Crop microinsurance offers targeted protection to smallholder farmers by covering losses from specific perils such as pest infestations or localized droughts, ensuring direct compensation for tangible crop damage. Weather index insurance mitigates risk through payouts triggered by predefined weather parameters like rainfall deficits or temperature extremes, reducing claim processing time and moral hazard. Explore how these insurance models enhance agricultural resilience and financial stability for farmers.

Why it is important

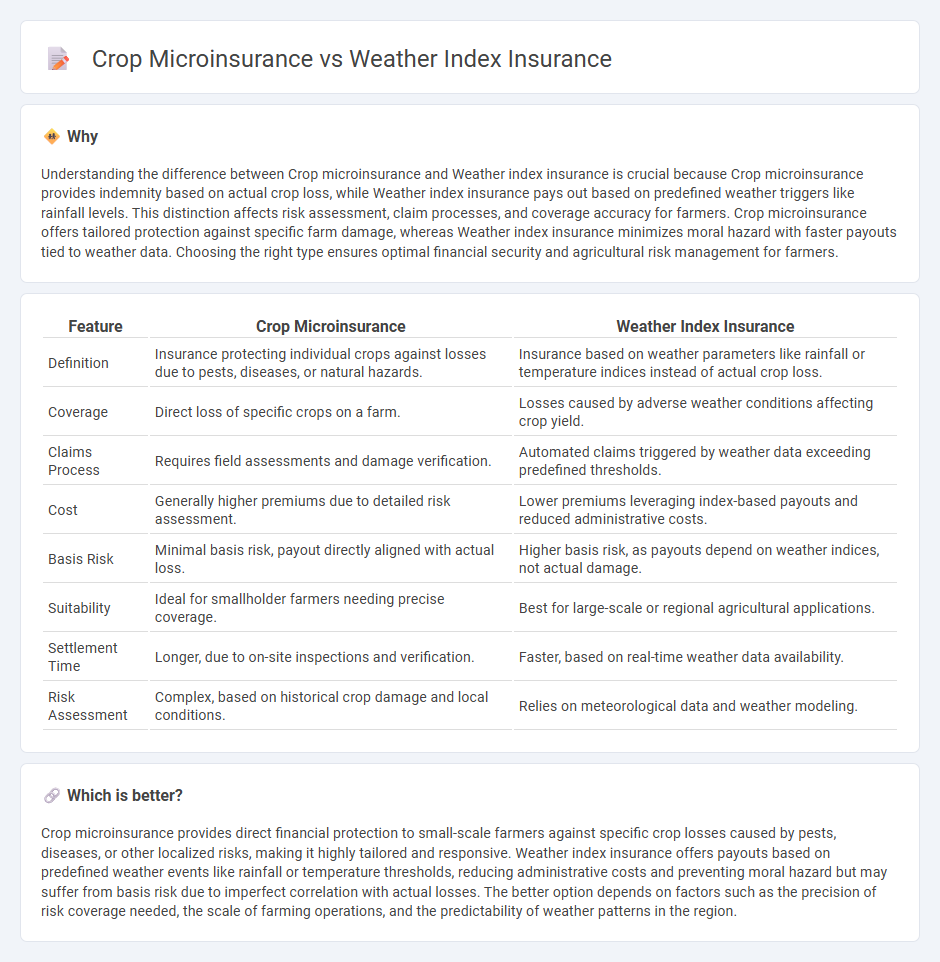

Understanding the difference between Crop microinsurance and Weather index insurance is crucial because Crop microinsurance provides indemnity based on actual crop loss, while Weather index insurance pays out based on predefined weather triggers like rainfall levels. This distinction affects risk assessment, claim processes, and coverage accuracy for farmers. Crop microinsurance offers tailored protection against specific farm damage, whereas Weather index insurance minimizes moral hazard with faster payouts tied to weather data. Choosing the right type ensures optimal financial security and agricultural risk management for farmers.

Comparison Table

| Feature | Crop Microinsurance | Weather Index Insurance |

|---|---|---|

| Definition | Insurance protecting individual crops against losses due to pests, diseases, or natural hazards. | Insurance based on weather parameters like rainfall or temperature indices instead of actual crop loss. |

| Coverage | Direct loss of specific crops on a farm. | Losses caused by adverse weather conditions affecting crop yield. |

| Claims Process | Requires field assessments and damage verification. | Automated claims triggered by weather data exceeding predefined thresholds. |

| Cost | Generally higher premiums due to detailed risk assessment. | Lower premiums leveraging index-based payouts and reduced administrative costs. |

| Basis Risk | Minimal basis risk, payout directly aligned with actual loss. | Higher basis risk, as payouts depend on weather indices, not actual damage. |

| Suitability | Ideal for smallholder farmers needing precise coverage. | Best for large-scale or regional agricultural applications. |

| Settlement Time | Longer, due to on-site inspections and verification. | Faster, based on real-time weather data availability. |

| Risk Assessment | Complex, based on historical crop damage and local conditions. | Relies on meteorological data and weather modeling. |

Which is better?

Crop microinsurance provides direct financial protection to small-scale farmers against specific crop losses caused by pests, diseases, or other localized risks, making it highly tailored and responsive. Weather index insurance offers payouts based on predefined weather events like rainfall or temperature thresholds, reducing administrative costs and preventing moral hazard but may suffer from basis risk due to imperfect correlation with actual losses. The better option depends on factors such as the precision of risk coverage needed, the scale of farming operations, and the predictability of weather patterns in the region.

Connection

Crop microinsurance and weather index insurance are connected through their focus on protecting farmers from climate-related risks and financial losses caused by adverse weather conditions. Weather index insurance uses measurable weather parameters, such as rainfall or temperature indices, to trigger payouts, which helps streamline claims and reduce administrative costs in crop microinsurance schemes. Both insurance types enhance agricultural resilience by providing timely financial support, thereby stabilizing farmers' incomes and promoting sustainable farming practices.

Key Terms

**Weather Index Insurance:**

Weather index insurance provides payouts based on predefined weather parameters such as rainfall levels or temperature thresholds, reducing the need for costly field assessments. It offers quick compensation to farmers during adverse weather events like droughts or floods, promoting financial stability in agriculture. Explore more about how weather index insurance protects farmers against climate risks and boosts crop resilience.

Index Trigger

Weather index insurance relies on predefined weather parameters such as rainfall or temperature levels that trigger payouts automatically when specific thresholds are breached, minimizing the need for loss assessments. Crop microinsurance, while sometimes index-based, may involve more localized data and tailored coverage, often integrating yield or loss evaluations alongside weather metrics to better match individual farmer risks. Explore detailed comparisons to understand which insurance model best protects agricultural investments under varying climatic conditions.

Parametric Payout

Weather index insurance provides payouts based on predefined weather parameters such as rainfall or temperature thresholds, enabling quick and objective claim settlements. Crop microinsurance, often incorporating parametric payouts, offers small-scale farmers tailored coverage where compensation is triggered by specific weather indices rather than traditional loss assessments. Explore detailed comparisons to understand how parametric payout models optimize risk management in agricultural insurance.

Source and External Links

Weather index-based insurance - CGSpace - Weather index insurance uses measurable weather variables like rainfall to automatically trigger payouts, reducing delays and disputes typical of traditional crop insurance and helping farmers manage climate risks and credit access effectively.

What is Weather Index Insurance? - Columbia University - Weather index insurance pays out based on a preset weather parameter, such as rainfall measured by local stations or satellites, eliminating the need for damage assessments and lowering costs, particularly beneficial for farmers in developing countries facing drought risks.

Weather index insurance: promises and challenges of promoting social and ecological resilience to climate change - Weather index insurance compensates insured parties based on predefined weather metrics rather than individual losses, offering cost-efficiency and reduced moral hazard, but faces challenges like affordability, insurer risk from extreme weather, and ecological impact considerations, especially in developing countries.

dowidth.com

dowidth.com