Embedded insurance integrates coverage directly into product offerings, providing seamless protection without separate purchase steps. Broker-distributed insurance involves intermediaries who assess client needs and offer tailored policies from multiple providers. Explore how these approaches differ in customer experience and market reach.

Why it is important

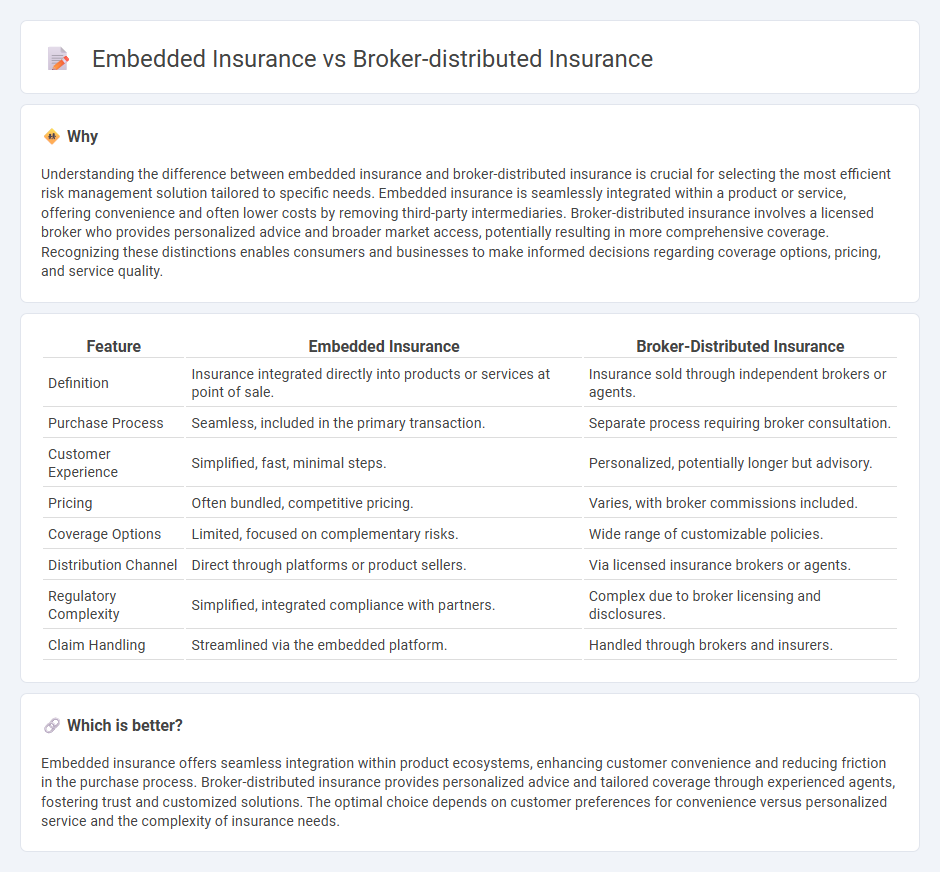

Understanding the difference between embedded insurance and broker-distributed insurance is crucial for selecting the most efficient risk management solution tailored to specific needs. Embedded insurance is seamlessly integrated within a product or service, offering convenience and often lower costs by removing third-party intermediaries. Broker-distributed insurance involves a licensed broker who provides personalized advice and broader market access, potentially resulting in more comprehensive coverage. Recognizing these distinctions enables consumers and businesses to make informed decisions regarding coverage options, pricing, and service quality.

Comparison Table

| Feature | Embedded Insurance | Broker-Distributed Insurance |

|---|---|---|

| Definition | Insurance integrated directly into products or services at point of sale. | Insurance sold through independent brokers or agents. |

| Purchase Process | Seamless, included in the primary transaction. | Separate process requiring broker consultation. |

| Customer Experience | Simplified, fast, minimal steps. | Personalized, potentially longer but advisory. |

| Pricing | Often bundled, competitive pricing. | Varies, with broker commissions included. |

| Coverage Options | Limited, focused on complementary risks. | Wide range of customizable policies. |

| Distribution Channel | Direct through platforms or product sellers. | Via licensed insurance brokers or agents. |

| Regulatory Complexity | Simplified, integrated compliance with partners. | Complex due to broker licensing and disclosures. |

| Claim Handling | Streamlined via the embedded platform. | Handled through brokers and insurers. |

Which is better?

Embedded insurance offers seamless integration within product ecosystems, enhancing customer convenience and reducing friction in the purchase process. Broker-distributed insurance provides personalized advice and tailored coverage through experienced agents, fostering trust and customized solutions. The optimal choice depends on customer preferences for convenience versus personalized service and the complexity of insurance needs.

Connection

Embedded insurance integrates coverage seamlessly into the purchase of products or services, while broker-distributed insurance relies on intermediaries to connect customers with suitable policies. Both models enhance accessibility by simplifying the buying process; embedded insurance offers real-time protection at the point of sale, and brokers provide personalized advice across multiple providers. The convergence of these approaches leverages digital platforms to streamline policy distribution and improve customer engagement within the insurance ecosystem.

Key Terms

Distribution Channel

Broker-distributed insurance leverages independent agents or brokers who connect customers with multiple insurance providers, offering a wide range of policy options through personalized advice, enhancing customer choice and competitive pricing. Embedded insurance integrates coverage directly within the purchase of a product or service, often through digital platforms, streamlining access and providing seamless protection without needing a separate insurance transaction. Explore further to understand how distribution channels shape customer experience and market reach in insurance.

Customer Experience

Broker-distributed insurance offers personalized interaction with customers through agents who provide tailored advice and support, enhancing trust and clarity in policy selection. Embedded insurance integrates coverage seamlessly into product or service purchases, simplifying the buying process and delivering instant protection without extra steps. Explore the nuances of customer experience in both insurance models to determine the best fit for your needs.

Product Integration

Broker-distributed insurance relies on third-party intermediaries to sell products, which often results in separate user journeys and less seamless product integration compared to embedded insurance. Embedded insurance integrates coverage directly within the primary product or service, offering a unified customer experience and real-time risk management. Explore the advantages of embedded solutions to enhance customer satisfaction and operational efficiency.

Source and External Links

Insurance Brokerage Market Update | Q2 2024 - Houlihan Lokey - Broker-distributed insurance involves brokers managing direct relationships with consumers to educate and sell insurance products, often working alongside Managing General Agents (MGAs) who control market access and underwriting for specialized or excess and surplus lines risks, facilitating placement of insurance through retail agents who serve as primary contact points to insureds.

A Deep Dive into Wholesale Insurance Distribution and Why It Matters - Broker-distributed insurance through wholesale channels acts as an intermediary link between retail agents and specialty insurance markets, enabling access to specialty and excess & surplus lines products not typically available through standard channels, with wholesale brokers providing underwriting expertise and market access.

The Insurance Distribution Channel Overview - AgentSync - Broker-distributed insurance is part of a complex multi-entity distribution channel where licensed agents, brokers, MGAs, and others coordinate to sell insurance products, with brokers representing insureds to find the best products across carriers and MGAs sometimes assuming carrier functions such as underwriting and claims.

dowidth.com

dowidth.com