Digital nomad insurance offers tailored coverage for remote workers living abroad, including health, liability, and equipment protection, while business travel insurance primarily focuses on short-term trips with provisions for trip cancellations, medical emergencies, and lost luggage. Understanding the specific benefits and limitations of each insurance type can help professionals secure the appropriate protection for their unique travel and work circumstances. Explore detailed comparisons to find the best insurance options for your lifestyle and business needs.

Why it is important

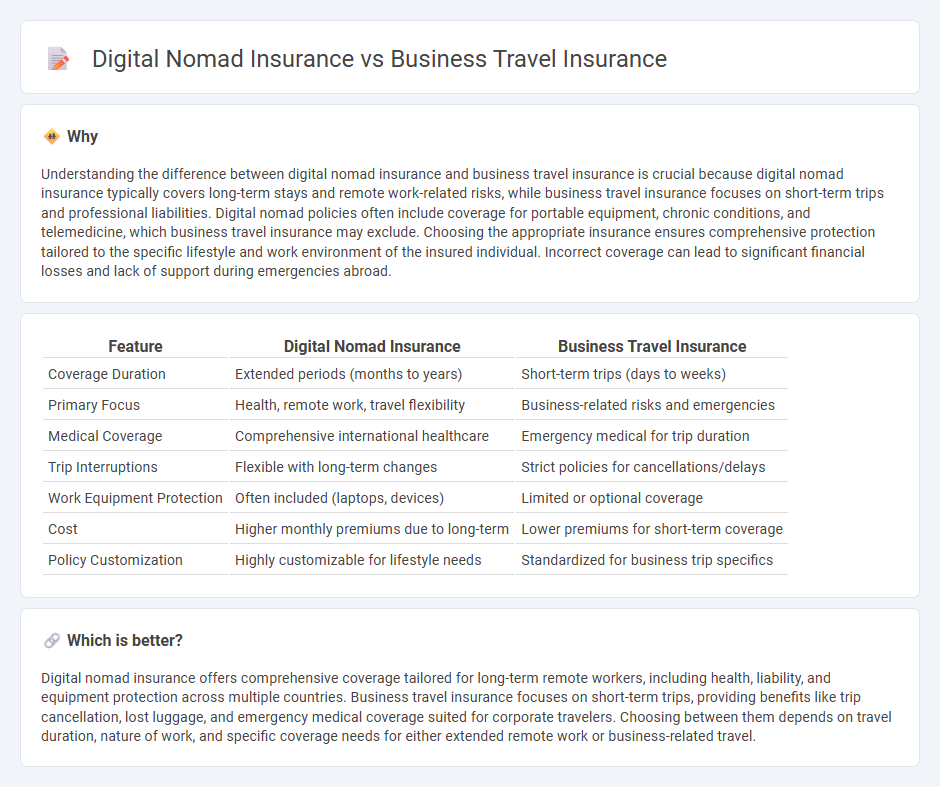

Understanding the difference between digital nomad insurance and business travel insurance is crucial because digital nomad insurance typically covers long-term stays and remote work-related risks, while business travel insurance focuses on short-term trips and professional liabilities. Digital nomad policies often include coverage for portable equipment, chronic conditions, and telemedicine, which business travel insurance may exclude. Choosing the appropriate insurance ensures comprehensive protection tailored to the specific lifestyle and work environment of the insured individual. Incorrect coverage can lead to significant financial losses and lack of support during emergencies abroad.

Comparison Table

| Feature | Digital Nomad Insurance | Business Travel Insurance |

|---|---|---|

| Coverage Duration | Extended periods (months to years) | Short-term trips (days to weeks) |

| Primary Focus | Health, remote work, travel flexibility | Business-related risks and emergencies |

| Medical Coverage | Comprehensive international healthcare | Emergency medical for trip duration |

| Trip Interruptions | Flexible with long-term changes | Strict policies for cancellations/delays |

| Work Equipment Protection | Often included (laptops, devices) | Limited or optional coverage |

| Cost | Higher monthly premiums due to long-term | Lower premiums for short-term coverage |

| Policy Customization | Highly customizable for lifestyle needs | Standardized for business trip specifics |

Which is better?

Digital nomad insurance offers comprehensive coverage tailored for long-term remote workers, including health, liability, and equipment protection across multiple countries. Business travel insurance focuses on short-term trips, providing benefits like trip cancellation, lost luggage, and emergency medical coverage suited for corporate travelers. Choosing between them depends on travel duration, nature of work, and specific coverage needs for either extended remote work or business-related travel.

Connection

Digital nomad insurance and business travel insurance both provide tailored coverage for individuals frequently on the move, addressing health, liability, and travel risks in various international locations. These insurance types overlap in offering protection against unexpected medical expenses, trip interruptions, and emergencies while working abroad. Emphasizing flexible policies, they ensure continuous coverage aligned with the dynamic lifestyles of remote workers and corporate travelers.

Key Terms

**Business Travel Insurance:**

Business travel insurance primarily covers short-term trips related to work, offering protection against trip cancellations, medical emergencies, lost luggage, and business equipment damage. It is tailored for professionals on limited-duration assignments, ensuring coverage aligned with corporate travel risks and policy requirements. Explore the specifics and benefits of business travel insurance to safeguard your next business trip effectively.

Trip Cancellation

Business travel insurance typically includes trip cancellation coverage for unforeseen events like meeting cancellations or client emergencies, protecting non-refundable expenses. Digital nomad insurance often provides broader trip cancellation benefits, accommodating extended stays and frequent travel changes common among remote workers. Explore the key differences to choose the best coverage for your travel lifestyle.

Corporate Liability

Business travel insurance primarily covers risks associated with business trips, including trip cancellations, medical emergencies, and corporate liability for incidents during short-term travel. Digital nomad insurance often extends coverage to longer stays and remote work environments, emphasizing corporate liability protection for diverse work settings worldwide. Explore detailed comparisons to understand which insurance best safeguards your business liabilities on the move.

Source and External Links

Business Travel Insurance for Employees Abroad - Offers comprehensive medical, trip interruption, and emergency assistance coverage for both individual and frequent business travelers, with options like GeoBlue Voyager for U.S. citizens and Atlas Travel Insurance for international travelers.

Business Travel Insurance Plan | Travel Guard - Provides customizable business travel insurance with medical, trip cancellation, missed connection, and baggage coverage, plus 24/7 emergency assistance and support for disruptions specific to work trips.

Business Travel Insurance | Chubb - Delivers tailored, high-limit coverage for business travelers, including 24/7 medical and security assistance, pre-travel risk assessments, and digital well-being tools, with group policies available for immediate cover.

dowidth.com

dowidth.com