Catastrophe bonds and sidecars are innovative financial instruments used in the insurance industry to transfer and manage risk from natural disasters. Catastrophe bonds allow insurers to raise capital by issuing securities to investors, who bear the risk of a specified catastrophe, while sidecars enable third-party investors to directly share in underwriting profits and losses of an insurer's specific book of business. Explore deeper insights into how these risk transfer mechanisms enhance insurance capital efficiency and resilience.

Why it is important

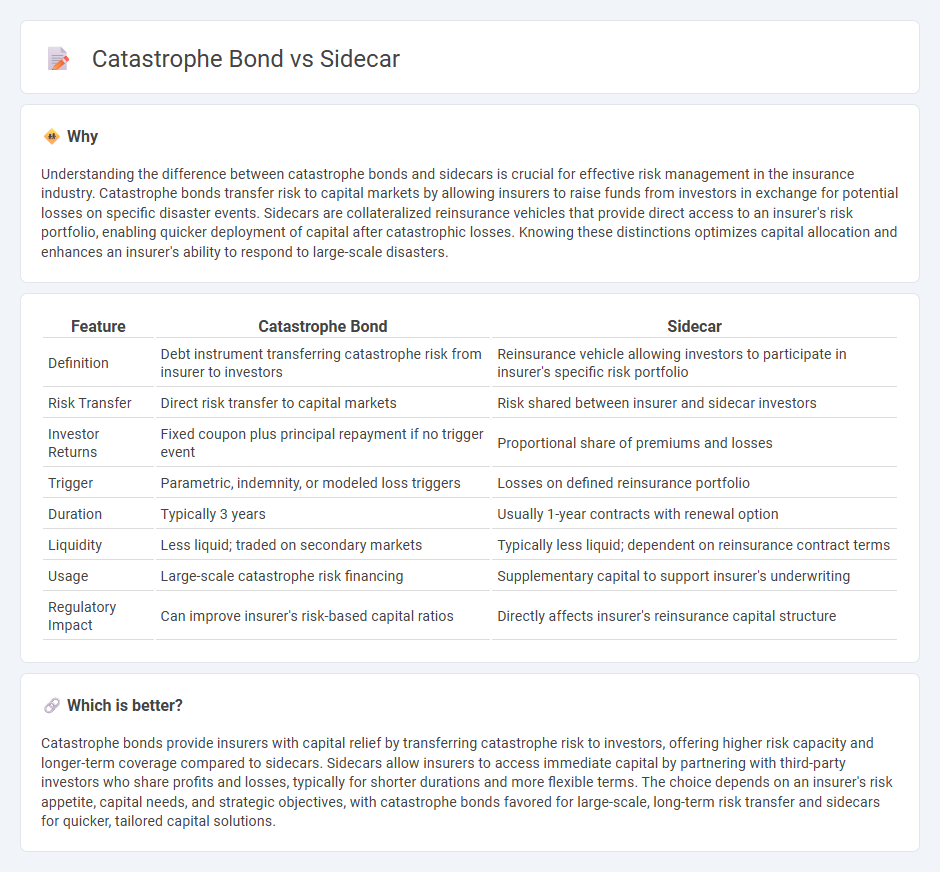

Understanding the difference between catastrophe bonds and sidecars is crucial for effective risk management in the insurance industry. Catastrophe bonds transfer risk to capital markets by allowing insurers to raise funds from investors in exchange for potential losses on specific disaster events. Sidecars are collateralized reinsurance vehicles that provide direct access to an insurer's risk portfolio, enabling quicker deployment of capital after catastrophic losses. Knowing these distinctions optimizes capital allocation and enhances an insurer's ability to respond to large-scale disasters.

Comparison Table

| Feature | Catastrophe Bond | Sidecar |

|---|---|---|

| Definition | Debt instrument transferring catastrophe risk from insurer to investors | Reinsurance vehicle allowing investors to participate in insurer's specific risk portfolio |

| Risk Transfer | Direct risk transfer to capital markets | Risk shared between insurer and sidecar investors |

| Investor Returns | Fixed coupon plus principal repayment if no trigger event | Proportional share of premiums and losses |

| Trigger | Parametric, indemnity, or modeled loss triggers | Losses on defined reinsurance portfolio |

| Duration | Typically 3 years | Usually 1-year contracts with renewal option |

| Liquidity | Less liquid; traded on secondary markets | Typically less liquid; dependent on reinsurance contract terms |

| Usage | Large-scale catastrophe risk financing | Supplementary capital to support insurer's underwriting |

| Regulatory Impact | Can improve insurer's risk-based capital ratios | Directly affects insurer's reinsurance capital structure |

Which is better?

Catastrophe bonds provide insurers with capital relief by transferring catastrophe risk to investors, offering higher risk capacity and longer-term coverage compared to sidecars. Sidecars allow insurers to access immediate capital by partnering with third-party investors who share profits and losses, typically for shorter durations and more flexible terms. The choice depends on an insurer's risk appetite, capital needs, and strategic objectives, with catastrophe bonds favored for large-scale, long-term risk transfer and sidecars for quicker, tailored capital solutions.

Connection

Catastrophe bonds and sidecars are financial instruments used by insurance companies to transfer risk from catastrophic events to the capital markets. Catastrophe bonds allow insurers to raise capital in exchange for bearing specific disaster risks, while sidecars provide additional reinsurance capacity by linking investors directly to an insurer's portfolio of catastrophe risks. Both mechanisms enhance risk management by diversifying exposure and providing alternative sources of capital beyond traditional reinsurance.

Key Terms

Risk Transfer

Sidecars provide insurers with a quota share reinsurance arrangement that transfers underwriting risk for specific portfolios, enhancing capital efficiency and risk diversification. Catastrophe bonds shift catastrophe risk to capital markets by issuing securities linked to predefined peril triggers, allowing risk transfer without traditional reinsurance counterparts. Explore the unique mechanisms and benefits of sidecars and catastrophe bonds to optimize your risk transfer strategy.

Capital Markets

Sidecars allow insurers to access predefined layers of reinsurance capital linked to specific portfolios, offering tailored risk transfer solutions in capital markets. Catastrophe bonds issue securities to investors that provide capital upon occurrence of defined catastrophe triggers, facilitating direct risk transfer from insurers to capital market participants. Explore the nuances of sidecars and catastrophe bonds to understand their strategic roles in capital markets risk management.

Reinsurance

Sidecars provide reinsurers with direct access to specific insurance portfolios, allowing them to share risks and returns without setting up a full reinsurance operation. Catastrophe bonds transfer extreme event risks to capital markets by issuing securities that pay off only if certain disaster triggers occur, facilitating risk diversification beyond traditional reinsurance limits. Explore the nuances of sidecars and catastrophe bonds to optimize your reinsurance risk management strategies.

Source and External Links

Sidecar (cocktail) - A classic cocktail made with brandy, orange liqueur, and lemon juice, named after the motorcycle sidecar and originated around the end of World War I.

Use an iPad as a second display for a Mac - A feature that allows using an iPad as an additional display for a Mac, extending or mirroring the desktop.

Sidecar Cocktail | Social Hour - Features various recipes for the Sidecar cocktail, emphasizing its elegant and rare nature with Cognac as the base.

dowidth.com

dowidth.com