Decoupled insurance separates the roles of insurance providers and distributors, allowing independent agents to offer multiple products from various carriers without being tied to a single brand. White-label insurance involves third-party products rebranded and sold under another company's name, enabling businesses to expand their offerings without developing their own insurance solutions. Explore how these models impact cost efficiency, customer reach, and market agility in the insurance industry.

Why it is important

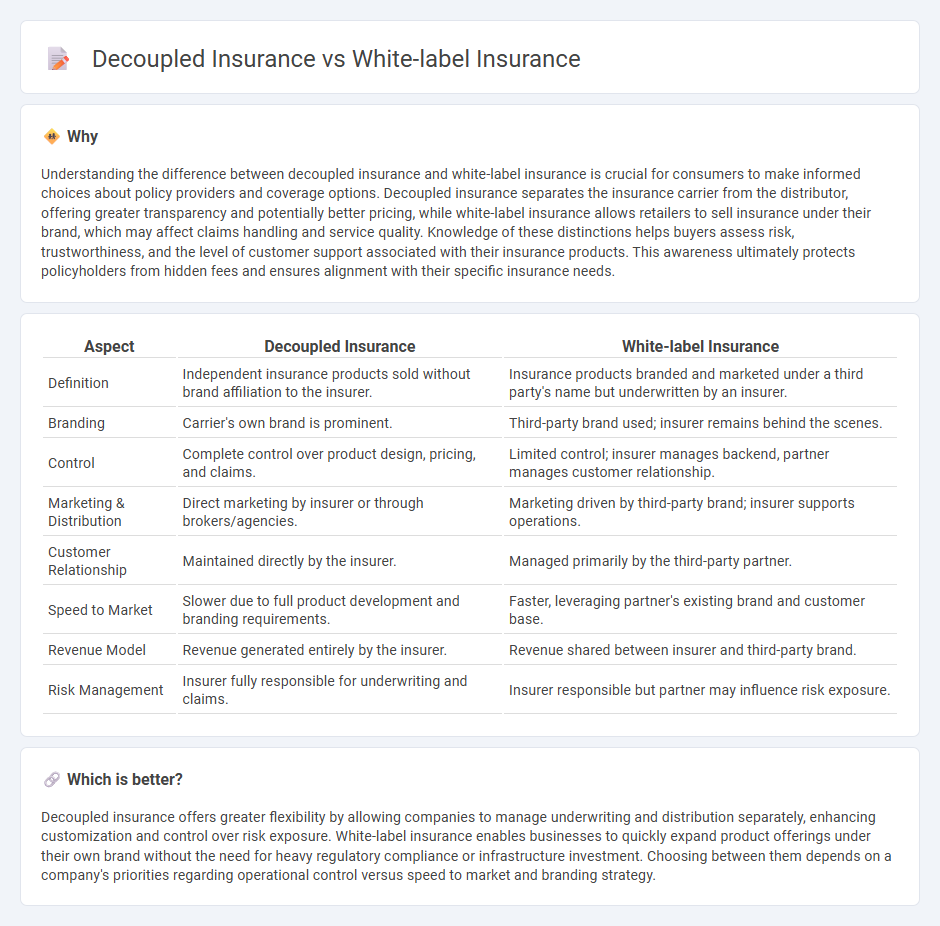

Understanding the difference between decoupled insurance and white-label insurance is crucial for consumers to make informed choices about policy providers and coverage options. Decoupled insurance separates the insurance carrier from the distributor, offering greater transparency and potentially better pricing, while white-label insurance allows retailers to sell insurance under their brand, which may affect claims handling and service quality. Knowledge of these distinctions helps buyers assess risk, trustworthiness, and the level of customer support associated with their insurance products. This awareness ultimately protects policyholders from hidden fees and ensures alignment with their specific insurance needs.

Comparison Table

| Aspect | Decoupled Insurance | White-label Insurance |

|---|---|---|

| Definition | Independent insurance products sold without brand affiliation to the insurer. | Insurance products branded and marketed under a third party's name but underwritten by an insurer. |

| Branding | Carrier's own brand is prominent. | Third-party brand used; insurer remains behind the scenes. |

| Control | Complete control over product design, pricing, and claims. | Limited control; insurer manages backend, partner manages customer relationship. |

| Marketing & Distribution | Direct marketing by insurer or through brokers/agencies. | Marketing driven by third-party brand; insurer supports operations. |

| Customer Relationship | Maintained directly by the insurer. | Managed primarily by the third-party partner. |

| Speed to Market | Slower due to full product development and branding requirements. | Faster, leveraging partner's existing brand and customer base. |

| Revenue Model | Revenue generated entirely by the insurer. | Revenue shared between insurer and third-party brand. |

| Risk Management | Insurer fully responsible for underwriting and claims. | Insurer responsible but partner may influence risk exposure. |

Which is better?

Decoupled insurance offers greater flexibility by allowing companies to manage underwriting and distribution separately, enhancing customization and control over risk exposure. White-label insurance enables businesses to quickly expand product offerings under their own brand without the need for heavy regulatory compliance or infrastructure investment. Choosing between them depends on a company's priorities regarding operational control versus speed to market and branding strategy.

Connection

Decoupled insurance enables businesses to offer insurance products without underwriting risks directly, while white-label insurance allows companies to brand these products as their own. Both models rely on partnerships with established insurers to handle policy administration, claims processing, and risk management. This connection empowers non-insurance companies to expand their service offerings and enter insurance markets efficiently.

Key Terms

Branding

White-label insurance allows companies to sell insurance products under their own brand without developing insurance services from scratch, enhancing brand loyalty and customer trust. Decoupled insurance separates the customer-facing brand from the insurance provider, enabling specialized marketing strategies but potentially diluting brand consistency. Explore how these models impact brand identity and customer experience in the insurance sector.

Distribution

White-label insurance involves insurers providing products sold under a retailer's brand, leveraging existing customer bases to enhance distribution channels effectively. Decoupled insurance separates the product from the distribution channel, allowing independent platforms or agents to offer various insurers' products, fostering competitive pricing and wider market reach. Explore deeper insights into how these models impact market strategies and customer engagement.

Underwriting

White-label insurance leverages a partner's underwriting framework to offer branded policies without direct risk assessment involvement, enhancing brand presence while minimizing operational complexities. Decoupled insurance separates underwriting from distribution, enabling specialized underwriters to assess risk independently, which fosters innovation and tailored coverage solutions. Explore further to understand how underwriting strategies shape both white-label and decoupled insurance models.

Source and External Links

What is White Label Insurance? - White-label insurance allows companies to rebrand and sell insurance products developed by others under their own brand, expanding offerings and customer engagement.

What are white label products for insurance companies? - White-label products enable insurance companies to expand their offerings by rebranding and selling another company's products under their own brand.

White Labeling for Insurance: What is it, And Why Does it Matter? - White-label insurance involves companies offering insurance products to other businesses, which then market and sell them under their own brand.

dowidth.com

dowidth.com