Weather index insurance offers farmers and businesses financial protection based on measurable weather data, triggering payouts when predefined weather thresholds are met. Catastrophe bonds provide investors with risk-linked securities that transfer disaster risks, such as hurricanes or earthquakes, from insurers to the capital markets. Discover how these innovative financial tools mitigate climate-related risks and enhance resilience.

Why it is important

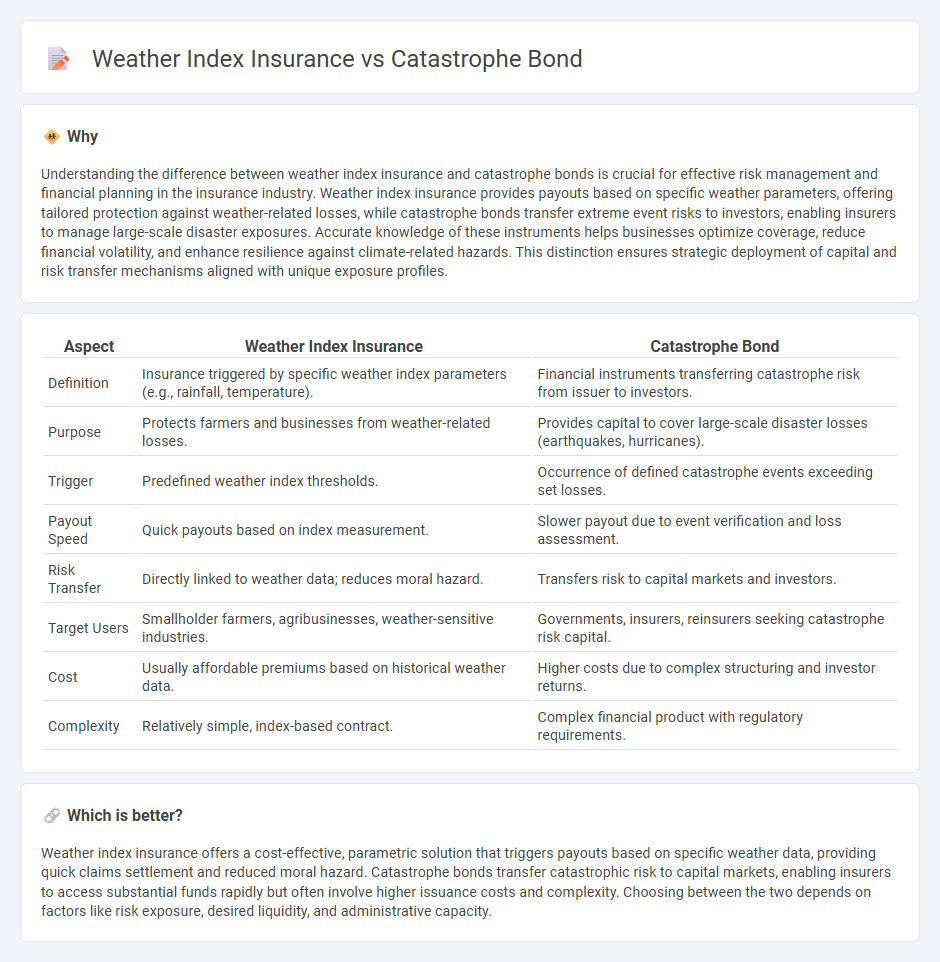

Understanding the difference between weather index insurance and catastrophe bonds is crucial for effective risk management and financial planning in the insurance industry. Weather index insurance provides payouts based on specific weather parameters, offering tailored protection against weather-related losses, while catastrophe bonds transfer extreme event risks to investors, enabling insurers to manage large-scale disaster exposures. Accurate knowledge of these instruments helps businesses optimize coverage, reduce financial volatility, and enhance resilience against climate-related hazards. This distinction ensures strategic deployment of capital and risk transfer mechanisms aligned with unique exposure profiles.

Comparison Table

| Aspect | Weather Index Insurance | Catastrophe Bond |

|---|---|---|

| Definition | Insurance triggered by specific weather index parameters (e.g., rainfall, temperature). | Financial instruments transferring catastrophe risk from issuer to investors. |

| Purpose | Protects farmers and businesses from weather-related losses. | Provides capital to cover large-scale disaster losses (earthquakes, hurricanes). |

| Trigger | Predefined weather index thresholds. | Occurrence of defined catastrophe events exceeding set losses. |

| Payout Speed | Quick payouts based on index measurement. | Slower payout due to event verification and loss assessment. |

| Risk Transfer | Directly linked to weather data; reduces moral hazard. | Transfers risk to capital markets and investors. |

| Target Users | Smallholder farmers, agribusinesses, weather-sensitive industries. | Governments, insurers, reinsurers seeking catastrophe risk capital. |

| Cost | Usually affordable premiums based on historical weather data. | Higher costs due to complex structuring and investor returns. |

| Complexity | Relatively simple, index-based contract. | Complex financial product with regulatory requirements. |

Which is better?

Weather index insurance offers a cost-effective, parametric solution that triggers payouts based on specific weather data, providing quick claims settlement and reduced moral hazard. Catastrophe bonds transfer catastrophic risk to capital markets, enabling insurers to access substantial funds rapidly but often involve higher issuance costs and complexity. Choosing between the two depends on factors like risk exposure, desired liquidity, and administrative capacity.

Connection

Weather index insurance and catastrophe bonds are both financial instruments designed to manage risks associated with extreme weather events and natural disasters. Weather index insurance provides payouts based on predefined weather parameters, such as rainfall or temperature thresholds, while catastrophe bonds transfer disaster risk from insurers to investors by issuing bonds that pay out when specified catastrophe triggers occur. These mechanisms enhance risk transfer efficiency, reduce insurer exposure, and provide liquidity in the aftermath of disasters.

Key Terms

Risk Transfer

Catastrophe bonds provide capital market investors exposure to disaster-related risks by transferring catastrophic event risks from insurers or governments to bondholders, triggering payouts contingent on specified event parameters. Weather index insurance offers payouts based on measurable weather conditions like rainfall or temperature, providing a parametric risk transfer mechanism that eliminates claims assessment delays. Explore these innovative financial instruments further to understand their distinct risk transfer benefits in disaster management.

Trigger Mechanism

Catastrophe bonds use pre-defined parametric triggers based on specific event measurements like earthquake magnitude or hurricane wind speed, allowing rapid payout without loss verification. Weather index insurance relies on quantifiable weather indices such as rainfall levels or temperature thresholds to activate compensation, minimizing moral hazard and basis risk. Explore the details of these trigger mechanisms to understand their impact on risk transfer efficiency and financial resilience.

Payout Structure

Catastrophe bonds provide investors with returns linked to the occurrence of predefined catastrophic events, where payouts are triggered only if losses exceed a specified threshold, transferring risk from insurers to the capital markets. Weather index insurance offers payouts based on pre-agreed weather indices such as rainfall or temperature measurements, allowing for rapid and objective settlement without loss verification. Explore further to understand how these payout structures impact risk management and financial resilience in disaster-prone sectors.

Source and External Links

Cat Bond Primer - Wharton ESG Initiative - Catastrophe bonds are insurance-linked securities that transfer catastrophe risk from sponsors (typically insurers/reinsurers) to investors through special purpose vehicles, which issue floating rate notes that can lose principal if a defined disaster event occurs, otherwise paying interest and returning principal at maturity.

Catastrophe bond - Wikipedia - Catastrophe bonds are a type of insurance-linked security created to transfer catastrophic risk from insurers to investors, who receive coupons unless specified disaster triggers occur, in which case principal is forgiven to cover claims.

What is a catastrophe bond? - Artemis - Resource Library - Catastrophe bonds can be structured to cover single or multiple catastrophic events over a risk period and may provide insurance, reinsurance, or retrocessional protection, with triggers linked to natural disasters.

dowidth.com

dowidth.com