Crop insurance protects farmers against financial losses due to damaged crops from events like droughts, floods, or pests, while title insurance safeguards property owners and lenders from legal claims or defects related to real estate ownership. Both types of insurance mitigate risk but focus on distinct areas: agricultural production versus real estate transactions. Explore the detailed differences and benefits of crop insurance and title insurance to make informed decisions about protecting your assets.

Why it is important

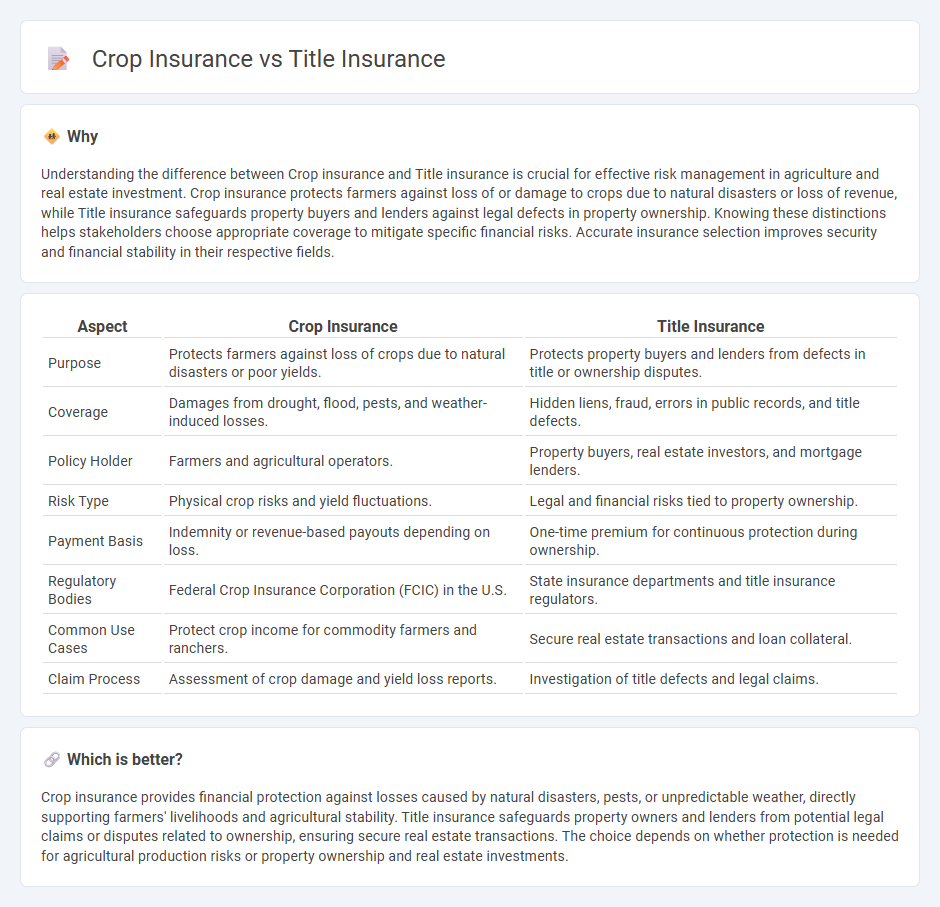

Understanding the difference between Crop insurance and Title insurance is crucial for effective risk management in agriculture and real estate investment. Crop insurance protects farmers against loss of or damage to crops due to natural disasters or loss of revenue, while Title insurance safeguards property buyers and lenders against legal defects in property ownership. Knowing these distinctions helps stakeholders choose appropriate coverage to mitigate specific financial risks. Accurate insurance selection improves security and financial stability in their respective fields.

Comparison Table

| Aspect | Crop Insurance | Title Insurance |

|---|---|---|

| Purpose | Protects farmers against loss of crops due to natural disasters or poor yields. | Protects property buyers and lenders from defects in title or ownership disputes. |

| Coverage | Damages from drought, flood, pests, and weather-induced losses. | Hidden liens, fraud, errors in public records, and title defects. |

| Policy Holder | Farmers and agricultural operators. | Property buyers, real estate investors, and mortgage lenders. |

| Risk Type | Physical crop risks and yield fluctuations. | Legal and financial risks tied to property ownership. |

| Payment Basis | Indemnity or revenue-based payouts depending on loss. | One-time premium for continuous protection during ownership. |

| Regulatory Bodies | Federal Crop Insurance Corporation (FCIC) in the U.S. | State insurance departments and title insurance regulators. |

| Common Use Cases | Protect crop income for commodity farmers and ranchers. | Secure real estate transactions and loan collateral. |

| Claim Process | Assessment of crop damage and yield loss reports. | Investigation of title defects and legal claims. |

Which is better?

Crop insurance provides financial protection against losses caused by natural disasters, pests, or unpredictable weather, directly supporting farmers' livelihoods and agricultural stability. Title insurance safeguards property owners and lenders from potential legal claims or disputes related to ownership, ensuring secure real estate transactions. The choice depends on whether protection is needed for agricultural production risks or property ownership and real estate investments.

Connection

Crop insurance and title insurance both mitigate financial risks by providing protection against specific uncertainties in agriculture and real estate sectors, respectively. Crop insurance covers losses due to unpredictable weather, pests, or disease, while title insurance safeguards property owners against legal disputes over ownership. Together, they support financial stability by reducing exposure to risks inherent in land use and property investment.

Key Terms

Property Ownership (Title insurance)

Title insurance protects property owners by ensuring the legal ownership of real estate, safeguarding against claims or disputes arising from defects in the title. Crop insurance, on the other hand, provides financial protection to farmers against losses from natural disasters or crop failure, unrelated to property ownership rights. Explore more to understand how these insurance types serve distinct purposes within property and agricultural risk management.

Agricultural Yield (Crop insurance)

Crop insurance protects agricultural yield by covering losses from natural disasters, pests, and adverse weather conditions, ensuring financial stability for farmers. Title insurance, by contrast, safeguards property ownership rights but does not address crop production risks or yield protection. Learn more about how crop insurance can secure your agricultural investment and maximize farm resilience.

Risk Coverage (both)

Title insurance safeguards property owners and lenders against losses stemming from defects in land titles, including undisclosed liens and ownership disputes. Crop insurance provides financial protection to farmers, covering losses due to natural disasters, pests, and unpredictable weather events that impact agricultural yield. Explore comprehensive risk coverage options to determine which insurance best fits your property or farming needs.

Source and External Links

Title Insurance: Coverage, Cost and Whether You Need It - This article explains what title insurance is, its different types, and the scenarios where it's necessary.

What is Title Insurance? - This resource provides an overview of title insurance, emphasizing its role in risk prevention and financial protection against title defects.

Title Insurance - This Wikipedia article offers a comprehensive overview of title insurance, including its function, types of policies, and geographical usage.

dowidth.com

dowidth.com