Short term rental insurance covers properties rented for brief periods, protecting against risks such as guest damages, liability claims, and property loss during tenant stays. Landlord insurance, on the other hand, is designed for long-term rental properties and provides coverage for property damage, liability, and loss of rental income from traditional tenants. Discover the key differences and tailor your coverage to ensure optimal protection for your rental investment.

Why it is important

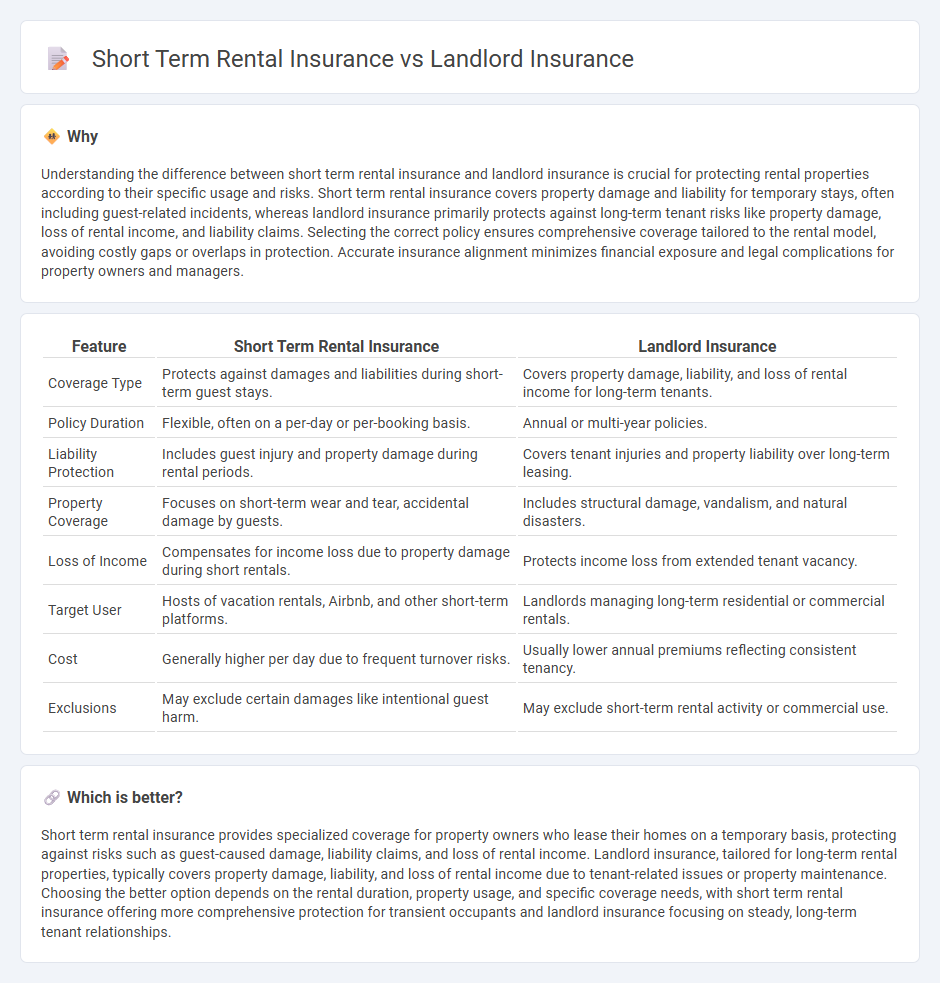

Understanding the difference between short term rental insurance and landlord insurance is crucial for protecting rental properties according to their specific usage and risks. Short term rental insurance covers property damage and liability for temporary stays, often including guest-related incidents, whereas landlord insurance primarily protects against long-term tenant risks like property damage, loss of rental income, and liability claims. Selecting the correct policy ensures comprehensive coverage tailored to the rental model, avoiding costly gaps or overlaps in protection. Accurate insurance alignment minimizes financial exposure and legal complications for property owners and managers.

Comparison Table

| Feature | Short Term Rental Insurance | Landlord Insurance |

|---|---|---|

| Coverage Type | Protects against damages and liabilities during short-term guest stays. | Covers property damage, liability, and loss of rental income for long-term tenants. |

| Policy Duration | Flexible, often on a per-day or per-booking basis. | Annual or multi-year policies. |

| Liability Protection | Includes guest injury and property damage during rental periods. | Covers tenant injuries and property liability over long-term leasing. |

| Property Coverage | Focuses on short-term wear and tear, accidental damage by guests. | Includes structural damage, vandalism, and natural disasters. |

| Loss of Income | Compensates for income loss due to property damage during short rentals. | Protects income loss from extended tenant vacancy. |

| Target User | Hosts of vacation rentals, Airbnb, and other short-term platforms. | Landlords managing long-term residential or commercial rentals. |

| Cost | Generally higher per day due to frequent turnover risks. | Usually lower annual premiums reflecting consistent tenancy. |

| Exclusions | May exclude certain damages like intentional guest harm. | May exclude short-term rental activity or commercial use. |

Which is better?

Short term rental insurance provides specialized coverage for property owners who lease their homes on a temporary basis, protecting against risks such as guest-caused damage, liability claims, and loss of rental income. Landlord insurance, tailored for long-term rental properties, typically covers property damage, liability, and loss of rental income due to tenant-related issues or property maintenance. Choosing the better option depends on the rental duration, property usage, and specific coverage needs, with short term rental insurance offering more comprehensive protection for transient occupants and landlord insurance focusing on steady, long-term tenant relationships.

Connection

Short-term rental insurance and landlord insurance both provide essential coverage for property owners, protecting against risks like property damage, liability claims, and loss of rental income. While landlord insurance focuses on long-term leases and tenant-related risks, short-term rental insurance caters to the unique challenges of transient guests and frequent turnover. Understanding their interconnected coverage areas ensures comprehensive protection for landlords managing both traditional and short-term rental properties.

Key Terms

Property Coverage

Landlord insurance primarily offers property coverage tailored for long-term rental properties, protecting against damages from fires, storms, or vandalism. Short term rental insurance provides specialized coverage addressing unique risks such as guest-related damages and frequent property turnover. Explore detailed comparisons to determine the best coverage for your rental property needs.

Liability Protection

Landlord insurance primarily covers property damage and liability risks associated with long-term tenants, ensuring protection against lawsuits from injuries or property damage on the rental premises. Short term rental insurance offers enhanced liability protection tailored to frequent guest turnover, addressing risks such as accidental injuries and property losses during brief stays. Explore further to understand which policy suits your rental property needs best.

Loss of Income

Landlord insurance primarily covers loss of income when a rental property becomes uninhabitable due to insured damages, ensuring steady cash flow during repairs. Short term rental insurance extends this coverage by addressing unique risks like frequent tenant turnover and potential cancellations that can impact rental income more frequently. Explore the differences in coverage options to protect your rental income effectively.

Source and External Links

What is Landlord Insurance? Coverage Options and Quotes - GEICO - Landlord insurance helps protect property owners financially from damages or injuries related to rental properties.

Landlords' insurance - Wikipedia - Landlords' insurance covers property owners from financial losses connected with rental properties, including different types like buy-to-let and multi-property insurance.

What Is Landlord Insurance? - Progressive - Landlord insurance protects rented homes and provides personal liability coverage, often required by lenders for financed properties.

dowidth.com

dowidth.com