Pet insurance platforms specialize in offering coverage tailored to veterinary care, accidents, and illnesses affecting cats, dogs, and other animals, focusing on claims processing and wellness plans. Cyber insurance platforms provide protection against digital risks such as data breaches, ransomware, and business interruption, with tools designed for risk assessment and incident response. Explore how these distinct insurance solutions safeguard your furry friends and digital assets effectively.

Why it is important

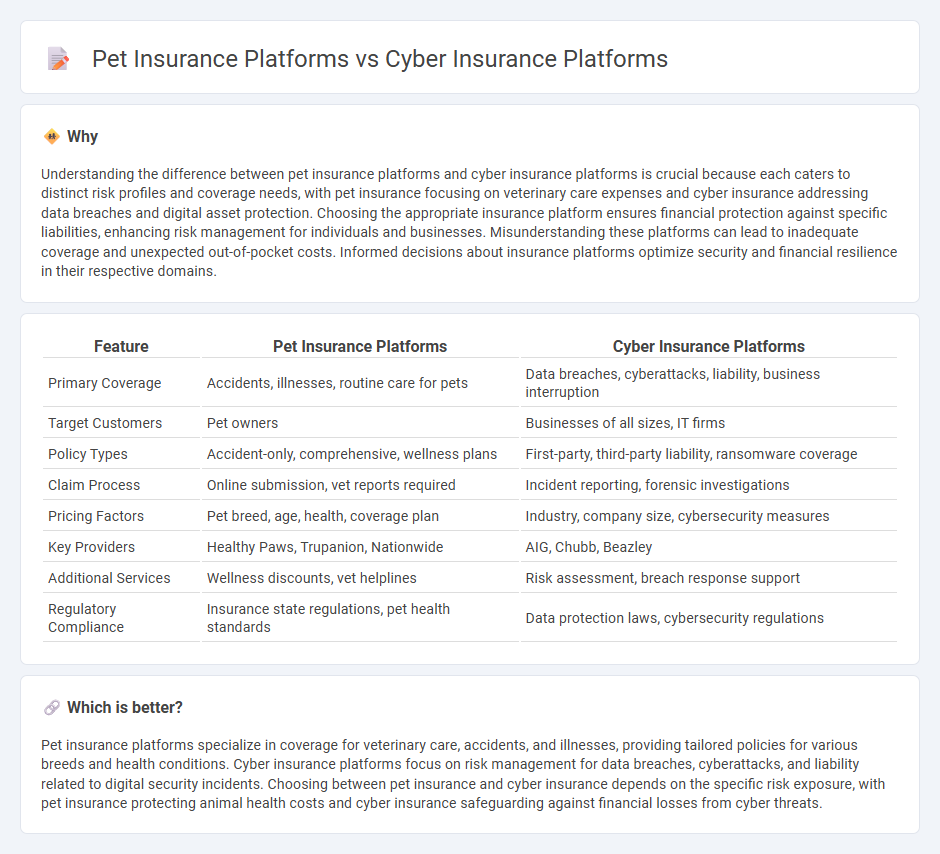

Understanding the difference between pet insurance platforms and cyber insurance platforms is crucial because each caters to distinct risk profiles and coverage needs, with pet insurance focusing on veterinary care expenses and cyber insurance addressing data breaches and digital asset protection. Choosing the appropriate insurance platform ensures financial protection against specific liabilities, enhancing risk management for individuals and businesses. Misunderstanding these platforms can lead to inadequate coverage and unexpected out-of-pocket costs. Informed decisions about insurance platforms optimize security and financial resilience in their respective domains.

Comparison Table

| Feature | Pet Insurance Platforms | Cyber Insurance Platforms |

|---|---|---|

| Primary Coverage | Accidents, illnesses, routine care for pets | Data breaches, cyberattacks, liability, business interruption |

| Target Customers | Pet owners | Businesses of all sizes, IT firms |

| Policy Types | Accident-only, comprehensive, wellness plans | First-party, third-party liability, ransomware coverage |

| Claim Process | Online submission, vet reports required | Incident reporting, forensic investigations |

| Pricing Factors | Pet breed, age, health, coverage plan | Industry, company size, cybersecurity measures |

| Key Providers | Healthy Paws, Trupanion, Nationwide | AIG, Chubb, Beazley |

| Additional Services | Wellness discounts, vet helplines | Risk assessment, breach response support |

| Regulatory Compliance | Insurance state regulations, pet health standards | Data protection laws, cybersecurity regulations |

Which is better?

Pet insurance platforms specialize in coverage for veterinary care, accidents, and illnesses, providing tailored policies for various breeds and health conditions. Cyber insurance platforms focus on risk management for data breaches, cyberattacks, and liability related to digital security incidents. Choosing between pet insurance and cyber insurance depends on the specific risk exposure, with pet insurance protecting animal health costs and cyber insurance safeguarding against financial losses from cyber threats.

Connection

Pet insurance platforms and cyber insurance platforms share a reliance on advanced data analytics and risk assessment models to tailor coverage and premiums. Both sectors leverage digital tools to streamline claims processing and enhance customer experience through user-friendly interfaces and real-time policy management. The increasing prevalence of cyber threats targeting sensitive pet health data underscores the growing interdependence between pet insurance and cybersecurity solutions.

Key Terms

**Cyber Insurance Platforms:**

Cyber insurance platforms leverage advanced analytics and real-time threat intelligence to provide tailored coverage against data breaches, ransomware, and cyberattacks, ensuring businesses minimize financial risk from increasingly sophisticated cyber threats. These platforms integrate with IT security systems to automate risk assessment and claims processing, offering policyholders seamless protection and rapid incident response. Discover more about how cyber insurance platforms are transforming digital risk management for organizations.

Data Breach

Cyber insurance platforms specialize in mitigating risks related to data breaches by providing coverage for expenses tied to breach response, notification, and liability claims. Pet insurance platforms focus primarily on covering veterinary costs and do not address data breach risks inherent in digital data management. Explore how cyber insurance platforms uniquely protect against data breach vulnerabilities in the digital age.

Incident Response

Cyber insurance platforms emphasize incident response by offering real-time threat detection, rapid claim processing, and expert support for data breaches. Pet insurance platforms focus on streamlined claims for veterinary care and wellness visits, lacking dedicated incident response mechanisms. Explore how specialized incident response shapes insurance platform efficiency and security.

dowidth.com

dowidth.com