Deepfake insurance safeguards individuals and businesses against financial losses caused by manipulated digital content that can damage reputation or lead to fraud. Reputational risk insurance focuses on protecting organizations from the consequences of negative publicity, defamation, or social media crises impacting their brand value. Explore the differences and benefits of these innovative insurance solutions to enhance your risk management strategy.

Why it is important

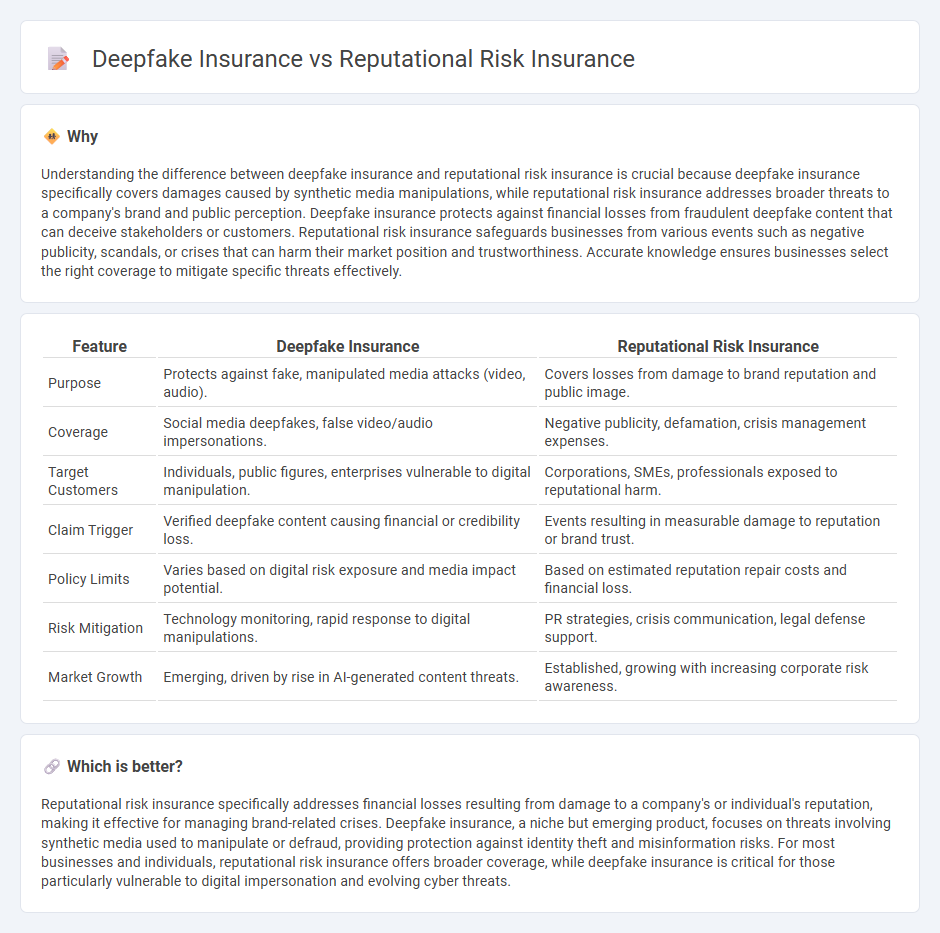

Understanding the difference between deepfake insurance and reputational risk insurance is crucial because deepfake insurance specifically covers damages caused by synthetic media manipulations, while reputational risk insurance addresses broader threats to a company's brand and public perception. Deepfake insurance protects against financial losses from fraudulent deepfake content that can deceive stakeholders or customers. Reputational risk insurance safeguards businesses from various events such as negative publicity, scandals, or crises that can harm their market position and trustworthiness. Accurate knowledge ensures businesses select the right coverage to mitigate specific threats effectively.

Comparison Table

| Feature | Deepfake Insurance | Reputational Risk Insurance |

|---|---|---|

| Purpose | Protects against fake, manipulated media attacks (video, audio). | Covers losses from damage to brand reputation and public image. |

| Coverage | Social media deepfakes, false video/audio impersonations. | Negative publicity, defamation, crisis management expenses. |

| Target Customers | Individuals, public figures, enterprises vulnerable to digital manipulation. | Corporations, SMEs, professionals exposed to reputational harm. |

| Claim Trigger | Verified deepfake content causing financial or credibility loss. | Events resulting in measurable damage to reputation or brand trust. |

| Policy Limits | Varies based on digital risk exposure and media impact potential. | Based on estimated reputation repair costs and financial loss. |

| Risk Mitigation | Technology monitoring, rapid response to digital manipulations. | PR strategies, crisis communication, legal defense support. |

| Market Growth | Emerging, driven by rise in AI-generated content threats. | Established, growing with increasing corporate risk awareness. |

Which is better?

Reputational risk insurance specifically addresses financial losses resulting from damage to a company's or individual's reputation, making it effective for managing brand-related crises. Deepfake insurance, a niche but emerging product, focuses on threats involving synthetic media used to manipulate or defraud, providing protection against identity theft and misinformation risks. For most businesses and individuals, reputational risk insurance offers broader coverage, while deepfake insurance is critical for those particularly vulnerable to digital impersonation and evolving cyber threats.

Connection

Deepfake insurance and reputational risk insurance are interconnected as both address emerging digital threats that can damage an individual's or organization's reputation. Deepfake insurance specifically protects against losses caused by synthetic media manipulation, while reputational risk insurance covers broader risks including defamation and misinformation. Together, they provide comprehensive coverage in mitigating financial and reputational harm due to malicious online content.

Key Terms

**Reputational Risk Insurance:**

Reputational risk insurance protects businesses from financial losses due to negative publicity, including defamation, social media backlash, and misinformation that harm brand value. This coverage typically includes crisis management expenses, legal costs, and lost revenue resulting from reputational damage. Explore how reputational risk insurance can safeguard your company's brand integrity and financial health in the face of modern threats.

Crisis Management

Reputational risk insurance primarily safeguards businesses against financial losses resulting from defamation, social media backlash, and negative publicity crises, offering crisis management support to restore brand trust and public image. Deepfake insurance specifically addresses threats from AI-generated synthetic media, providing coverage and response strategies for incidents where manipulated videos or audio undermine corporate credibility and cause reputational harm. Explore further to understand how tailored insurance solutions enhance organizational resilience during digital and reputational crises.

Public Relations Costs

Reputational risk insurance covers financial losses related to brand damage from negative publicity, including crisis management and public relations costs. Deepfake insurance specifically addresses the risks of synthetic media manipulation, providing coverage for expenses incurred in combating misinformation and restoring public trust. Explore how these options protect your PR investments and mitigate emerging digital threats.

Source and External Links

ReputationGuard by AIG - This insurance solution helps protect a company's reputation by providing coverage for crisis communication costs and income loss resulting from reputational damage.

Lockton Insights on Reputational Risk - This resource explains how various insurance policies, including professional indemnity and cyber insurance, can mitigate reputational risks, with the option for stand-alone reputational insurance products.

Reputation Risk Insurance by AJG Australia - This insurance solution provides a safety net to mitigate the effects of events that could damage a business's standing in the market, protecting against potential financial impacts.

dowidth.com

dowidth.com