Digital claim automation leverages artificial intelligence and machine learning to expedite the processing of insurance claims, reducing errors and enhancing efficiency compared to traditional human-only claim adjudication. Human adjudicators rely on experience and judgment but can encounter delays and inconsistencies due to manual workflows and volume of claims. Explore how integrating digital claim automation can transform claim handling in your insurance operations.

Why it is important

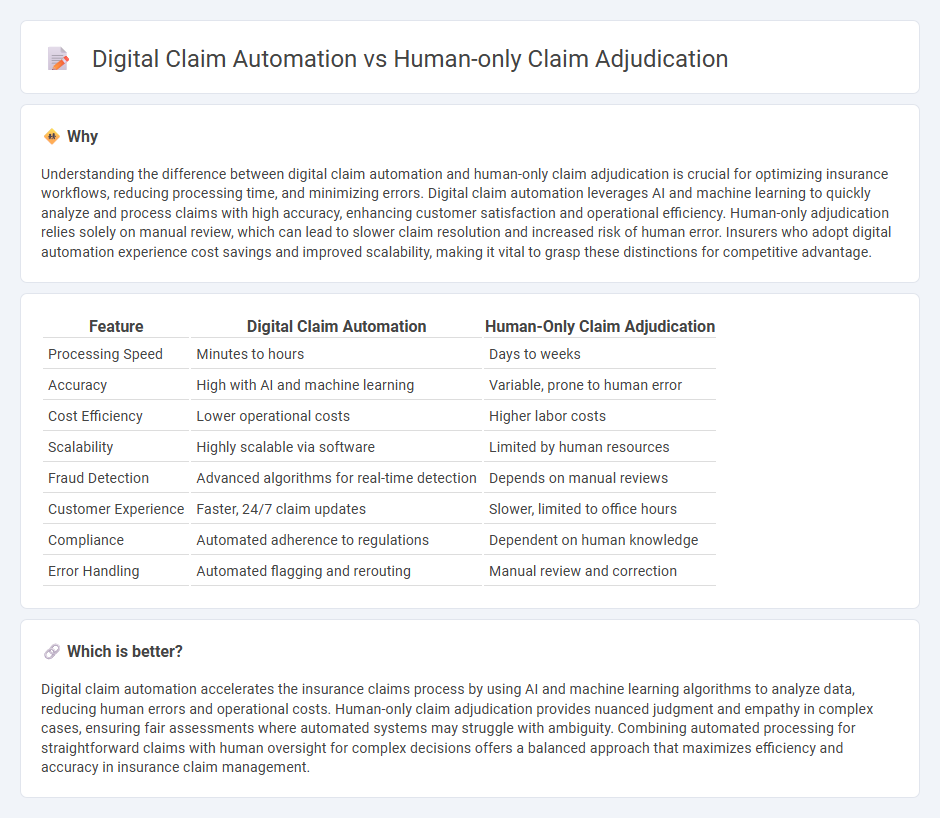

Understanding the difference between digital claim automation and human-only claim adjudication is crucial for optimizing insurance workflows, reducing processing time, and minimizing errors. Digital claim automation leverages AI and machine learning to quickly analyze and process claims with high accuracy, enhancing customer satisfaction and operational efficiency. Human-only adjudication relies solely on manual review, which can lead to slower claim resolution and increased risk of human error. Insurers who adopt digital automation experience cost savings and improved scalability, making it vital to grasp these distinctions for competitive advantage.

Comparison Table

| Feature | Digital Claim Automation | Human-Only Claim Adjudication |

|---|---|---|

| Processing Speed | Minutes to hours | Days to weeks |

| Accuracy | High with AI and machine learning | Variable, prone to human error |

| Cost Efficiency | Lower operational costs | Higher labor costs |

| Scalability | Highly scalable via software | Limited by human resources |

| Fraud Detection | Advanced algorithms for real-time detection | Depends on manual reviews |

| Customer Experience | Faster, 24/7 claim updates | Slower, limited to office hours |

| Compliance | Automated adherence to regulations | Dependent on human knowledge |

| Error Handling | Automated flagging and rerouting | Manual review and correction |

Which is better?

Digital claim automation accelerates the insurance claims process by using AI and machine learning algorithms to analyze data, reducing human errors and operational costs. Human-only claim adjudication provides nuanced judgment and empathy in complex cases, ensuring fair assessments where automated systems may struggle with ambiguity. Combining automated processing for straightforward claims with human oversight for complex decisions offers a balanced approach that maximizes efficiency and accuracy in insurance claim management.

Connection

Digital claim automation enhances efficiency by processing high volumes of insurance claims using AI-driven algorithms, while human-only claim adjudication ensures accuracy and complex decision-making through expert review. Integrating automated systems with human adjudicators creates a hybrid model that balances speed and precision, reducing claim processing times and minimizing errors. This connection improves customer satisfaction by streamlining workflows and maintaining high standards of claim validation.

Key Terms

Manual Processing

Manual processing in human-only claim adjudication involves claims examiners reviewing each case individually, ensuring accuracy through personalized assessment but often resulting in longer turnaround times and higher labor costs. Digital claim automation leverages artificial intelligence and machine learning to expedite claim evaluation, reduce errors, and enhance efficiency by processing large volumes of data rapidly. Explore how integrating manual expertise with automated systems can optimize claim adjudication outcomes.

Algorithmic Assessment

Human-only claim adjudication relies heavily on manual evaluation, which can lead to inconsistencies and slower processing times due to human error and subjective judgment. Digital claim automation leverages algorithmic assessment to analyze vast datasets quickly and accurately, improving claim accuracy, reducing processing time, and minimizing operational costs. Explore the impact of algorithmic models on claim adjudication to enhance efficiency and outcomes in insurance processing.

Fraud Detection

Human-only claim adjudication relies heavily on expert intuition and manual review to detect anomalies, making it slower and prone to oversight in complex fraud schemes. Digital claim automation utilizes advanced algorithms, machine learning, and real-time data analysis to identify patterns and flag suspicious claims with higher accuracy and speed. Explore how integrating AI-driven tools enhances fraud detection effectiveness in insurance claims processing.

Source and External Links

What is Claims Adjudication? - Claims adjudication is a multi-step insurance process to decide coverage of healthcare claims, involving initial review, automatic computer-based review, and possible manual review if discrepancies arise, but human-only adjudication is not specifically detailed.

Adjudication in Healthcare - Healthcare claims adjudication is a complex insurer process that can include documentation checks and decisions to reject or settle claims; while automated systems handle many aspects, human involvement is common in reviewing errors or appeals.

Claims Adjudication - The claims adjudication process evaluates medical claims for accuracy and validity, where payors may sometimes use medical examiners for necessity validation, implying human review but not strictly human-only adjudication.

dowidth.com

dowidth.com