Parametric insurance provides predefined payouts based on measurable parameters, such as rainfall levels or wind speeds, rather than on the actual loss incurred, making claims processing faster and more transparent. Event-triggered insurance activates coverage only when specific events occur, such as natural disasters or accidents, ensuring targeted protection for policyholders. Explore the differences and benefits of parametric versus event-triggered insurance to determine the best fit for your risk management needs.

Why it is important

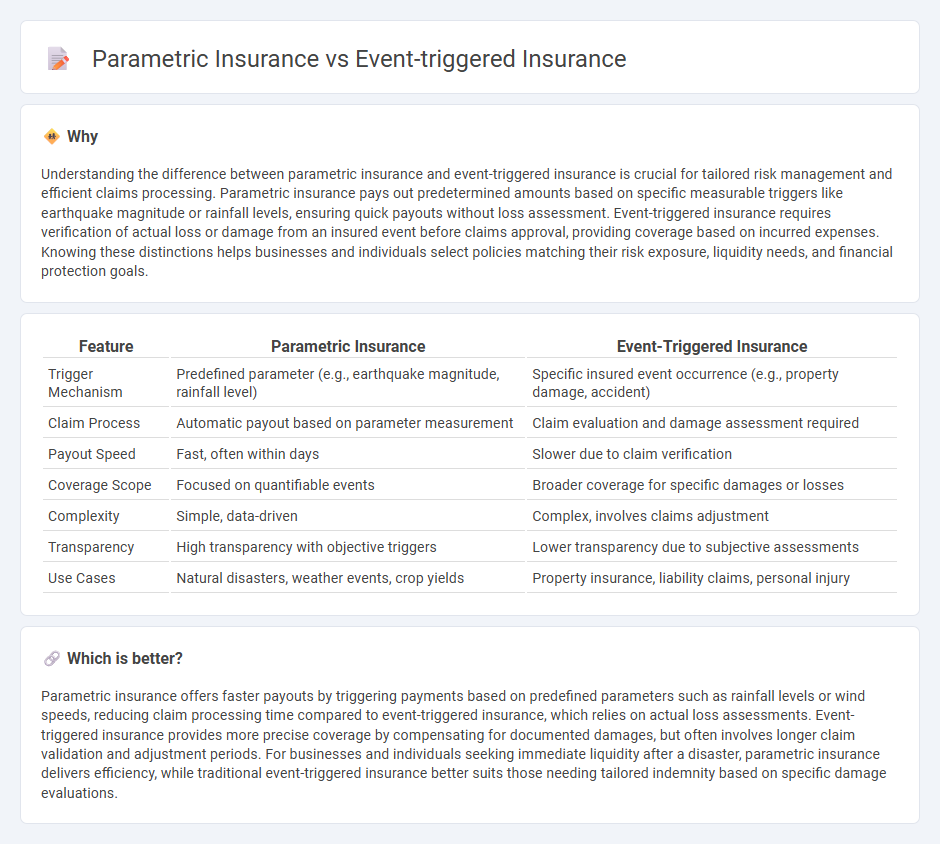

Understanding the difference between parametric insurance and event-triggered insurance is crucial for tailored risk management and efficient claims processing. Parametric insurance pays out predetermined amounts based on specific measurable triggers like earthquake magnitude or rainfall levels, ensuring quick payouts without loss assessment. Event-triggered insurance requires verification of actual loss or damage from an insured event before claims approval, providing coverage based on incurred expenses. Knowing these distinctions helps businesses and individuals select policies matching their risk exposure, liquidity needs, and financial protection goals.

Comparison Table

| Feature | Parametric Insurance | Event-Triggered Insurance |

|---|---|---|

| Trigger Mechanism | Predefined parameter (e.g., earthquake magnitude, rainfall level) | Specific insured event occurrence (e.g., property damage, accident) |

| Claim Process | Automatic payout based on parameter measurement | Claim evaluation and damage assessment required |

| Payout Speed | Fast, often within days | Slower due to claim verification |

| Coverage Scope | Focused on quantifiable events | Broader coverage for specific damages or losses |

| Complexity | Simple, data-driven | Complex, involves claims adjustment |

| Transparency | High transparency with objective triggers | Lower transparency due to subjective assessments |

| Use Cases | Natural disasters, weather events, crop yields | Property insurance, liability claims, personal injury |

Which is better?

Parametric insurance offers faster payouts by triggering payments based on predefined parameters such as rainfall levels or wind speeds, reducing claim processing time compared to event-triggered insurance, which relies on actual loss assessments. Event-triggered insurance provides more precise coverage by compensating for documented damages, but often involves longer claim validation and adjustment periods. For businesses and individuals seeking immediate liquidity after a disaster, parametric insurance delivers efficiency, while traditional event-triggered insurance better suits those needing tailored indemnity based on specific damage evaluations.

Connection

Parametric insurance and event-triggered insurance both rely on predefined parameters or specific events to initiate claims payments, eliminating the need for traditional loss assessments. These insurance models use measurable data points, such as hurricane wind speeds or earthquake magnitudes, to automatically trigger payouts, enhancing efficiency and reducing claim processing time. By linking coverage directly to objective event metrics, parametric and event-triggered insurance provide faster financial relief and greater transparency for policyholders.

Key Terms

**Event-Triggered Insurance:**

Event-triggered insurance activates coverage based on the occurrence of specific events, such as natural disasters, requiring damage assessment to confirm losses before payouts. This type of insurance provides tailored protection aligned with actual claims, often involving a detailed claims process. Discover more about how event-triggered insurance differs from parametric options and benefits risk management strategies.

Indemnity

Event-triggered insurance provides indemnity based on the actual loss incurred by the policyholder after an insured event, requiring detailed claims adjustment and documentation. Parametric insurance, by contrast, pays out predetermined amounts when specific, measurable parameters or triggers--such as hurricane wind speed or earthquake magnitude--are met, bypassing the need for loss assessment. Explore how these indemnity approaches impact risk management strategies and claims efficiency.

Loss Assessment

Event-triggered insurance activates coverage based on the occurrence of a predefined event, such as a hurricane or earthquake, without immediate loss assessment, speeding up claim payments. Parametric insurance relies on measurable parameters like wind speed or rainfall levels, triggering payouts instantly once predetermined thresholds are met, bypassing lengthy traditional loss adjustment processes. Explore how these innovative insurance models streamline loss assessment for faster financial relief.

Source and External Links

Coverage Trigger - IRMI - This term refers to the event that must occur for a liability policy to apply to a given loss, differing between occurrence and claims-made policies.

Understanding Parametric Triggers in Catastrophe Insurance - Parametric triggers in catastrophe insurance are explicit conditions that automatically activate coverage in events like flooding or earthquakes.

What Triggers You? A Question for Every Insurance Policy - The coverage trigger is an event that must occur before a loss implicates a particular insurance policy, often involving theories like injury-in-fact or manifestation.

dowidth.com

dowidth.com