Artificial intelligence underwriting leverages machine learning algorithms and vast data analytics to assess risk with speed and precision, minimizing human bias and improving accuracy. Crowdsourced underwriting relies on diverse human input from multiple individuals to evaluate policies, bringing varied perspectives but potentially slower decision-making processes. Explore the evolving impact of these underwriting approaches to discover which suits your insurance needs best.

Why it is important

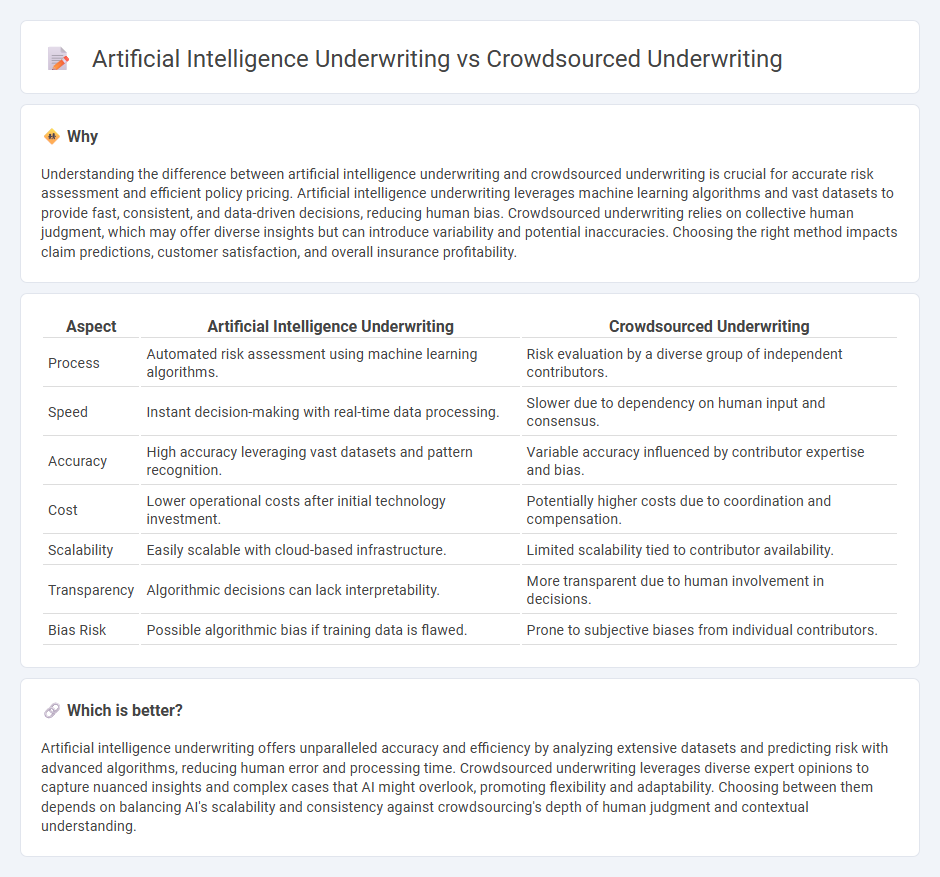

Understanding the difference between artificial intelligence underwriting and crowdsourced underwriting is crucial for accurate risk assessment and efficient policy pricing. Artificial intelligence underwriting leverages machine learning algorithms and vast datasets to provide fast, consistent, and data-driven decisions, reducing human bias. Crowdsourced underwriting relies on collective human judgment, which may offer diverse insights but can introduce variability and potential inaccuracies. Choosing the right method impacts claim predictions, customer satisfaction, and overall insurance profitability.

Comparison Table

| Aspect | Artificial Intelligence Underwriting | Crowdsourced Underwriting |

|---|---|---|

| Process | Automated risk assessment using machine learning algorithms. | Risk evaluation by a diverse group of independent contributors. |

| Speed | Instant decision-making with real-time data processing. | Slower due to dependency on human input and consensus. |

| Accuracy | High accuracy leveraging vast datasets and pattern recognition. | Variable accuracy influenced by contributor expertise and bias. |

| Cost | Lower operational costs after initial technology investment. | Potentially higher costs due to coordination and compensation. |

| Scalability | Easily scalable with cloud-based infrastructure. | Limited scalability tied to contributor availability. |

| Transparency | Algorithmic decisions can lack interpretability. | More transparent due to human involvement in decisions. |

| Bias Risk | Possible algorithmic bias if training data is flawed. | Prone to subjective biases from individual contributors. |

Which is better?

Artificial intelligence underwriting offers unparalleled accuracy and efficiency by analyzing extensive datasets and predicting risk with advanced algorithms, reducing human error and processing time. Crowdsourced underwriting leverages diverse expert opinions to capture nuanced insights and complex cases that AI might overlook, promoting flexibility and adaptability. Choosing between them depends on balancing AI's scalability and consistency against crowdsourcing's depth of human judgment and contextual understanding.

Connection

Artificial intelligence underwriting leverages machine learning algorithms to analyze vast datasets and predict risk with high accuracy, while crowdsourced underwriting incorporates the collective insights of diverse human experts to assess insurance applications. Both methods optimize risk evaluation by combining quantitative data analysis and qualitative judgments, enhancing overall underwriting efficiency and precision. Integrating AI with crowdsourced input can lead to more dynamic and adaptive underwriting models that improve decision-making in insurance.

Key Terms

Crowdsourced Underwriting:

Crowdsourced underwriting leverages a diverse group of individuals to assess risk, drawing on collective intelligence to improve decision accuracy and reduce bias. This approach contrasts with artificial intelligence underwriting, which relies on algorithms and machine learning models to analyze large datasets for risk evaluation. Discover more about how crowdsourced underwriting can revolutionize risk assessment and enhance insurance processes.

Peer Review

Crowdsourced underwriting leverages diverse human expertise to evaluate risk, enhancing accuracy through collective insights, while artificial intelligence underwriting employs algorithms and machine learning to analyze vast data sets for faster, data-driven decisions. Peer review in crowdsourced underwriting ensures quality and consistency by allowing multiple underwriters to validate evaluations, whereas AI systems rely on model validation and continuous feedback loops to refine underwriting accuracy. Explore further to understand how integrating peer review with AI can optimize underwriting processes for improved risk assessment.

Collective Intelligence

Crowdsourced underwriting leverages collective intelligence by aggregating assessments from diverse individuals to improve risk evaluation accuracy through human judgment and experience. Artificial intelligence underwriting utilizes machine learning algorithms and vast datasets to identify patterns and predict risk with speed and scalability. Explore how integrating collective intelligence with AI can revolutionize underwriting processes and enhance decision-making efficiency.

Source and External Links

What is Community Underwriting? - Credibles: crowdfunding and gift ... - Community underwriting involves customers prepaying for products or services, effectively participating in underwriting by sharing market insights and becoming loyal customers, creating a self-fulfilling positive market dynamic through crowdsourced funding and engagement.

Crowdsourcing to Build Better Insurance - State of the Planet - Crowdsourcing in insurance leverages millions of local participants to provide bottom-up data and community intelligence, improving index reliability and trust, thus enhancing underwriting decisions for better insurance products.

Underwriting Metrics: Going Beyond Credit Score - AI & Lending - The underwriting process can be viewed as a form of crowdsourcing because different data sources contribute to credit scores, but quality assurance and additional metrics beyond credit scores are necessary to better assess creditworthiness.

dowidth.com

dowidth.com