Silent cyber coverage addresses cyber risks not explicitly included or excluded in traditional insurance policies, filling gaps in protection against cyberattacks. Aggregation risk involves the potential for multiple claims from a single cyber event, which can significantly impact insurers' financial stability. Explore more to understand how these concepts shape modern insurance strategies.

Why it is important

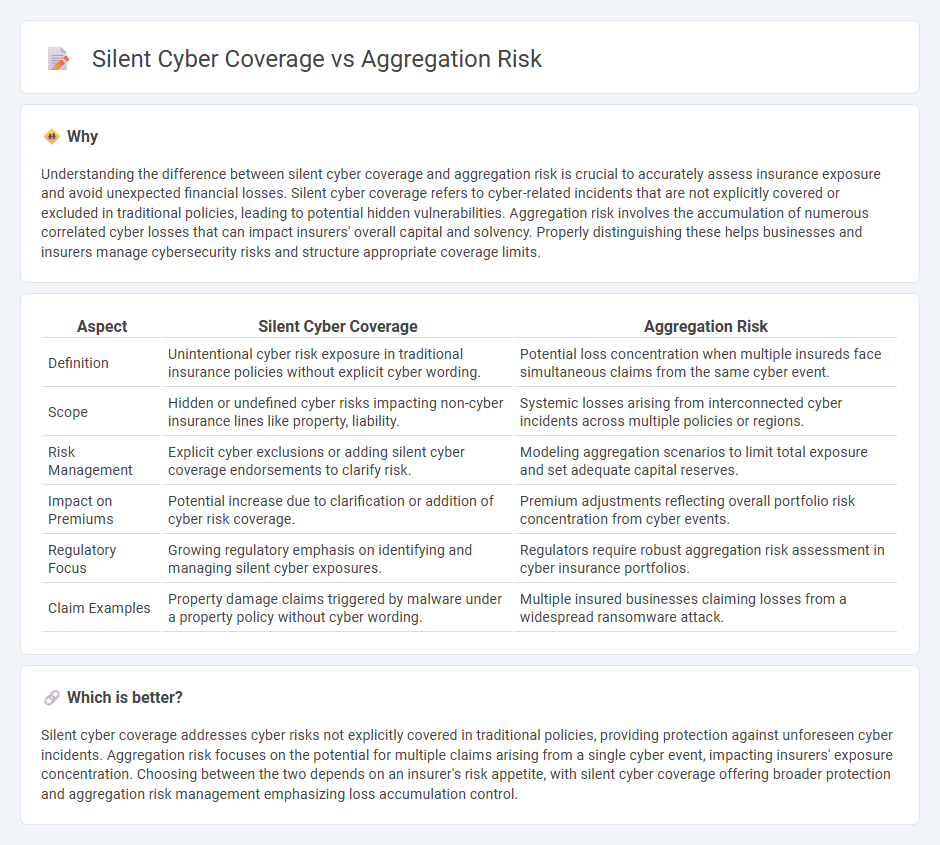

Understanding the difference between silent cyber coverage and aggregation risk is crucial to accurately assess insurance exposure and avoid unexpected financial losses. Silent cyber coverage refers to cyber-related incidents that are not explicitly covered or excluded in traditional policies, leading to potential hidden vulnerabilities. Aggregation risk involves the accumulation of numerous correlated cyber losses that can impact insurers' overall capital and solvency. Properly distinguishing these helps businesses and insurers manage cybersecurity risks and structure appropriate coverage limits.

Comparison Table

| Aspect | Silent Cyber Coverage | Aggregation Risk |

|---|---|---|

| Definition | Unintentional cyber risk exposure in traditional insurance policies without explicit cyber wording. | Potential loss concentration when multiple insureds face simultaneous claims from the same cyber event. |

| Scope | Hidden or undefined cyber risks impacting non-cyber insurance lines like property, liability. | Systemic losses arising from interconnected cyber incidents across multiple policies or regions. |

| Risk Management | Explicit cyber exclusions or adding silent cyber coverage endorsements to clarify risk. | Modeling aggregation scenarios to limit total exposure and set adequate capital reserves. |

| Impact on Premiums | Potential increase due to clarification or addition of cyber risk coverage. | Premium adjustments reflecting overall portfolio risk concentration from cyber events. |

| Regulatory Focus | Growing regulatory emphasis on identifying and managing silent cyber exposures. | Regulators require robust aggregation risk assessment in cyber insurance portfolios. |

| Claim Examples | Property damage claims triggered by malware under a property policy without cyber wording. | Multiple insured businesses claiming losses from a widespread ransomware attack. |

Which is better?

Silent cyber coverage addresses cyber risks not explicitly covered in traditional policies, providing protection against unforeseen cyber incidents. Aggregation risk focuses on the potential for multiple claims arising from a single cyber event, impacting insurers' exposure concentration. Choosing between the two depends on an insurer's risk appetite, with silent cyber coverage offering broader protection and aggregation risk management emphasizing loss accumulation control.

Connection

Silent cyber coverage addresses gaps in traditional insurance policies by providing protection against cyber incidents not explicitly covered, while aggregation risk refers to the potential for multiple simultaneous claims resulting from a single cyber event. The connection lies in how silent cyber exposures can accumulate unnoticed across various lines of business, amplifying aggregate losses for insurers. Effective management of this linkage requires insurers to quantify silent cyber risks and implement aggregation controls to mitigate financial impact from widespread cyber attacks.

Key Terms

Aggregation risk:

Aggregation risk refers to the potential for multiple cyber incidents to occur simultaneously or in a correlated manner, leading to significant losses that exceed typical policy limits. This risk is particularly critical for insurers underwriting silent cyber coverage, as traditional policies may not explicitly address cumulative cyber events embedded within non-cyber insurance lines. Explore how careful assessment and modeling of aggregation risk can enhance your cyber risk management strategy.

Accumulation

Aggregation risk arises when multiple insurance claims stem from a single cyber event affecting numerous policyholders, potentially leading to significant financial exposure for insurers. Silent cyber coverage addresses this risk by filling gaps in traditional policies that do not explicitly cover cyber incidents, thereby managing accumulation through clear cyber-specific provisions. Explore deeper insights into how silent cyber solutions mitigate aggregation risk in evolving insurance landscapes.

Correlation

Aggregation risk arises when multiple insurance claims result from a single event, causing significant financial exposure due to high correlation of losses across policies. Silent cyber coverage addresses this issue by explicitly incorporating cyber-related risks that are often unintentionally excluded, reducing gaps in protection caused by correlated cyber events. Explore further to understand how managing correlation enhances risk mitigation strategies in insurance portfolios.

Source and External Links

Risk Aggregation - The process of combining individual risks to determine a company's overall risk exposure.

The Art and Science of Risk Aggregation - A method used to gain a comprehensive understanding of an organization's risk profile by aggregating risks across various processes and lines.

Considering Aggregate Portfolio Risk - Focuses on the accumulation of losses due to concentration risks leading to financial, resource-based, or reputational impacts in a portfolio.

dowidth.com

dowidth.com