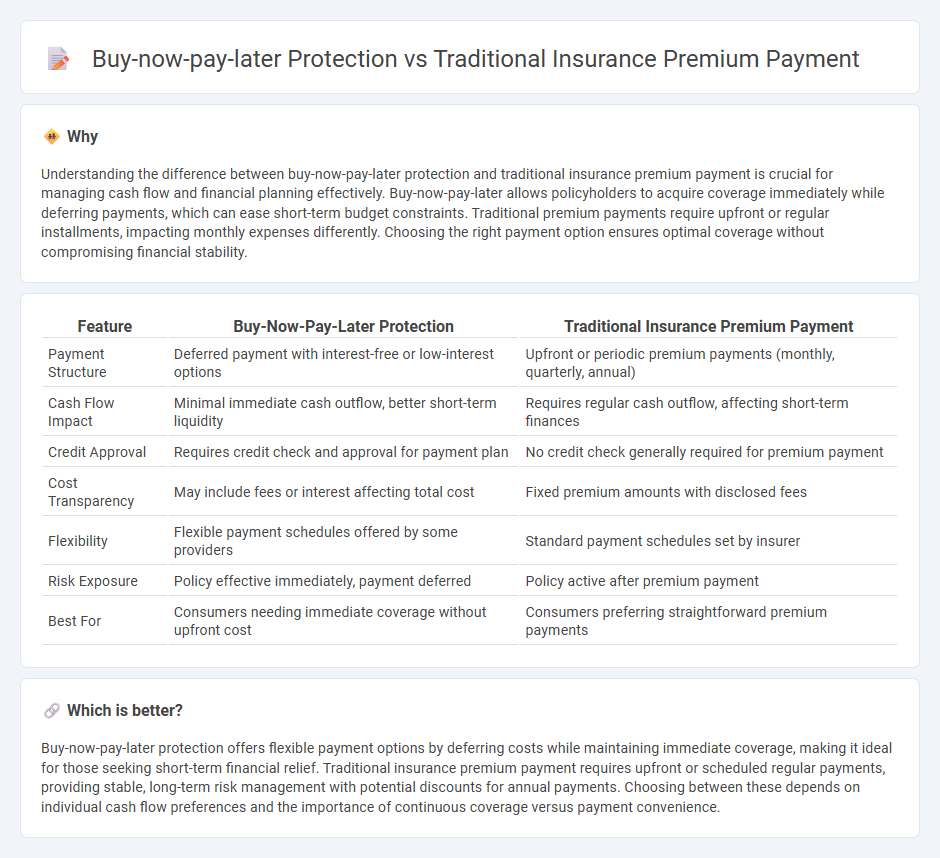

Understanding the difference between buy-now-pay-later protection and traditional insurance premium payment is crucial for managing cash flow and financial planning effectively. Buy-now-pay-later allows policyholders to acquire coverage immediately while deferring payments, which can ease short-term budget constraints. Traditional premium payments require upfront or regular installments, impacting monthly expenses differently. Choosing the right payment option ensures optimal coverage without compromising financial stability.

Comparison Table

| Feature | Buy-Now-Pay-Later Protection | Traditional Insurance Premium Payment |

|---|---|---|

| Payment Structure | Deferred payment with interest-free or low-interest options | Upfront or periodic premium payments (monthly, quarterly, annual) |

| Cash Flow Impact | Minimal immediate cash outflow, better short-term liquidity | Requires regular cash outflow, affecting short-term finances |

| Credit Approval | Requires credit check and approval for payment plan | No credit check generally required for premium payment |

| Cost Transparency | May include fees or interest affecting total cost | Fixed premium amounts with disclosed fees |

| Flexibility | Flexible payment schedules offered by some providers | Standard payment schedules set by insurer |

| Risk Exposure | Policy effective immediately, payment deferred | Policy active after premium payment |

| Best For | Consumers needing immediate coverage without upfront cost | Consumers preferring straightforward premium payments |

Which is better?

Buy-now-pay-later protection offers flexible payment options by deferring costs while maintaining immediate coverage, making it ideal for those seeking short-term financial relief. Traditional insurance premium payment requires upfront or scheduled regular payments, providing stable, long-term risk management with potential discounts for annual payments. Choosing between these depends on individual cash flow preferences and the importance of continuous coverage versus payment convenience.

Connection

Buy-now-pay-later protection integrates with traditional insurance premium payments by offering flexible financing options that allow consumers to spread out premium costs over time without immediate full payment. This connection enhances accessibility and affordability, reducing upfront financial burdens and improving customer retention for insurers. Insurers leveraging this model can increase policy uptake by aligning payment schedules with buyers' cash flow preferences, combining modern payment solutions with conventional risk coverage.

Key Terms

Underwriting

Traditional insurance premium payments require upfront or periodic payments assessed through comprehensive underwriting processes that evaluate risk factors such as age, health, and historical claims data. Buy-now-pay-later protection models streamline underwriting by leveraging digital data analytics and real-time risk assessments, enabling quicker policy issuance with flexible payment schedules. Discover how innovative underwriting techniques are transforming insurance with faster approvals and personalized coverage options.

Payment Schedule

Traditional insurance premium payments usually involve fixed, periodic installments such as monthly or annual payments, ensuring predictable cash flow for policyholders. Buy-now-pay-later protection offers flexibility by allowing consumers to defer payments or split costs over time without immediate full payment, catering to short-term budget constraints. Discover how each payment schedule impacts your financial planning and policy accessibility.

Coverage Activation

Traditional insurance premium payment requires upfront full or periodic payments before coverage activation, ensuring immediate protection upon receipt. Buy-now-pay-later protection activates coverage instantly while deferring payments, offering flexibility without compromising risk mitigation. Explore how these models impact your insurance experience and financial planning.

Source and External Links

6 types of life insurance policies to fit your needs - Bank of Texas - Traditional whole life insurance requires paying a level, guaranteed premium for life, where premiums exceed current insurance costs with the excess credited to a cash value account growing tax deferred and can be borrowed against or surrendered.

Traditional Whole Life Insurance - eMoney Advisor - In traditional whole life insurance, you pay a fixed, level premium regularly (monthly, quarterly, annually) that remains constant for life and builds a cash reserve (cash value) that helps cover insurance costs as you age.

Mode of Premium Payment Options for Life Insurance - The mode of premium payment defines how often premiums are paid (e.g., monthly, quarterly), and while you can often switch modes after purchase, insurers typically schedule payments on predetermined dates.

dowidth.com

dowidth.com