Flood insurance integration focuses specifically on protecting assets and property against water damage caused by floods, providing coverage for structural repairs and flood-related losses. Business interruption insurance integration complements this by covering lost income, operational costs, and other financial impacts when business activities are disrupted due to a covered event such as flooding. Explore how combining flood and business interruption insurance creates comprehensive protection tailored to mitigate both physical and financial risks from flood events.

Why it is important

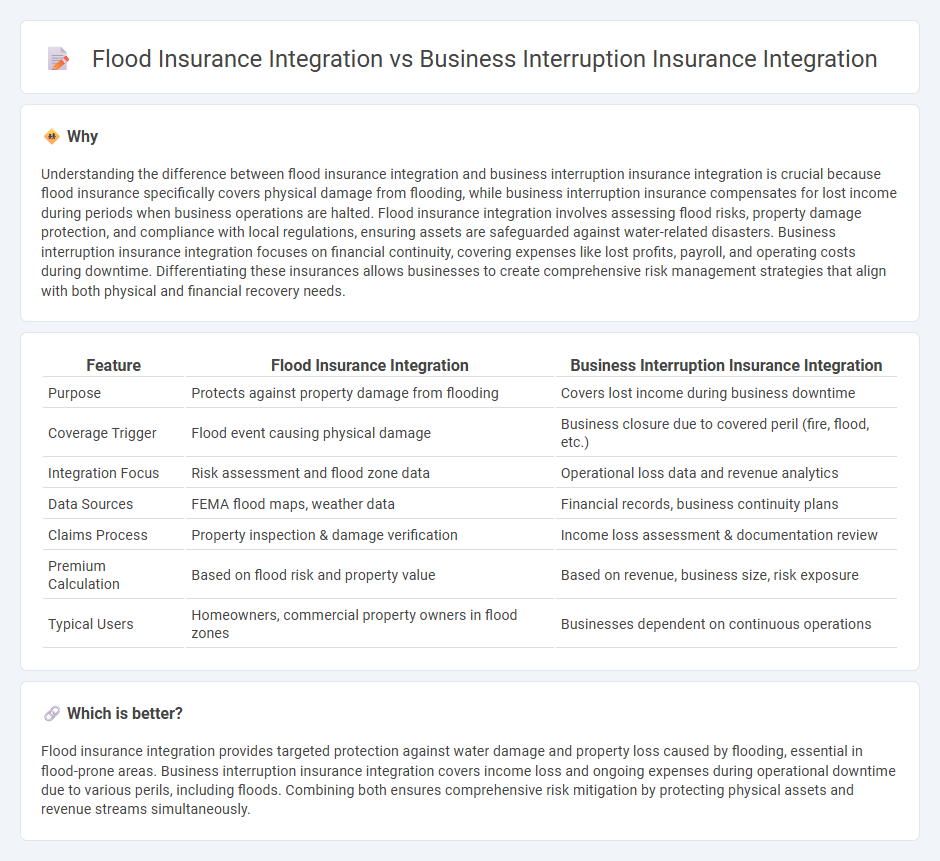

Understanding the difference between flood insurance integration and business interruption insurance integration is crucial because flood insurance specifically covers physical damage from flooding, while business interruption insurance compensates for lost income during periods when business operations are halted. Flood insurance integration involves assessing flood risks, property damage protection, and compliance with local regulations, ensuring assets are safeguarded against water-related disasters. Business interruption insurance integration focuses on financial continuity, covering expenses like lost profits, payroll, and operating costs during downtime. Differentiating these insurances allows businesses to create comprehensive risk management strategies that align with both physical and financial recovery needs.

Comparison Table

| Feature | Flood Insurance Integration | Business Interruption Insurance Integration |

|---|---|---|

| Purpose | Protects against property damage from flooding | Covers lost income during business downtime |

| Coverage Trigger | Flood event causing physical damage | Business closure due to covered peril (fire, flood, etc.) |

| Integration Focus | Risk assessment and flood zone data | Operational loss data and revenue analytics |

| Data Sources | FEMA flood maps, weather data | Financial records, business continuity plans |

| Claims Process | Property inspection & damage verification | Income loss assessment & documentation review |

| Premium Calculation | Based on flood risk and property value | Based on revenue, business size, risk exposure |

| Typical Users | Homeowners, commercial property owners in flood zones | Businesses dependent on continuous operations |

Which is better?

Flood insurance integration provides targeted protection against water damage and property loss caused by flooding, essential in flood-prone areas. Business interruption insurance integration covers income loss and ongoing expenses during operational downtime due to various perils, including floods. Combining both ensures comprehensive risk mitigation by protecting physical assets and revenue streams simultaneously.

Connection

Flood insurance integration and business interruption insurance integration are connected through their ability to collectively mitigate financial risks caused by natural disasters and operational disruptions. Flood insurance specifically covers property damage due to flooding, while business interruption insurance compensates for lost income during recovery periods. Coordinating both coverages ensures comprehensive protection for businesses facing physical damage and revenue loss simultaneously.

Key Terms

Coverage Scope

Business interruption insurance integration primarily addresses loss of income and operating expenses during unexpected disruptions such as fire, theft, or equipment failure, ensuring financial stability for affected businesses. Flood insurance integration, by contrast, specifically covers damages caused by flooding events, which are typically excluded from standard policies, protecting properties in high-risk flood zones. Explore detailed coverage comparisons and determine the best integration strategy for your risk management needs.

Exclusion Clauses

Business interruption insurance integration often excludes losses caused by floods, as detailed in specific flood exclusion clauses that limit coverage scope during water-related events. Flood insurance integration complements this by providing dedicated protection for property and income losses stemming from flood damage, filling the gaps left by business interruption policies. Explore the distinct exclusion clauses and integration strategies to optimize your insurance portfolio effectively.

Trigger Events

Business interruption insurance integration is triggered by events that cause a direct halt in business operations, such as fire, equipment breakdown, or other insured perils resulting in loss of income. Flood insurance integration specifically activates upon water damage due to flooding, a peril typically excluded from standard property or business interruption policies. To explore how these trigger events impact your risk management strategy, learn more about tailored insurance solutions.

Source and External Links

What is covered by business interruption insurance? - Outlines the core components of business interruption insurance, including compensation for lost revenue, coverage for ongoing operating expenses, extra expenses, as well as contingent and civil authority coverage, plus service interruption protection.

Business Interruption Insurance - NFP - Describes how business interruption insurance can be integrated into a Business Owner's Policy (BOP), covering lost income and additional costs after a disruption, with flexible extensions for civil authority and relocation scenarios.

Business Interruption: Complex Interdependencies - Details the need for sophisticated policy extensions to address risks from interdependencies across corporate groups and supply chains, ensuring coverage for losses from disruptions at related but separately insured entities.

dowidth.com

dowidth.com