Short term rental insurance provides coverage tailored to property damage and liability risks faced by hosts renting out their homes for brief periods, while host protection insurance offers broader liability protection against third-party claims of bodily injury or property damage occurring during guest stays. Understanding the distinct benefits and limitations of each policy type is essential for safeguarding rental income and personal assets. Explore the key differences and select the optimal insurance solution for your rental property.

Why it is important

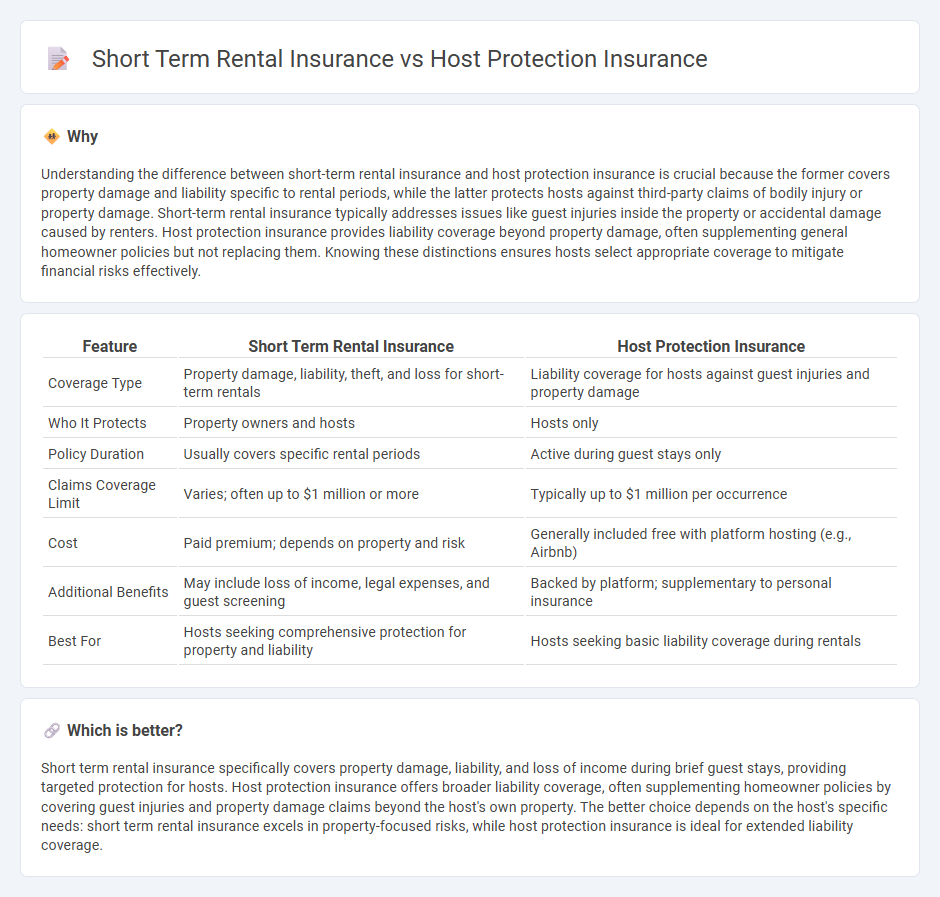

Understanding the difference between short-term rental insurance and host protection insurance is crucial because the former covers property damage and liability specific to rental periods, while the latter protects hosts against third-party claims of bodily injury or property damage. Short-term rental insurance typically addresses issues like guest injuries inside the property or accidental damage caused by renters. Host protection insurance provides liability coverage beyond property damage, often supplementing general homeowner policies but not replacing them. Knowing these distinctions ensures hosts select appropriate coverage to mitigate financial risks effectively.

Comparison Table

| Feature | Short Term Rental Insurance | Host Protection Insurance |

|---|---|---|

| Coverage Type | Property damage, liability, theft, and loss for short-term rentals | Liability coverage for hosts against guest injuries and property damage |

| Who It Protects | Property owners and hosts | Hosts only |

| Policy Duration | Usually covers specific rental periods | Active during guest stays only |

| Claims Coverage Limit | Varies; often up to $1 million or more | Typically up to $1 million per occurrence |

| Cost | Paid premium; depends on property and risk | Generally included free with platform hosting (e.g., Airbnb) |

| Additional Benefits | May include loss of income, legal expenses, and guest screening | Backed by platform; supplementary to personal insurance |

| Best For | Hosts seeking comprehensive protection for property and liability | Hosts seeking basic liability coverage during rentals |

Which is better?

Short term rental insurance specifically covers property damage, liability, and loss of income during brief guest stays, providing targeted protection for hosts. Host protection insurance offers broader liability coverage, often supplementing homeowner policies by covering guest injuries and property damage claims beyond the host's own property. The better choice depends on the host's specific needs: short term rental insurance excels in property-focused risks, while host protection insurance is ideal for extended liability coverage.

Connection

Short term rental insurance provides coverage for property damage and liability during guest stays, ensuring protection against accidents or theft. Host protection insurance complements this by offering additional liability coverage for injuries or property damage claims filed by guests or third parties. Together, these policies create a comprehensive safety net, minimizing financial risks for property owners in the short-term rental market.

Key Terms

Liability coverage

Host protection insurance offers liability coverage specifically designed for platforms like Airbnb, protecting hosts against claims of property damage or bodily injury during guest stays. Short term rental insurance provides broader liability protection that covers accidental damages, theft, and legal fees related to guest incidents, often including property damage beyond platform requirements. Explore detailed policy comparisons to choose the best liability coverage for your short term rental needs.

Property damage

Host protection insurance primarily covers liability claims related to bodily injury and property damage caused to guests, offering protection against lawsuits but often excluding direct property damage to the rental property itself. Short term rental insurance typically provides comprehensive coverage, including property damage to both the building and personal belongings caused by guests, theft, or accidental damage during the rental period. Explore detailed comparisons to determine which insurance best safeguards your rental property's physical assets.

Duration of coverage

Host protection insurance typically provides coverage only during the guest's stay, offering liability protection for incidents that occur while the property is actively rented. Short term rental insurance often extends coverage beyond the guest's stay, including pre- and post-rental periods, protecting against property damage and loss of income during gaps between bookings. Explore the key differences in coverage duration and benefits to choose the right insurance for your rental needs.

Source and External Links

Airbnb Insurance: How It Protects Hosts - ValuePenguin - Host protection insurance on Airbnb includes host damage protection, which covers up to $3 million for property damage caused by guests, including vandalism, accidents, and extra cleaning costs, but excludes weather-related damage and special irreplaceable items.

Host liability insurance - Airbnb Help Center - Host liability insurance under Airbnb's AirCover provides up to $1 million coverage if a host is legally responsible for a guest's injury or damage to a guest's belongings during their stay, including coverage for co-hosts and cleaners at no cost to the host.

What To Know About Airbnb Insurance | Bankrate - Airbnb's host protection insurance, known as AirCover, offers two main protections: host damage protection up to $3 million for property and belongings damage by guests, and host liability insurance up to $1 million for bodily injury and property damage claims made by guests or others associated with the rental.

dowidth.com

dowidth.com