Insurtech sandboxes provide a controlled regulatory environment for startups to test innovative insurance technologies without full compliance burdens, accelerating product development and market entry. Telematics leverages real-time data from connected devices to personalize insurance policies, particularly in auto insurance, by monitoring driving behavior and enhancing risk assessment. Explore how these technologies reshape insurance landscape and discover their unique benefits.

Why it is important

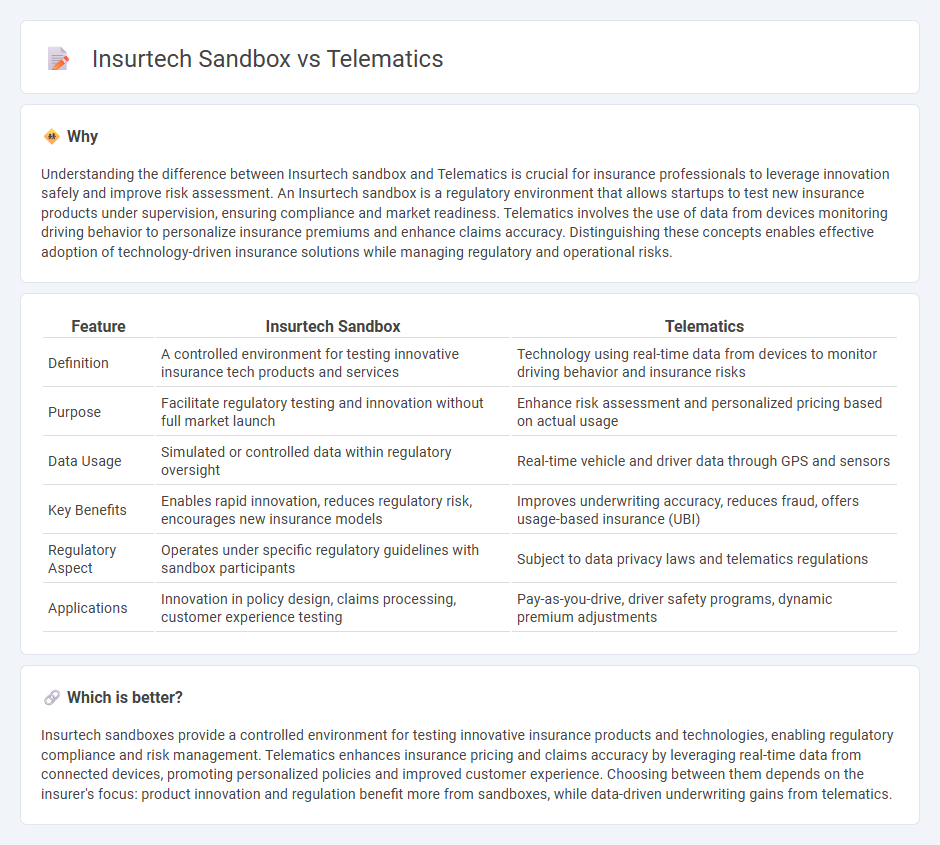

Understanding the difference between Insurtech sandbox and Telematics is crucial for insurance professionals to leverage innovation safely and improve risk assessment. An Insurtech sandbox is a regulatory environment that allows startups to test new insurance products under supervision, ensuring compliance and market readiness. Telematics involves the use of data from devices monitoring driving behavior to personalize insurance premiums and enhance claims accuracy. Distinguishing these concepts enables effective adoption of technology-driven insurance solutions while managing regulatory and operational risks.

Comparison Table

| Feature | Insurtech Sandbox | Telematics |

|---|---|---|

| Definition | A controlled environment for testing innovative insurance tech products and services | Technology using real-time data from devices to monitor driving behavior and insurance risks |

| Purpose | Facilitate regulatory testing and innovation without full market launch | Enhance risk assessment and personalized pricing based on actual usage |

| Data Usage | Simulated or controlled data within regulatory oversight | Real-time vehicle and driver data through GPS and sensors |

| Key Benefits | Enables rapid innovation, reduces regulatory risk, encourages new insurance models | Improves underwriting accuracy, reduces fraud, offers usage-based insurance (UBI) |

| Regulatory Aspect | Operates under specific regulatory guidelines with sandbox participants | Subject to data privacy laws and telematics regulations |

| Applications | Innovation in policy design, claims processing, customer experience testing | Pay-as-you-drive, driver safety programs, dynamic premium adjustments |

Which is better?

Insurtech sandboxes provide a controlled environment for testing innovative insurance products and technologies, enabling regulatory compliance and risk management. Telematics enhances insurance pricing and claims accuracy by leveraging real-time data from connected devices, promoting personalized policies and improved customer experience. Choosing between them depends on the insurer's focus: product innovation and regulation benefit more from sandboxes, while data-driven underwriting gains from telematics.

Connection

Insurtech sandboxes provide a controlled regulatory environment for testing innovative insurance technologies, including telematics-based solutions. Telematics enhances insurance products by using real-time data from devices to assess risk accurately and personalize premiums. This synergy accelerates product development and drives data-driven decision-making within the insurance industry.

Key Terms

Data Analytics

Telematics leverages real-time vehicle and driver data to enhance risk assessment and personalize insurance policies, improving accuracy in premium pricing. Insurtech sandboxes provide a controlled environment for piloting innovative data analytics tools, fostering collaboration between insurers and technology developers. Explore deeper insights into how data analytics transforms insurance through telematics and insurtech innovations.

Regulatory Framework

The telematics industry primarily operates within established transportation and data privacy regulations, emphasizing the integration of vehicle telematics with user consent and data protection standards. Insurtech sandboxes are regulatory initiatives designed to enable innovative insurance products, including telematics-based insurance models, by providing a controlled environment for testing compliance with evolving insurance laws and consumer protection requirements. Explore how regulatory frameworks shape the future of telematics and insurtech innovation.

Usage-Based Insurance

Usage-Based Insurance (UBI) leverages telematics technology to collect real-time driving data, enabling insurers to tailor premiums based on individual driving behavior. Insurtech sandboxes facilitate the testing and regulatory approval of innovative UBI models, promoting market adoption while ensuring consumer protection. Discover how telematics and insurtech sandboxes are transforming the future of auto insurance through personalized risk assessment.

Source and External Links

What Are the Benefits of Telematics? - BusinessNewsDaily.com - Telematics is a GPS fleet management technology that collects real-time vehicle data, such as engine diagnostics, location, and driver behavior, sending it via cellular networks to provide a comprehensive view of fleet operations.

Telematics - Wikipedia - Telematics is an interdisciplinary field combining telecommunications, vehicular technologies, electrical engineering, and computer science, primarily involving sending, receiving, and storing information remotely, commonly applied in vehicle and fleet management.

Telematics - DCA - Telematics monitors assets like vehicles using GPS and onboard diagnostics to record detailed operational data, transmitting it via a telematics device connected to cellular networks for analysis and management.

dowidth.com

dowidth.com