Pre-existing condition coverage ensures individuals with prior health issues can access necessary medical insurance without denial or exorbitant premiums, while open enrollment is a limited timeframe allowing everyone to enroll in or change their health insurance plans regardless of health status. Understanding how these options affect eligibility, coverage options, and costs is crucial for selecting the right policy. Explore further to make informed insurance decisions tailored to your health needs.

Why it is important

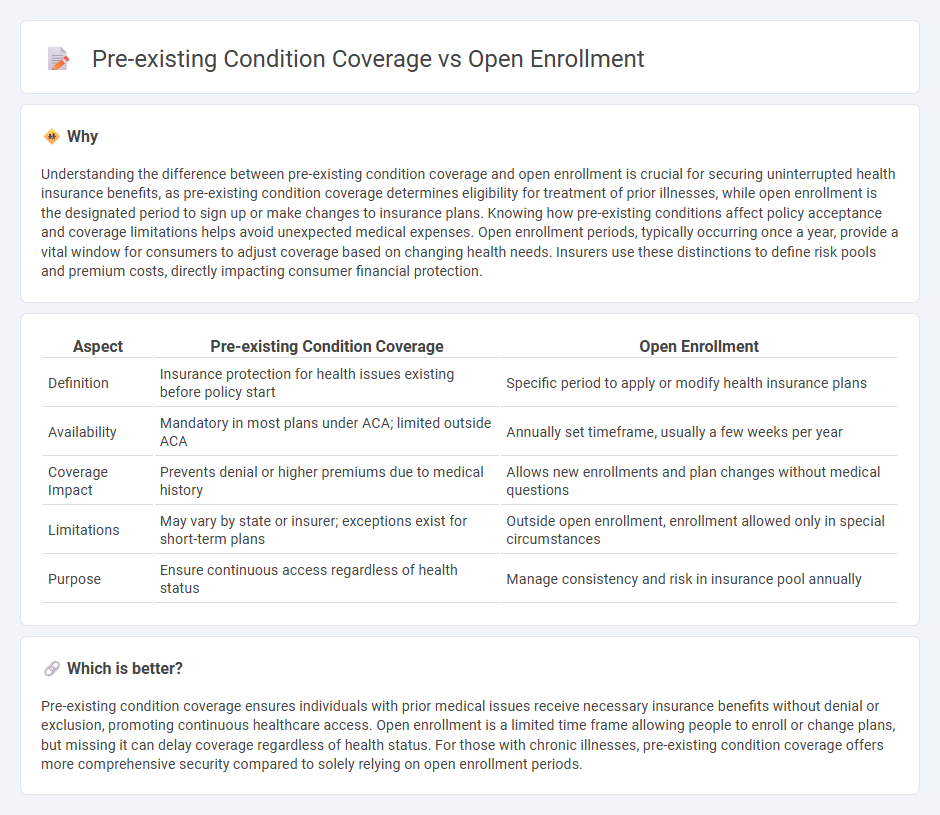

Understanding the difference between pre-existing condition coverage and open enrollment is crucial for securing uninterrupted health insurance benefits, as pre-existing condition coverage determines eligibility for treatment of prior illnesses, while open enrollment is the designated period to sign up or make changes to insurance plans. Knowing how pre-existing conditions affect policy acceptance and coverage limitations helps avoid unexpected medical expenses. Open enrollment periods, typically occurring once a year, provide a vital window for consumers to adjust coverage based on changing health needs. Insurers use these distinctions to define risk pools and premium costs, directly impacting consumer financial protection.

Comparison Table

| Aspect | Pre-existing Condition Coverage | Open Enrollment |

|---|---|---|

| Definition | Insurance protection for health issues existing before policy start | Specific period to apply or modify health insurance plans |

| Availability | Mandatory in most plans under ACA; limited outside ACA | Annually set timeframe, usually a few weeks per year |

| Coverage Impact | Prevents denial or higher premiums due to medical history | Allows new enrollments and plan changes without medical questions |

| Limitations | May vary by state or insurer; exceptions exist for short-term plans | Outside open enrollment, enrollment allowed only in special circumstances |

| Purpose | Ensure continuous access regardless of health status | Manage consistency and risk in insurance pool annually |

Which is better?

Pre-existing condition coverage ensures individuals with prior medical issues receive necessary insurance benefits without denial or exclusion, promoting continuous healthcare access. Open enrollment is a limited time frame allowing people to enroll or change plans, but missing it can delay coverage regardless of health status. For those with chronic illnesses, pre-existing condition coverage offers more comprehensive security compared to solely relying on open enrollment periods.

Connection

Pre-existing condition coverage is a critical component of health insurance policies that protects individuals with prior health issues from being denied coverage or charged higher premiums. Open enrollment periods allow individuals to enroll or make changes to their health insurance plans, ensuring those with pre-existing conditions can secure or update coverage without facing discrimination. This connection guarantees access to affordable healthcare for people managing chronic illnesses or past medical conditions.

Key Terms

Eligibility Period

Open enrollment determines the specific period when individuals can sign up for or change health insurance plans without facing exclusions based on health status. Pre-existing condition coverage ensures individuals with prior health issues receive protection, but eligibility to enroll outside this coverage depends on qualifying events or special enrollment periods. Explore how these eligibility periods impact your health coverage options to make informed decisions.

Waiting Period

Open enrollment periods allow individuals to sign up for health insurance without facing denial due to pre-existing conditions, eliminating waiting periods for coverage activation. In contrast, policies addressing pre-existing condition coverage often include specific waiting periods before benefits for those conditions become effective. Explore detailed comparisons to better understand how waiting periods impact your health insurance options.

Underwriting

Open enrollment periods allow individuals to obtain health insurance without medical underwriting, ensuring coverage regardless of pre-existing conditions. Pre-existing condition coverage outside open enrollment often requires underwriting, where insurers assess risk and may impose higher premiums or exclusions. Explore more about underwriting processes and how they impact your insurance options.

Source and External Links

What is open enrollment? | UnitedHealthcare - Open enrollment is a yearly period, typically in fall, when you can sign up, change, or cancel health insurance plans without needing a qualifying event, with ACA plans open November 1-January 16 in most states, Medicare October 15-December 7, and Medicaid anytime.

Medicare Open Enrollment - CMS - Medicare's open enrollment runs October 15 to December 7 annually, allowing people with Medicare to review and change their health or drug plans for the coming year.

Covered California 2024/25 Open Enrollment Period: Nov. 1 - Jan. 31 - Covered California's open enrollment for 2024-25 spans November 1, 2024, through January 31, 2025, enabling individuals to purchase health insurance for the upcoming year, with exceptions only for qualifying life events.

dowidth.com

dowidth.com