Deepfake insurance specifically addresses risks associated with manipulated digital media, providing coverage for damages caused by synthetic identity fraud or reputational harm, while cyber insurance focuses broadly on data breaches, ransomware, and cybersecurity incidents impacting IT systems. Both policies are crucial in today's digital landscape, but deepfake insurance targets emerging threats in AI-generated content whereas cyber insurance covers traditional cyberattack losses. Explore the distinct benefits of each insurance type to safeguard your digital assets effectively.

Why it is important

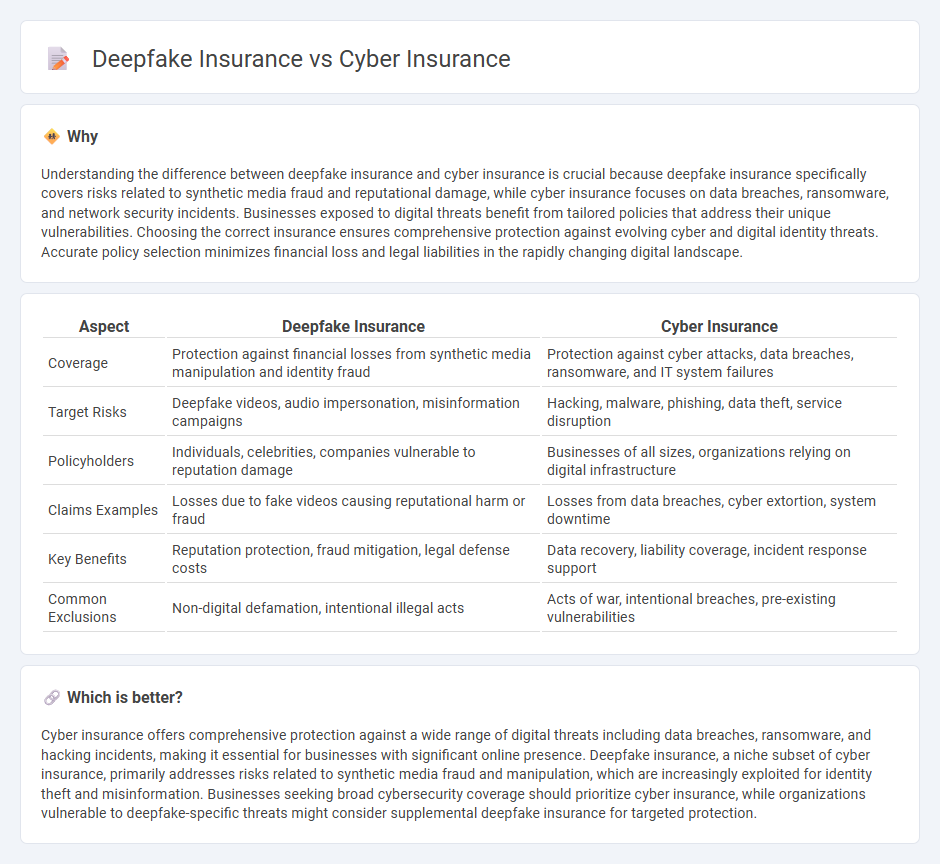

Understanding the difference between deepfake insurance and cyber insurance is crucial because deepfake insurance specifically covers risks related to synthetic media fraud and reputational damage, while cyber insurance focuses on data breaches, ransomware, and network security incidents. Businesses exposed to digital threats benefit from tailored policies that address their unique vulnerabilities. Choosing the correct insurance ensures comprehensive protection against evolving cyber and digital identity threats. Accurate policy selection minimizes financial loss and legal liabilities in the rapidly changing digital landscape.

Comparison Table

| Aspect | Deepfake Insurance | Cyber Insurance |

|---|---|---|

| Coverage | Protection against financial losses from synthetic media manipulation and identity fraud | Protection against cyber attacks, data breaches, ransomware, and IT system failures |

| Target Risks | Deepfake videos, audio impersonation, misinformation campaigns | Hacking, malware, phishing, data theft, service disruption |

| Policyholders | Individuals, celebrities, companies vulnerable to reputation damage | Businesses of all sizes, organizations relying on digital infrastructure |

| Claims Examples | Losses due to fake videos causing reputational harm or fraud | Losses from data breaches, cyber extortion, system downtime |

| Key Benefits | Reputation protection, fraud mitigation, legal defense costs | Data recovery, liability coverage, incident response support |

| Common Exclusions | Non-digital defamation, intentional illegal acts | Acts of war, intentional breaches, pre-existing vulnerabilities |

Which is better?

Cyber insurance offers comprehensive protection against a wide range of digital threats including data breaches, ransomware, and hacking incidents, making it essential for businesses with significant online presence. Deepfake insurance, a niche subset of cyber insurance, primarily addresses risks related to synthetic media fraud and manipulation, which are increasingly exploited for identity theft and misinformation. Businesses seeking broad cybersecurity coverage should prioritize cyber insurance, while organizations vulnerable to deepfake-specific threats might consider supplemental deepfake insurance for targeted protection.

Connection

Deepfake insurance and cyber insurance are interconnected as both address emerging digital threats that compromise data security and online identity. Deepfake insurance specifically protects against risks related to synthetic media manipulation, such as fraudulent videos or audio used for deception, while cyber insurance covers broader cyber threats, including data breaches, ransomware, and hacking incidents. Together, these insurance types provide comprehensive coverage against evolving cyber risks in the digital age.

Key Terms

**Cyber Insurance:**

Cyber insurance provides financial protection against data breaches, ransomware attacks, and other cyber threats that compromise digital assets and business operations. It covers costs related to incident response, legal fees, and customer notification, helping organizations mitigate the impact of cyber incidents. Explore more to understand how cyber insurance safeguards your enterprise in an evolving digital risk landscape.

Data Breach

Cyber insurance primarily covers financial losses from data breaches, including costs related to notification, legal fees, and remediation. Deepfake insurance specifically addresses risks tied to synthetic identity fraud and reputational damage caused by manipulated media in data breach scenarios. Explore the differences and benefits of these insurance types to safeguard your digital assets effectively.

Ransomware

Cyber insurance primarily covers financial losses and recovery costs related to ransomware attacks, including data restoration and business interruption expenses. Deepfake insurance targets risks from manipulated media used in social engineering schemes, which can indirectly facilitate ransomware infections by tricking employees into compromising security. Explore the differences between these emerging insurance solutions to protect your organization effectively against sophisticated cyber threats.

Source and External Links

What is Cyber Insurance? - Cyber insurance covers financial losses from cyber incidents like ransomware attacks and data breaches, aiding in business recovery and risk management.

Cyber Insurance: What You Need to Consider Before - This resource provides insights into what cyber insurance covers, including data recovery, business interruption, and legal expenses, to help organizations mitigate cyber risks.

Cyber Insurance - Cyber insurance is a specialty product designed to protect businesses from IT-related risks by providing financial coverage for losses due to cyber threats and breaches.

dowidth.com

dowidth.com