Insurtech sandboxes enable startups and insurers to test innovative insurance products and services in a controlled regulatory environment, fostering rapid development and compliance. Insurance aggregators collect and compare quotes from multiple insurers, providing consumers with a convenient platform to find the best coverage options and prices. Explore the differences and advantages of insurtech sandboxes and insurance aggregators to enhance your understanding of digital insurance solutions.

Why it is important

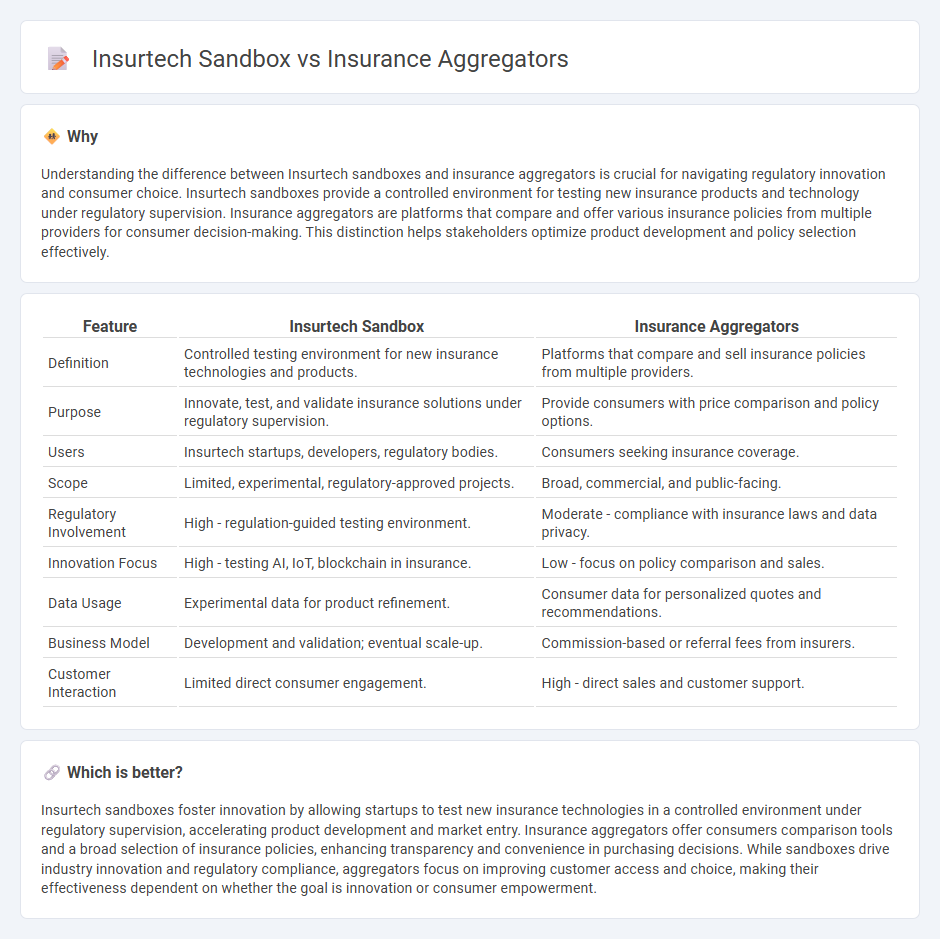

Understanding the difference between Insurtech sandboxes and insurance aggregators is crucial for navigating regulatory innovation and consumer choice. Insurtech sandboxes provide a controlled environment for testing new insurance products and technology under regulatory supervision. Insurance aggregators are platforms that compare and offer various insurance policies from multiple providers for consumer decision-making. This distinction helps stakeholders optimize product development and policy selection effectively.

Comparison Table

| Feature | Insurtech Sandbox | Insurance Aggregators |

|---|---|---|

| Definition | Controlled testing environment for new insurance technologies and products. | Platforms that compare and sell insurance policies from multiple providers. |

| Purpose | Innovate, test, and validate insurance solutions under regulatory supervision. | Provide consumers with price comparison and policy options. |

| Users | Insurtech startups, developers, regulatory bodies. | Consumers seeking insurance coverage. |

| Scope | Limited, experimental, regulatory-approved projects. | Broad, commercial, and public-facing. |

| Regulatory Involvement | High - regulation-guided testing environment. | Moderate - compliance with insurance laws and data privacy. |

| Innovation Focus | High - testing AI, IoT, blockchain in insurance. | Low - focus on policy comparison and sales. |

| Data Usage | Experimental data for product refinement. | Consumer data for personalized quotes and recommendations. |

| Business Model | Development and validation; eventual scale-up. | Commission-based or referral fees from insurers. |

| Customer Interaction | Limited direct consumer engagement. | High - direct sales and customer support. |

Which is better?

Insurtech sandboxes foster innovation by allowing startups to test new insurance technologies in a controlled environment under regulatory supervision, accelerating product development and market entry. Insurance aggregators offer consumers comparison tools and a broad selection of insurance policies, enhancing transparency and convenience in purchasing decisions. While sandboxes drive industry innovation and regulatory compliance, aggregators focus on improving customer access and choice, making their effectiveness dependent on whether the goal is innovation or consumer empowerment.

Connection

Insurtech sandboxes provide a controlled regulatory environment that enables startups to test innovative insurance products and technologies, fostering rapid development in the insurtech sector. Insurance aggregators leverage these innovations by integrating diverse insurance offerings and personalized pricing models, enhancing consumer access and comparison capabilities. This synergy accelerates market disruption and drives digital transformation within the insurance industry.

Key Terms

**Insurance aggregators:**

Insurance aggregators serve as digital platforms that compare multiple insurance policies, streamlining the decision-making process for consumers by providing comprehensive quotes and policy details in one place. They leverage advanced algorithms and vast databases to optimize insurance selection based on pricing, coverage, and customer reviews. Explore deeper insights into how insurance aggregators revolutionize market transparency and consumer empowerment.

Comparison platforms

Insurance aggregators serve as digital platforms that compare multiple insurance policies, enabling consumers to select the best options based on price, coverage, and user reviews, thus enhancing transparency and convenience. The Insurtech sandbox, however, is a regulatory framework that allows startups to test innovative insurance products in a controlled environment before full market entry, promoting innovation while managing risk. Explore our detailed analysis to understand how these systems transform the insurance industry and benefit consumers.

Policy distribution

Insurance aggregators streamline policy distribution by offering consumers a platform to compare multiple insurance products, enhancing transparency and choice through real-time data integration and user-friendly interfaces. Insurtech sandboxes enable insurers to test innovative distribution models and technologies under regulatory oversight, fostering product customization and seamless digital transactions. Explore how these solutions revolutionize policy distribution efficiency and customer engagement in insurance.

Source and External Links

What is an Insurance Aggregator? Unpacking the Benefits - This article explores the role of insurance aggregators in connecting independent insurance agencies with multiple carriers, offering benefits like increased commissions and shared resources.

Insurance 101: What Are Aggregators, Networks, And ... - This blog post explains the differences between insurance aggregators, networks, and clusters, highlighting their roles in providing access to carriers and improving agency operations.

Understanding Insurance Aggregators, Clusters, and ... - This resource helps insurance agencies understand the benefits and differences between affiliations with aggregators, clusters, and networks, including enhanced carrier access and improved commissions.

dowidth.com

dowidth.com