Digital health insurance leverages advanced technology to provide personalized policy management, telemedicine access, and real-time health monitoring, enhancing convenience and preventative care. Managed care insurance focuses on coordinating patient services through networks of providers to control costs and improve quality by emphasizing primary care and pre-authorization processes. Explore the differences and benefits to determine which insurance model best suits your healthcare needs.

Why it is important

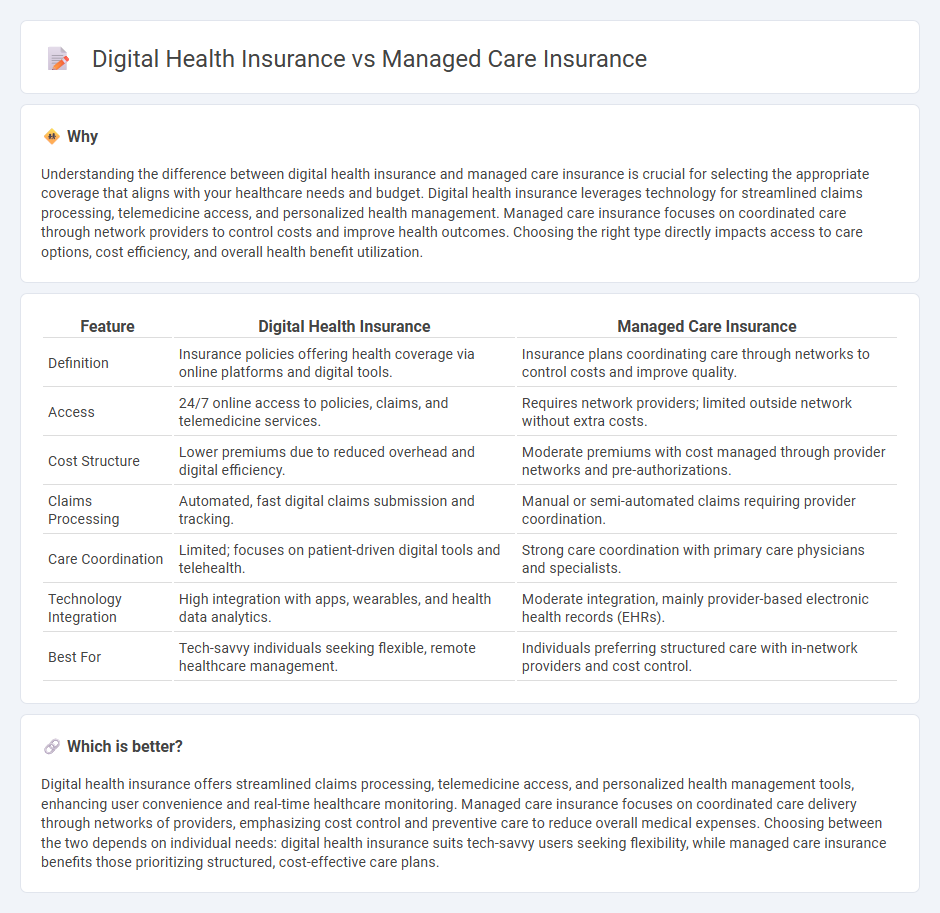

Understanding the difference between digital health insurance and managed care insurance is crucial for selecting the appropriate coverage that aligns with your healthcare needs and budget. Digital health insurance leverages technology for streamlined claims processing, telemedicine access, and personalized health management. Managed care insurance focuses on coordinated care through network providers to control costs and improve health outcomes. Choosing the right type directly impacts access to care options, cost efficiency, and overall health benefit utilization.

Comparison Table

| Feature | Digital Health Insurance | Managed Care Insurance |

|---|---|---|

| Definition | Insurance policies offering health coverage via online platforms and digital tools. | Insurance plans coordinating care through networks to control costs and improve quality. |

| Access | 24/7 online access to policies, claims, and telemedicine services. | Requires network providers; limited outside network without extra costs. |

| Cost Structure | Lower premiums due to reduced overhead and digital efficiency. | Moderate premiums with cost managed through provider networks and pre-authorizations. |

| Claims Processing | Automated, fast digital claims submission and tracking. | Manual or semi-automated claims requiring provider coordination. |

| Care Coordination | Limited; focuses on patient-driven digital tools and telehealth. | Strong care coordination with primary care physicians and specialists. |

| Technology Integration | High integration with apps, wearables, and health data analytics. | Moderate integration, mainly provider-based electronic health records (EHRs). |

| Best For | Tech-savvy individuals seeking flexible, remote healthcare management. | Individuals preferring structured care with in-network providers and cost control. |

Which is better?

Digital health insurance offers streamlined claims processing, telemedicine access, and personalized health management tools, enhancing user convenience and real-time healthcare monitoring. Managed care insurance focuses on coordinated care delivery through networks of providers, emphasizing cost control and preventive care to reduce overall medical expenses. Choosing between the two depends on individual needs: digital health insurance suits tech-savvy users seeking flexibility, while managed care insurance benefits those prioritizing structured, cost-effective care plans.

Connection

Digital health insurance leverages technology to streamline claims processing, enhance patient data management, and improve service delivery, which aligns closely with the principles of managed care insurance focused on cost efficiency and coordinated healthcare. Managed care insurance uses integrated networks of providers and evidence-based protocols that benefit from digital tools for real-time monitoring, disease management, and preventive care analytics. The synergy between digital health insurance and managed care insurance drives better health outcomes while reducing administrative overhead and overall healthcare costs.

Key Terms

**Managed care insurance:**

Managed care insurance integrates healthcare services through a network of providers, aiming to control costs while improving quality and access via primary care physicians who coordinate patient care. It emphasizes preventive care, cost-efficiency, and comprehensive management of healthcare benefits within organizations such as Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). Explore the key differences and benefits to understand which insurance model suits your healthcare needs best.

Network providers

Managed care insurance typically relies on a predefined network of providers to control costs and ensure coordinated care, often requiring members to choose primary care physicians and obtain referrals for specialists. Digital health insurance leverages technology to offer more flexible access to network providers, including virtual consultations and real-time provider reviews, enhancing convenience and personalized care options. Explore how network provider integration transforms patient experience in both insurance models for deeper insights.

Prior authorization

Managed care insurance often relies on manual prior authorization processes to control costs and approve services, which can lead to delays and administrative burden. Digital health insurance leverages automated, AI-driven prior authorization systems to streamline approvals, reduce wait times, and enhance accuracy in claims processing. Explore how digital innovations are transforming prior authorization efficiency in healthcare.

Source and External Links

What Is Managed Care? - Managed care is a health care model where states contract with Managed Care Organizations (MCOs) that receive a fixed payment to provide care, offering more predictable, cost-effective, and streamlined coverage than traditional fee-for-service models, especially common in Medicaid programs.

What is Managed Care? - Managed care plans typically feature provider networks, focus on preventive care, and may require a Primary Care Provider to coordinate care, aiming to reduce costs while maintaining high quality of care.

Managed Care - Managed care plans are types of health insurance that contract with providers to offer care at reduced costs, with main types including HMOs, PPOs, and POS plans, which differ in network restrictions and flexibility affecting out-of-pocket costs.

dowidth.com

dowidth.com