Pay-as-you-drive insurance and mileage-based insurance both offer cost-effective solutions by tailoring premiums to actual driving habits, with pay-as-you-drive insurance focusing on the time and distance driven, while mileage-based insurance strictly charges based on total miles traveled. These flexible insurance models provide personalized risk assessments, encouraging safer driving behaviors and potential savings on auto insurance premiums. Explore the differences and benefits of each option to find the ideal coverage that meets your specific driving needs.

Why it is important

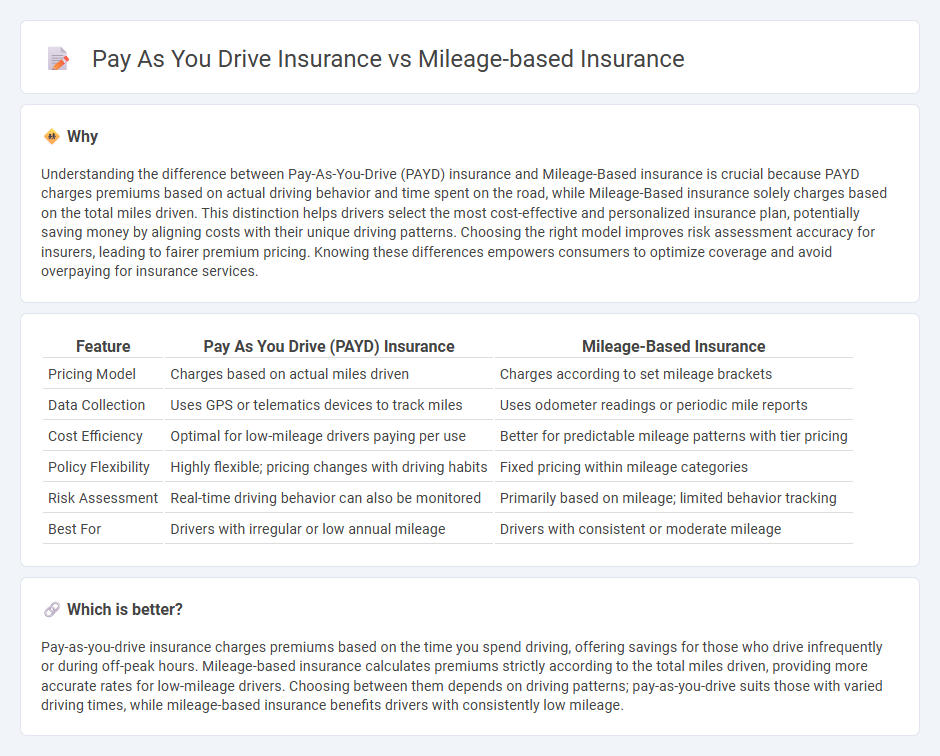

Understanding the difference between Pay-As-You-Drive (PAYD) insurance and Mileage-Based insurance is crucial because PAYD charges premiums based on actual driving behavior and time spent on the road, while Mileage-Based insurance solely charges based on the total miles driven. This distinction helps drivers select the most cost-effective and personalized insurance plan, potentially saving money by aligning costs with their unique driving patterns. Choosing the right model improves risk assessment accuracy for insurers, leading to fairer premium pricing. Knowing these differences empowers consumers to optimize coverage and avoid overpaying for insurance services.

Comparison Table

| Feature | Pay As You Drive (PAYD) Insurance | Mileage-Based Insurance |

|---|---|---|

| Pricing Model | Charges based on actual miles driven | Charges according to set mileage brackets |

| Data Collection | Uses GPS or telematics devices to track miles | Uses odometer readings or periodic mile reports |

| Cost Efficiency | Optimal for low-mileage drivers paying per use | Better for predictable mileage patterns with tier pricing |

| Policy Flexibility | Highly flexible; pricing changes with driving habits | Fixed pricing within mileage categories |

| Risk Assessment | Real-time driving behavior can also be monitored | Primarily based on mileage; limited behavior tracking |

| Best For | Drivers with irregular or low annual mileage | Drivers with consistent or moderate mileage |

Which is better?

Pay-as-you-drive insurance charges premiums based on the time you spend driving, offering savings for those who drive infrequently or during off-peak hours. Mileage-based insurance calculates premiums strictly according to the total miles driven, providing more accurate rates for low-mileage drivers. Choosing between them depends on driving patterns; pay-as-you-drive suits those with varied driving times, while mileage-based insurance benefits drivers with consistently low mileage.

Connection

Pay-as-you-drive insurance and mileage-based insurance both calculate premiums primarily based on the number of miles driven, linking cost directly to vehicle usage. These models leverage telematics technology to monitor driving habits and distance, enabling more accurate risk assessment and personalized pricing for policyholders. By aligning insurance costs with actual driving behavior, they encourage safer and reduced driving, ultimately lowering claims and premiums.

Key Terms

Premium Calculation

Mileage-based insurance calculates premiums primarily on the total number of miles driven annually, offering savings for low-mileage drivers by directly linking risk exposure to distance covered. Pay-as-you-drive insurance incorporates real-time driving behavior and trip frequency alongside mileage to assess risk more dynamically, potentially adjusting premiums based on how, when, and where the vehicle is used. Explore more to understand which premium calculation method aligns best with your driving habits and financial goals.

Telematics

Mileage-based insurance calculates premiums primarily on the total distance driven, using odometer readings for rate adjustments. Pay-as-you-drive (PAYD) insurance leverages telematics technology to monitor not only mileage but also driving behaviors, enabling more personalized risk assessments and pricing. Explore how telematics transforms auto insurance models for tailored, cost-effective coverage.

Usage Data

Mileage-based insurance calculates premiums using total miles driven, leveraging precise odometer readings to assess risk and promote cost savings. Pay-as-you-drive insurance employs real-time usage data, including driving patterns and time of day, to offer highly personalized rates based on actual behavior. Explore further to understand how each model harnesses usage data for optimized insurance solutions.

Source and External Links

Pay-Per-Mile Car Insurance: What You Should Know - This article explains how pay-per-mile insurance works, including the use of telematics to track miles and the factors affecting base rates.

Pay-Per-Mile Car Insurance with SmartMiles - Nationwide's SmartMiles offers flexible monthly rates based on miles driven, with discounts for safe driving behavior.

Should I Get Pay-Per-Mile Car Insurance? - This guide helps determine if pay-per-mile insurance is the best option by comparing it to traditional insurance and explaining how it works.

dowidth.com

dowidth.com