Crop insurance protects farmers against losses caused by natural disasters or crop failures, ensuring financial stability in agriculture. Disability insurance offers income replacement for individuals unable to work due to injury or illness, safeguarding personal earnings. Explore the key differences and benefits of these insurance types to determine which best suits your needs.

Why it is important

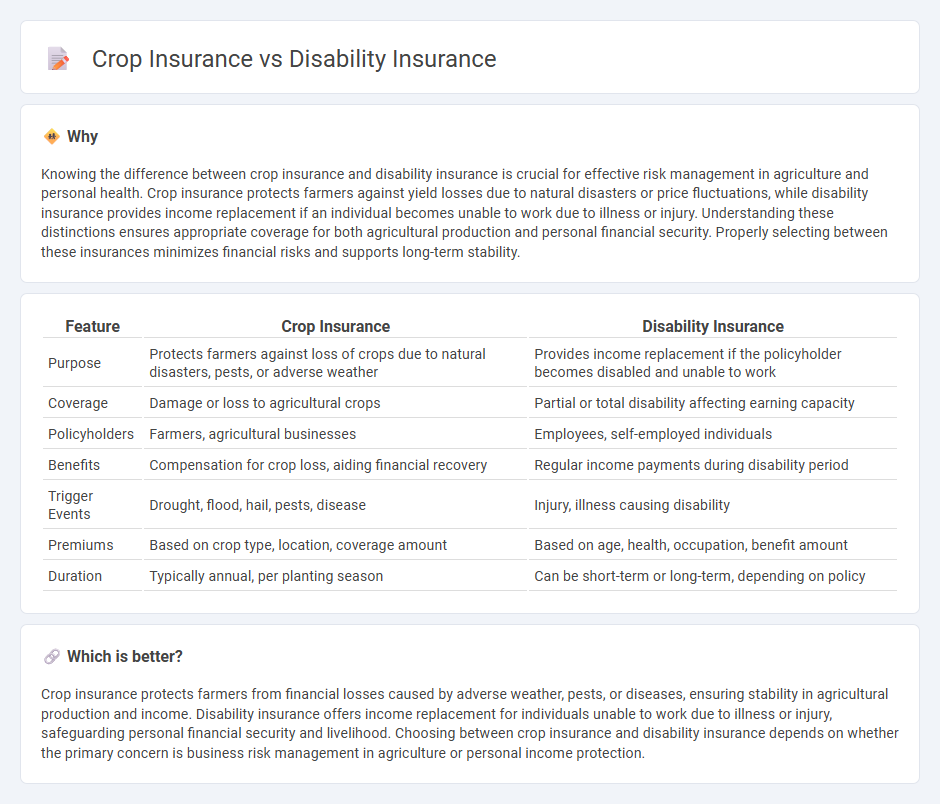

Knowing the difference between crop insurance and disability insurance is crucial for effective risk management in agriculture and personal health. Crop insurance protects farmers against yield losses due to natural disasters or price fluctuations, while disability insurance provides income replacement if an individual becomes unable to work due to illness or injury. Understanding these distinctions ensures appropriate coverage for both agricultural production and personal financial security. Properly selecting between these insurances minimizes financial risks and supports long-term stability.

Comparison Table

| Feature | Crop Insurance | Disability Insurance |

|---|---|---|

| Purpose | Protects farmers against loss of crops due to natural disasters, pests, or adverse weather | Provides income replacement if the policyholder becomes disabled and unable to work |

| Coverage | Damage or loss to agricultural crops | Partial or total disability affecting earning capacity |

| Policyholders | Farmers, agricultural businesses | Employees, self-employed individuals |

| Benefits | Compensation for crop loss, aiding financial recovery | Regular income payments during disability period |

| Trigger Events | Drought, flood, hail, pests, disease | Injury, illness causing disability |

| Premiums | Based on crop type, location, coverage amount | Based on age, health, occupation, benefit amount |

| Duration | Typically annual, per planting season | Can be short-term or long-term, depending on policy |

Which is better?

Crop insurance protects farmers from financial losses caused by adverse weather, pests, or diseases, ensuring stability in agricultural production and income. Disability insurance offers income replacement for individuals unable to work due to illness or injury, safeguarding personal financial security and livelihood. Choosing between crop insurance and disability insurance depends on whether the primary concern is business risk management in agriculture or personal income protection.

Connection

Crop insurance and disability insurance both provide financial protection against unforeseen risks--crop insurance shields farmers from losses due to adverse weather or pests, while disability insurance protects individuals from income loss caused by injury or illness. Both types of insurance play crucial roles in risk management for agricultural workers, ensuring economic stability despite physical or environmental challenges. By securing income streams, these insurances support sustained livelihoods in the farming community.

Key Terms

Benefit Period (Disability)

Disability insurance offers a benefit period that typically ranges from a few months to several years, depending on the policy terms, designed to provide income replacement during the insured's inability to work due to illness or injury. Crop insurance benefit periods are tied to the agricultural growing season and claim processing timelines, focusing on yield or revenue protection rather than income replacement over an extended time. Explore detailed comparisons to understand how benefit periods impact coverage choices and financial planning.

Yield Coverage (Crop)

Yield coverage in crop insurance protects farmers against losses in crop production due to events like drought, pests, and disease, ensuring financial stability by compensating for reduced yields. Disability insurance, in contrast, provides income replacement when an individual is unable to work due to a disabling condition, focusing on personal income protection rather than production loss. Explore detailed comparisons and benefits to determine the best insurance coverage for your agricultural and personal income needs.

Premiums

Disability insurance premiums are typically based on the insured's age, occupation, and health, reflecting the risk of income loss due to disability. Crop insurance premiums depend on factors like crop type, location, planting history, and weather patterns, designed to mitigate agricultural losses. Explore detailed comparisons to understand how these premiums impact your financial planning.

Source and External Links

Disability Insurance - Disability insurance is a form of insurance that protects the beneficiary's earned income against the risk of disability, including short-term and long-term benefits.

Disability Insurance - State Farm - State Farm offers disability insurance to help protect your income if you become disabled, providing coverage for expenses like mortgage and car loans.

Affordable Disability Insurance Plans - Guardian offers affordable disability insurance plans for individuals and businesses, helping replace income if illness or injury prevents work.

dowidth.com

dowidth.com